Estimated Value: $197,000 - $227,000

2

Beds

2

Baths

1,182

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 825 Cobblestone Dr Unit X, Troy, OH 45373 and is currently estimated at $210,527, approximately $178 per square foot. 825 Cobblestone Dr Unit X is a home located in Miami County with nearby schools including Heywood Elementary School, Troy Junior High School, and Van Cleve Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2017

Sold by

Green Kenneth and Green Leanne

Bought by

Pritchard Lois Anne

Current Estimated Value

Purchase Details

Closed on

Aug 10, 2015

Sold by

Carpenter Anthony H

Bought by

Green Kenneth J and Green Leanna C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,421

Interest Rate

4.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 29, 2005

Sold by

Steck Jarrod C

Bought by

Carpenter Anthony H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,765

Interest Rate

5.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 24, 2003

Sold by

Muhlenkamp Tricia

Bought by

Steck Jarrod C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,800

Interest Rate

6.23%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 8, 1992

Bought by

Hazen Robert L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pritchard Lois Anne | $110,000 | None Available | |

| Green Kenneth J | $110,000 | Attorney | |

| Carpenter Anthony H | $103,500 | -- | |

| Steck Jarrod C | $91,000 | -- | |

| Hazen Robert L | $87,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Green Kenneth J | $83,421 | |

| Previous Owner | Steck Jarrod C | $81,765 | |

| Previous Owner | Steck Jarrod C | $72,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,270 | $42,950 | $12,080 | $30,870 |

| 2023 | $1,252 | $42,950 | $12,080 | $30,870 |

| 2022 | $1,076 | $42,950 | $12,080 | $30,870 |

| 2021 | $947 | $37,350 | $10,500 | $26,850 |

| 2020 | $949 | $37,350 | $10,500 | $26,850 |

| 2019 | $957 | $37,350 | $10,500 | $26,850 |

| 2018 | $866 | $33,640 | $11,340 | $22,300 |

| 2017 | $1,213 | $33,640 | $11,340 | $22,300 |

| 2016 | $1,197 | $33,640 | $11,340 | $22,300 |

| 2015 | $1,124 | $31,150 | $10,500 | $20,650 |

| 2014 | $1,124 | $31,150 | $10,500 | $20,650 |

| 2013 | $1,132 | $31,150 | $10,500 | $20,650 |

Source: Public Records

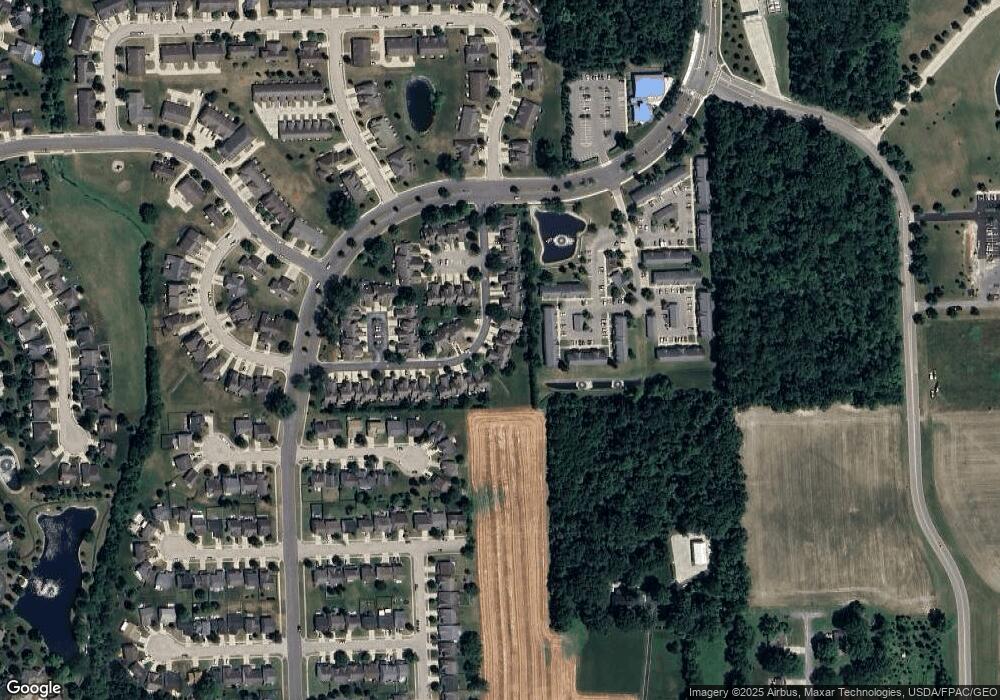

Map

Nearby Homes

- 2290 Murphy Ln E

- 2365 Murphy Ln W

- 2391 Girard Ln W

- 541 Northpoint Ct

- 673 Sedgwick Way

- 2659 Stonebridge

- 536 Barnhart Rd

- 2024 State Route 718

- 606 Barnhart Rd

- 535 Barnhart Rd

- 2472 Thornhill Dr

- 2508 Foxchase Ct W

- 612 Barnhart Rd

- 410 Armand Dr

- 3318 Heatherstone Dr

- 1360 Croydon Rd

- 45 Colony Park Dr Unit 4

- 1481 Lantern Ln

- 1479 Lantern Ln Unit 1479

- 1137 Red Maple Dr

- 825 Cobblestone Dr Unit 14

- 823 Cobblestone Dr Unit 13

- 827 Cobblestone Dr Unit 15

- 819 Cobblestone Dr Unit 11

- 829 Cobblestone Dr

- 831 Cobblestone Dr

- 817 Cobblestone Dr Unit 9

- 828 Cobblestone Dr

- 833 Cobblestone Dr Unit 6

- 833 Cobblestone Dr

- 815 Cobblestone Dr Unit 8

- 815 Cobblestone Dr

- 815 Cobblestone Dr

- 815 Cobblestone Dr Unit x

- 830 Cobblestone Dr

- 835 Cobblestone Dr

- 813 Cobblestone Dr Unit 7

- 728 Rockhurst Cir

- 728 Rockhurst Cir

- 832 Cobblestone Dr

Your Personal Tour Guide

Ask me questions while you tour the home.