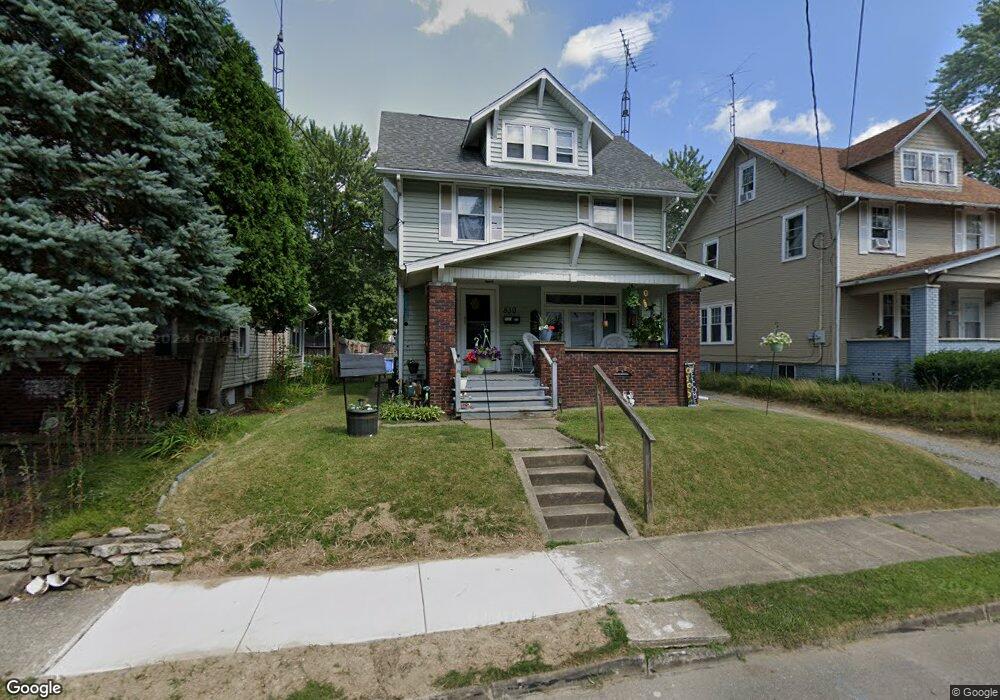

830 Wright Ave Alliance, OH 44601

Estimated Value: $79,000 - $107,000

3

Beds

1

Bath

1,264

Sq Ft

$69/Sq Ft

Est. Value

About This Home

This home is located at 830 Wright Ave, Alliance, OH 44601 and is currently estimated at $87,788, approximately $69 per square foot. 830 Wright Ave is a home located in Stark County with nearby schools including Alliance Early Learning School, Alliance Intermediate School at Northside, and Alliance Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2007

Sold by

Sherrys Treasures Llc

Bought by

Victory Shoe Shine Llc

Current Estimated Value

Purchase Details

Closed on

Mar 17, 2005

Sold by

Hustus Nicholas and Hustus Sherry A

Bought by

Sherrys Treasures Llc

Purchase Details

Closed on

Dec 19, 2001

Sold by

Beneficial Ohio Inc

Bought by

Hustus Nicholas L and Hustus Sherry A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,700

Interest Rate

6.92%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 25, 2001

Sold by

Long Unknown Heirs Devisees James J

Bought by

Beneficial Ohio Inc and Beneficial Mtg Co Of Ohio

Purchase Details

Closed on

Apr 17, 2001

Sold by

Unknown Heirs Devisees Of James J Long J

Bought by

Beneficial Ohio Inc and Beneficial Mtg Co Of Ohio

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Victory Shoe Shine Llc | -- | Attorney | |

| Sherrys Treasures Llc | -- | -- | |

| Hustus Nicholas L | $53,000 | -- | |

| Beneficial Ohio Inc | $38,600 | Stewart Title Guaranty Compa | |

| Beneficial Ohio Inc | $38,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hustus Nicholas L | $47,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $21,640 | $5,710 | $15,930 |

| 2024 | -- | $21,640 | $5,710 | $15,930 |

| 2023 | $725 | $17,610 | $5,360 | $12,250 |

| 2022 | $437 | $17,610 | $5,360 | $12,250 |

| 2021 | $454 | $17,610 | $5,360 | $12,250 |

| 2020 | $662 | $14,880 | $4,660 | $10,220 |

| 2019 | $125 | $14,880 | $4,660 | $10,220 |

Source: Public Records

Map

Nearby Homes

- 203 Glamorgan St

- 228 W Oxford St

- 535 S Mckinley Ave

- 807 S Union Ave

- 725 W Summit St

- 870 Parkway Blvd

- 535 S Union Ave

- 46 Rosenberry St

- 0 E Oxford St

- 479 W High St

- 427 S Union Ave

- 1050 Parkway Blvd

- 1136 Parkway Blvd

- 970 Kingsway St

- 62 E High St

- 264 W Market St

- 118 S Mckinley Ave

- 167 11th St

- 234 Rosenberry St

- 226 Milner St

- 822 Wright Ave

- 812 Wright Ave

- 846 Wright Ave

- 829 S Haines Ave

- 837 S Haines Ave

- 815 S Haines Ave

- 332 W Grant St

- 854 Wright Ave

- 847 S Haines Ave

- 829 Wright Ave

- 837 Wright Ave

- 821 Wright Ave

- 803 S Haines Ave

- 811 Wright Ave

- 864 Wright Ave

- 855 Wright Ave

- 803 Wright Ave

- 863 S Haines Ave

- 863 S Haines Ave

- 784 Wright Ave