83 Limestone Crossing Peebles, OH 45660

Estimated Value: $219,140 - $265,000

3

Beds

2

Baths

1,772

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 83 Limestone Crossing, Peebles, OH 45660 and is currently estimated at $245,785, approximately $138 per square foot. 83 Limestone Crossing is a home located in Adams County with nearby schools including Peebles Elementary School and Peebles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2009

Sold by

Ogden William Anthony and Ogden Dianne

Bought by

Hamilton David and Hamilton Sharon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Outstanding Balance

$55,377

Interest Rate

5.11%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$190,408

Purchase Details

Closed on

Jun 4, 2007

Sold by

Ogden William Anthony and Ogden Dianne

Bought by

Hamilton David C and Hamilton Sharon

Purchase Details

Closed on

Apr 29, 2005

Sold by

Turner Daniel R and Turner Darlene M

Bought by

Ogden William Anthony

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,500

Interest Rate

6.13%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hamilton David | $115,000 | None Available | |

| Hamilton David C | $115,000 | None Available | |

| Ogden William Anthony | $13,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hamilton David | $84,000 | |

| Closed | Ogden William Anthony | $76,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,429 | $51,240 | $2,450 | $48,790 |

| 2023 | $1,460 | $51,240 | $2,450 | $48,790 |

| 2022 | $1,502 | $45,080 | $1,750 | $43,330 |

| 2021 | $1,469 | $45,080 | $1,750 | $43,330 |

| 2020 | $1,424 | $45,080 | $1,750 | $43,330 |

| 2019 | $1,424 | $45,080 | $1,750 | $43,330 |

| 2018 | $1,136 | $37,870 | $1,750 | $36,120 |

| 2017 | $1,082 | $37,870 | $1,750 | $36,120 |

| 2016 | $7,217 | $37,870 | $1,750 | $36,120 |

| 2015 | $1,090 | $40,220 | $2,100 | $38,120 |

| 2014 | $1,127 | $40,220 | $2,100 | $38,120 |

Source: Public Records

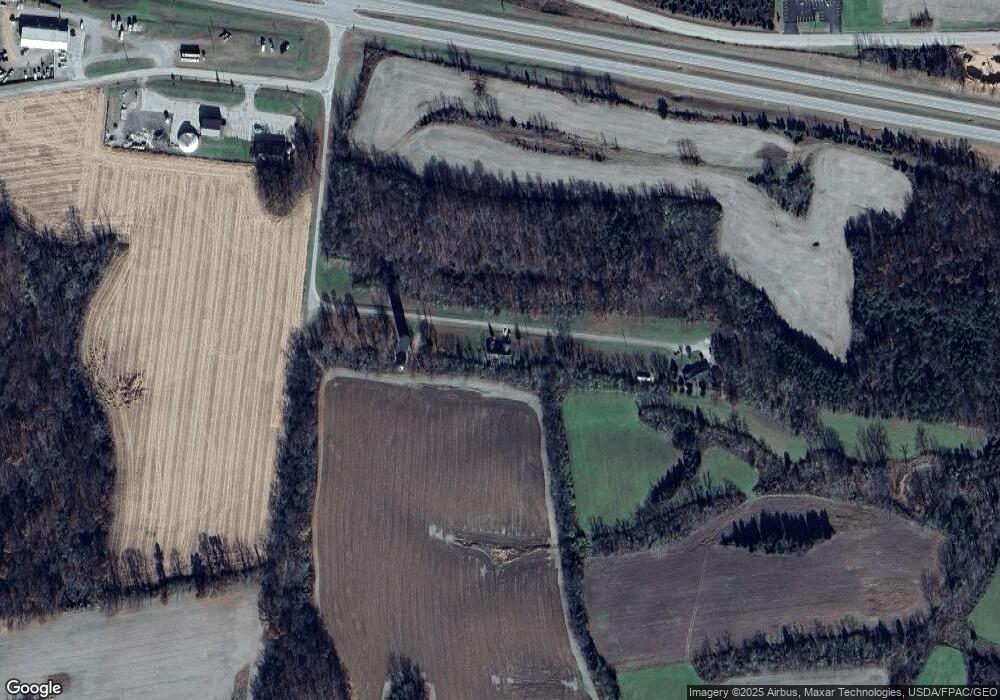

Map

Nearby Homes

- 1425 Jacksonville Rd

- LOT 4 Jacksonville Rd

- LOT 2 Jacksonville Rd

- LOT 1 Jacksonville Rd

- 23837 State Route 41

- 0 Lawshe Rd Unit 1854673

- 1949 Inlow Ave

- 55 Olive St

- 61 Chautauqua St

- 748 Inlow Ave

- 64 2nd St

- 176 Vine St

- 185 Marble Furnace Rd

- LOT 6 State Route 41

- LOT 5 State Route 41

- A Inlow Ave

- 0 State Route 41

- 64 Church St

- 18 Church St

- 3942 Steam Furnace Rd

- 223 Limestone Crossing

- 223 Limestone Crossing

- 0 Measley Ridge Rd

- 0 Measley Ridge Rd Unit 21126789

- 0 Measley Ridge Rd Unit 1826598

- 0 Measley Ridge Rd Unit 1807057

- 0 Measley Ridge Rd Unit 11256554

- 0 Measley Ridge Rd Unit 1779809

- 0 Measley Ridge Rd Unit 1763240

- 0 Measley Ridge Rd Unit 1746316

- 110 Branscome Rd

- 625 Branscome Rd

- 100 Thomas Stone Rd

- 1177 Jacksonville Rd

- 950 Measley Ridge Rd

- 150 Roslin Dr

- 145 Roslin Dr

- 871 Measley Ridge Rd

- 136 Roslin Dr

- 1590 Jacksonville Rd