831 Neeb Rd Unit 7 Cincinnati, OH 45233

Cotillion Village NeighborhoodEstimated Value: $199,000 - $214,000

1

Bed

2

Baths

1,215

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 831 Neeb Rd Unit 7, Cincinnati, OH 45233 and is currently estimated at $209,663, approximately $172 per square foot. 831 Neeb Rd Unit 7 is a home located in Hamilton County with nearby schools including C.O. Harrison Elementary School, Rapid Run Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2025

Sold by

Tenhundfeld Matthew Allen

Bought by

Michael W Klapper Revocable Trust and Joann Klapper Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Oct 6, 2023

Sold by

Lammers Scott M and Lammers Carol S

Bought by

Tenhundfeld Matthew Allen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,913

Interest Rate

7.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 4, 2015

Sold by

Lammers Scott and Class Lammers Carol S

Bought by

Lammers Scott M and Class Lammers Carol S

Purchase Details

Closed on

Aug 16, 2011

Sold by

Helbling Jeffrey and Helbling Linda J

Bought by

Lammers Scott

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 27, 2003

Sold by

Oaktree Condominiums Ltd

Bought by

Helbling Jeffrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,000

Interest Rate

6.07%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michael W Klapper Revocable Trust | $210,000 | Tandem Title | |

| Tenhundfeld Matthew Allen | $185,000 | None Listed On Document | |

| Tenhundfeld Matthew Allen | $185,000 | None Listed On Document | |

| Lammers Scott M | -- | None Available | |

| Lammers Scott | $70,000 | 360 American Title Services | |

| Helbling Jeffrey | $98,000 | Title First Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tenhundfeld Matthew Allen | $185,913 | |

| Previous Owner | Lammers Scott | $56,000 | |

| Previous Owner | Helbling Jeffrey | $78,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,787 | $48,122 | $5,775 | $42,347 |

| 2023 | $2,796 | $48,122 | $5,775 | $42,347 |

| 2022 | $1,939 | $29,663 | $6,300 | $23,363 |

| 2021 | $1,899 | $29,663 | $6,300 | $23,363 |

| 2020 | $1,926 | $29,663 | $6,300 | $23,363 |

| 2019 | $1,983 | $27,461 | $6,300 | $21,161 |

| 2018 | $1,985 | $27,461 | $6,300 | $21,161 |

| 2017 | $1,792 | $27,461 | $6,300 | $21,161 |

| 2016 | $1,498 | $22,978 | $4,977 | $18,001 |

| 2015 | $1,494 | $22,978 | $4,977 | $18,001 |

| 2014 | $1,501 | $22,978 | $4,977 | $18,001 |

| 2013 | $1,933 | $31,465 | $6,300 | $25,165 |

Source: Public Records

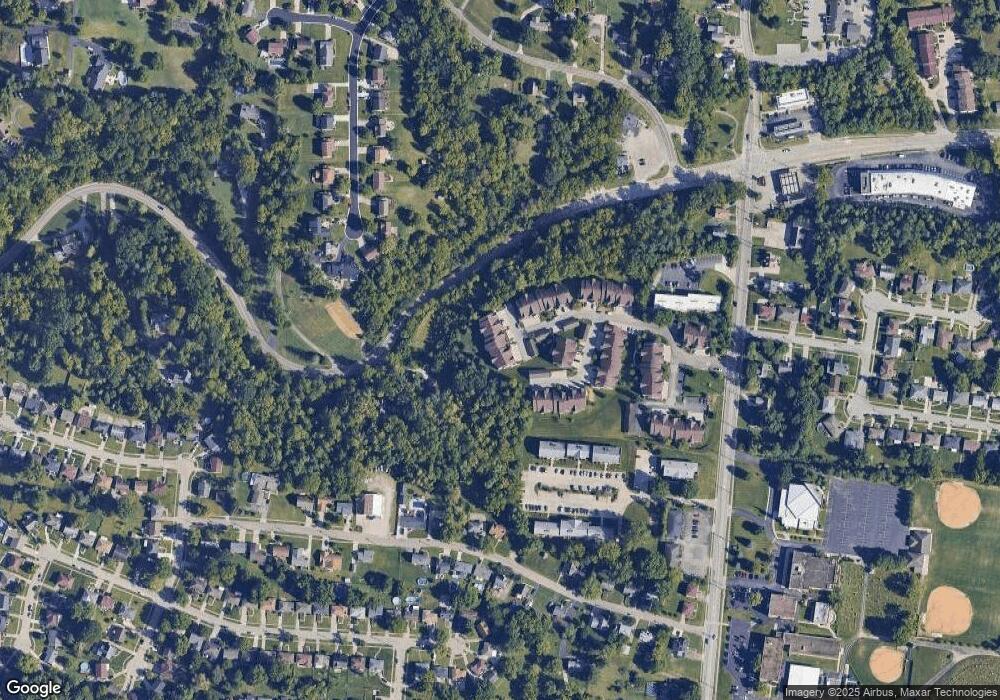

Map

Nearby Homes

- 5819 Faysel Dr

- 5789 Juvene Way

- 5861 Chapelhill Dr

- 760 Stonebridge Dr

- 1366 Devils Backbone Rd

- 685 Ivyhill Dr

- 774 Ivyhill Dr

- 5435 Lariat Dr

- 5434 Lariat Dr

- 6226 Rapid Run Rd

- 5341 Carefree Ct

- 1706 Beech Grove Dr

- 5318 Hillside Ave

- 5320 Hillside Ave

- 6278 Gardenlake Ct

- 503 Happy Dr

- 5229 Rapid Run Rd

- 1676 Devils Backbone Rd

- 464 Happy Dr

- 1259 Wexford Ln

- 831 Neeb Rd Unit 70A

- 831 Neeb Rd Unit 71A

- 831 Neeb Rd Unit 70A

- 831 Neeb Rd Unit 66A

- 831 Neeb Rd Unit 65A

- 831 Neeb Rd Unit 68A

- 831 Neeb Rd Unit 69A

- 831 Neeb Rd

- 831 Neeb Rd

- 831 Neeb Rd Unit 68A

- 831 Neeb Rd Unit 69A

- 831 Neeb Rd Unit 65A

- 831 Neeb Rd Unit 3

- 831 Neeb Rd Unit 1

- 831 Neeb Rd Unit 5

- 831 Neeb Rd Unit 6

- 831 Neeb Rd Unit 4

- 831 Neeb Rd Unit 2

- 833 Neeb Rd Unit 60A

- 833 Neeb Rd Unit 60A