83 N 1280 W Pleasant Grove, UT 84062

Estimated Value: $328,000 - $365,000

2

Beds

2

Baths

1,176

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 83 N 1280 W, Pleasant Grove, UT 84062 and is currently estimated at $343,951, approximately $292 per square foot. 83 N 1280 W is a home located in Utah County with nearby schools including Mount Mahogany School, Pleasant Grove Junior High School, and Pleasant Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 7, 2007

Sold by

Nelson Daniel

Bought by

Bills Nathan

Current Estimated Value

Purchase Details

Closed on

Apr 26, 2007

Sold by

Nelson Daniel Gary and Nelson Angela

Bought by

Bills Nathan

Purchase Details

Closed on

Mar 14, 2005

Sold by

Trophy Homes Lc and Taylor Rogan L

Bought by

Crm Investments 6 Lc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bills Nathan | -- | Equity Title Production F | |

| Bills Nathan | -- | Equity Title Production F | |

| Crm Investments 6 Lc | -- | Affiliated First Title Comp |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,532 | $182,105 | $36,800 | $294,300 |

| 2024 | $1,532 | $182,710 | $0 | $0 |

| 2023 | $1,457 | $177,980 | $0 | $0 |

| 2022 | $1,512 | $183,865 | $0 | $0 |

| 2021 | $1,328 | $245,800 | $29,500 | $216,300 |

| 2020 | $1,243 | $225,500 | $27,100 | $198,400 |

| 2019 | $1,092 | $205,000 | $23,900 | $181,100 |

| 2018 | $1,014 | $180,000 | $21,600 | $158,400 |

| 2017 | $926 | $87,450 | $0 | $0 |

| 2016 | $917 | $83,600 | $0 | $0 |

| 2015 | $968 | $83,600 | $0 | $0 |

| 2014 | $868 | $74,250 | $0 | $0 |

Source: Public Records

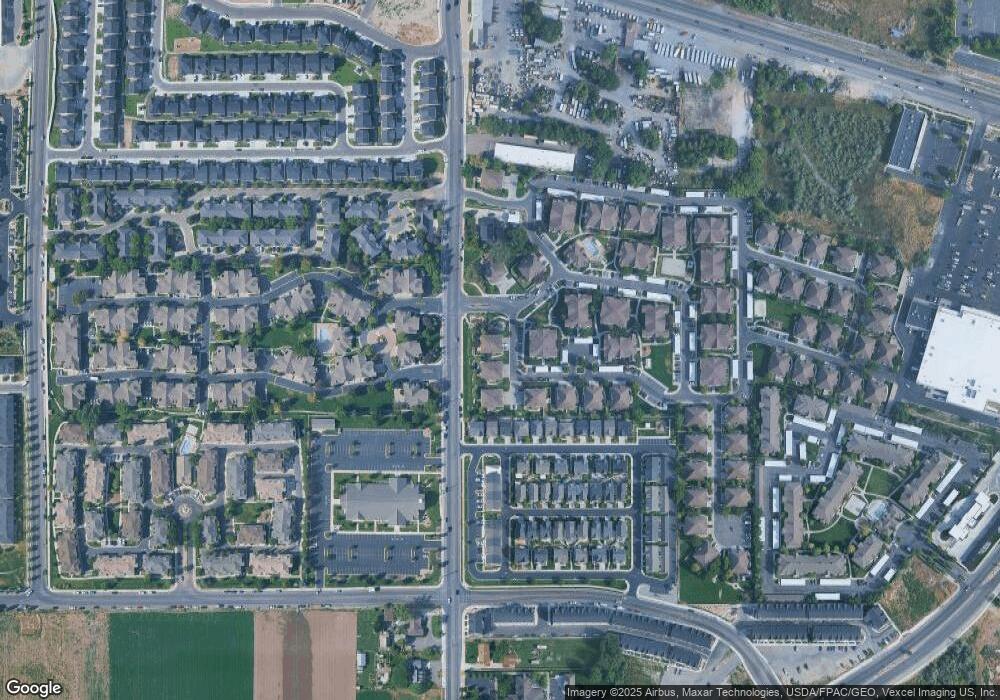

Map

Nearby Homes

- 1249 W Cambria Dr Unit 101

- 150 N 1300 W

- 123 N Romney Ln Unit 103

- 1267 W 20 S

- 1406 W 50 N

- 1429 W 110 N

- 1512 W 50 N

- 1542 W 110 N

- 1559 W 50 N

- 1541 W 250 N

- 1584 W 110 N

- 1593 W 220 N

- 1525 W 300 N

- 1130 W State Rd

- 165 S Pleasant Blvd Unit 45

- 293 N 1630 W

- 1598 W 220 N

- 289 S 1000 W Unit 203

- 317 S 1000 W Unit 104

- 128 S 1700 W Unit 12

- 79 N 1280 W

- 85 Spencer Rd Unit D103

- 83 Spencer Rd Unit D102

- 85 Spencer Rd

- 83 Spencer Rd Unit D-103

- 79 N Spencer Rd Unit D101

- 85 N 1280 W

- 65 N Spencer Rd Unit E102

- 65 N 1280 W

- 59 N 1280 W

- 59 N Spencer Rd Unit E101

- 1269 N Spencer Rd Unit G102

- 1285 W 50 N Unit 102

- 84N 1280w K301

- 1285 W Spencer Rd Unit 102

- 1285 W Spencer Rd

- 1285 W Spencer Rd

- 62 N Spencer Rd Unit E103

- 84 N 1280 W Unit 302

- 84 N 1280 W Unit K204