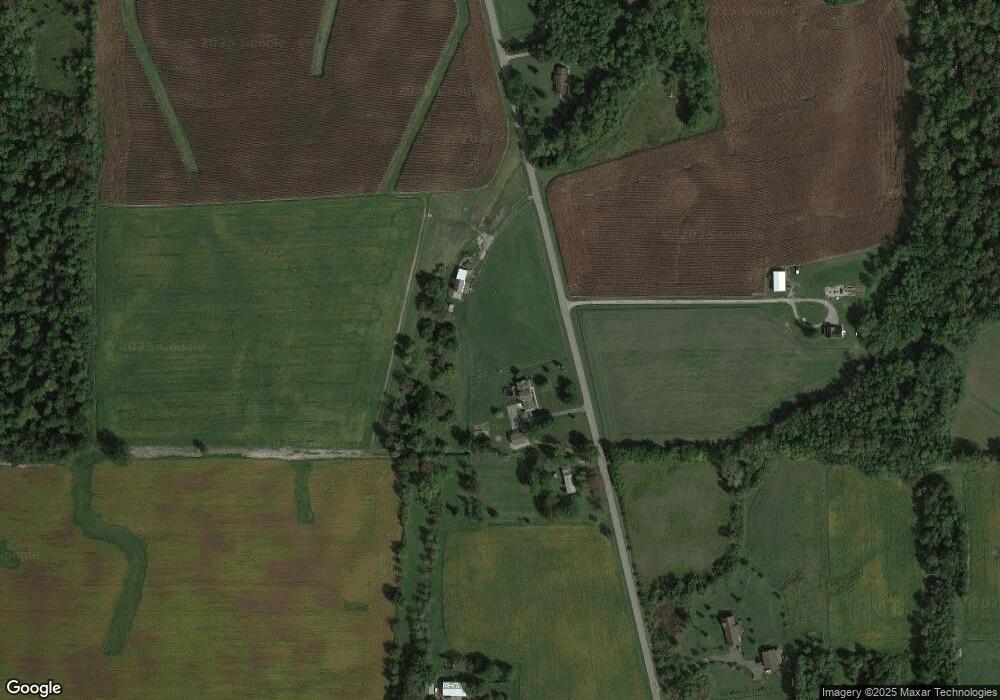

8287 Wayne Trace Rd Camden, OH 45311

Estimated Value: $472,000 - $664,000

4

Beds

3

Baths

2,280

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 8287 Wayne Trace Rd, Camden, OH 45311 and is currently estimated at $537,595, approximately $235 per square foot. 8287 Wayne Trace Rd is a home located in Preble County with nearby schools including Preble Shawnee Elementary School, West Elkton Intermediate School, and Preble Shawnee Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2018

Sold by

King Sheena A and Brown John M

Bought by

George Robert G and George Alicia N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,000

Outstanding Balance

$36,734

Interest Rate

4.4%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$500,861

Purchase Details

Closed on

Jul 24, 2013

Sold by

Baker Willard and Baker Karen S

Bought by

George Robert G and George Alicia N

Purchase Details

Closed on

Dec 14, 1987

Bought by

George Robert G and George Alicia N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| George Robert G | $75,000 | None Available | |

| George Robert G | $300,000 | None Available | |

| George Robert G | $92,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | George Robert G | $62,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,616 | $141,520 | $68,750 | $72,770 |

| 2023 | $3,616 | $141,520 | $68,750 | $72,770 |

| 2022 | $2,573 | $66,520 | $13,880 | $52,640 |

| 2021 | $2,689 | $109,160 | $56,520 | $52,640 |

| 2020 | $2,573 | $109,160 | $56,520 | $52,640 |

| 2019 | $2,926 | $108,180 | $53,820 | $54,360 |

| 2018 | $3,033 | $108,180 | $53,820 | $54,360 |

| 2017 | $2,932 | $108,180 | $53,820 | $54,360 |

| 2016 | $2,821 | $94,880 | $45,560 | $49,320 |

| 2014 | $2,599 | $94,890 | $45,570 | $49,320 |

| 2013 | $2,599 | $86,345 | $37,030 | $49,315 |

Source: Public Records

Map

Nearby Homes

- 725 Sr

- 759 Barnetts Mill Rd

- 471 Camden West Elkton Rd

- 103 Katherine Ct

- 6171 Somers Gratis Rd

- 131 S Lafayette St

- 388 W Hendricks St

- 407 W Central Ave

- 3412 Ohio 122

- 12320 Ohio 122

- 11756 Ohio 122

- 679 Oxford Germantown Rd

- 8793 Greenbush Rd

- 8023 Pleasant Valley Rd

- 105 Mill St

- 6394 E Carlton Rd

- 1222 Oxford Germantown Rd

- 1246 Oxford Germantown Rd

- 0 Oxford Germantown Rd

- 817 Old Norse Dr

- 8335 Wayne Trace Rd

- 3191 Somers Gratis Rd

- 8480 Wayne Trace Rd

- 8224 Wayne Trace Rd

- 8028 Wayne Trace Rd

- 8020 Wayne Trace Rd

- 3421 Somers Gratis Rd

- 7919 Wayne Trace Rd

- 3060 Somers Gratis Rd

- 7891 Wayne Trace Rd

- 3525 Somers Gratis Rd

- 8588 Wayne Trace Rd

- 3547 Somers Gratis Rd

- 2836 Somers Gratis Rd

- 3550 Somers Gratis Rd

- 2788 Somers Gratis Rd

- 8791 Wayne Trace Rd

- 3680 Somers Gratis Rd

- 2696 Somers Gratis Rd

- 8860 Wayne Trace Rd