8277 Sun Country Dr Elizabeth, CO 80107

Estimated Value: $695,560 - $784,000

3

Beds

3

Baths

3,172

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 8277 Sun Country Dr, Elizabeth, CO 80107 and is currently estimated at $734,890, approximately $231 per square foot. 8277 Sun Country Dr is a home located in Elbert County with nearby schools including Elizabeth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2021

Sold by

Larson Christopher J and Larson Ashley R

Bought by

The Larson Trust

Current Estimated Value

Purchase Details

Closed on

Aug 22, 2019

Sold by

Kauffman Greg and Kauffman Ana

Bought by

Larson Christopher J and Larson Ashley R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$484,350

Outstanding Balance

$422,355

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$312,535

Purchase Details

Closed on

Jun 15, 2001

Sold by

Nickle Thomas J and Nickle Suzette K

Bought by

Kauffman Greg and Kauffman Ana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,950

Interest Rate

7.2%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Larson Trust | -- | None Available | |

| Larson Christopher J | $510,000 | Homestead Title & Escrow | |

| Kauffman Greg | $254,950 | Land Title Guarantee Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Larson Christopher J | $484,350 | |

| Previous Owner | Kauffman Greg | $203,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,814 | $46,190 | $8,070 | $38,120 |

| 2023 | $3,814 | $46,190 | $8,070 | $38,120 |

| 2022 | $3,090 | $34,580 | $8,690 | $25,890 |

| 2021 | $3,157 | $35,570 | $8,940 | $26,630 |

| 2020 | $2,872 | $31,620 | $5,010 | $26,610 |

| 2019 | $2,875 | $31,620 | $5,010 | $26,610 |

| 2018 | $2,554 | $27,200 | $3,600 | $23,600 |

| 2017 | $2,557 | $27,200 | $3,600 | $23,600 |

| 2016 | $2,000 | $25,400 | $3,580 | $21,820 |

| 2015 | $1,567 | $25,400 | $3,580 | $21,820 |

| 2014 | $1,567 | $19,210 | $3,850 | $15,360 |

Source: Public Records

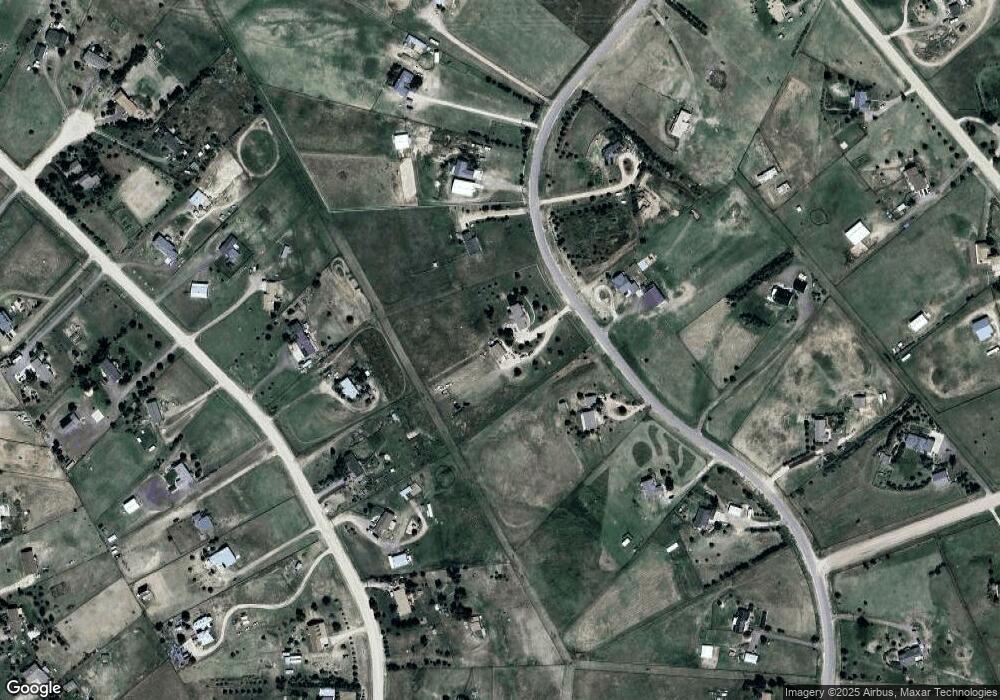

Map

Nearby Homes

- 8692 Lariat Loop

- 4 Winners Cir Unit 4

- Tract 4 County Road 29

- 0 Last Dart Rd Unit 5 REC4495885

- 0 Last Dart Rd Unit Lot 8 REC5508509

- 0 Last Dart Rd Unit Lot 6 REC4599089

- 0 Last Dart Rd Unit 3 REC4285345

- 0 Last Dart Rd Unit 13 REC6037465

- 0 Last Dart Rd Unit 10 REC4221010

- 0 Last Dart Rd Unit Lot 9 REC9962097

- 0 Last Dart Rd Unit 12 REC8361988

- 0 Last Dart Rd Unit 11 REC9530974

- 0 Last Dart Rd Unit Lot 7 REC6943524

- 0 Last Dart Rd Unit 4 REC9323581

- 45523 Sun Country Dr

- 42950 Colonial Trail

- 42952 Colonial Trail

- 42954 Colonial Trail

- 42956 Colonial Trail

- 5608 Westin Hills Dr

- 8329 Sun Country Dr

- 8245 Sun Country Dr

- 8286 Sun Country Dr

- 7729 Shenandoah Dr

- 8331 Sun Country Dr

- 7731 Shenandoah Dr

- 7717 Shenandoah Dr

- 7743 Shenandoah Dr

- 8223 Sun Country Dr

- 8348 Sun Country Dr

- 7705 Shenandoah Dr

- 8191 Sun Country Dr

- 7755 Shenandoah Dr

- 7693 Shenandoah Dr

- 8353 Sun Country Dr

- 8254 Sun Country Dr

- 8370 Sun Country Dr

- 7681 Shenandoah Dr

- 7728 Shenandoah Dr

- 8232 Sun Country Dr