832 Gentlewinds Ct Unit 138 Fort Mill, SC 29708

Gold Hill NeighborhoodEstimated Value: $315,000 - $345,697

3

Beds

3

Baths

1,446

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 832 Gentlewinds Ct Unit 138, Fort Mill, SC 29708 and is currently estimated at $333,424, approximately $230 per square foot. 832 Gentlewinds Ct Unit 138 is a home located in York County with nearby schools including Gold Hill Elementary School, Pleasant Knoll Middle School, and Fort Mill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2023

Sold by

Shone Jennifer

Bought by

Taylor Michael David and Taylor Melissa Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$293,625

Outstanding Balance

$287,185

Interest Rate

6.78%

Mortgage Type

VA

Estimated Equity

$46,239

Purchase Details

Closed on

May 25, 2018

Sold by

Summey Kristen Cara

Bought by

Shone Jennifer

Purchase Details

Closed on

Jan 29, 2016

Sold by

Alix Virginia and Du Moulin Bethany

Bought by

Summey Kristen Cara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,800

Interest Rate

4.04%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 21, 2012

Sold by

Handschumacher Jason and Hanschumacher Erica

Bought by

Alix Viginia and Moulin Bethany Du

Purchase Details

Closed on

Mar 31, 2005

Sold by

Westfield Homes Of The Carolinas Llc

Bought by

Handschumacher Jason and Handschumacher Erica

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Taylor Michael David | $330,000 | None Listed On Document | |

| Shone Jennifer | $185,000 | None Available | |

| Summey Kristen Cara | $144,000 | -- | |

| Alix Viginia | $119,750 | -- | |

| Handschumacher Jason | $127,185 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Taylor Michael David | $293,625 | |

| Previous Owner | Summey Kristen Cara | $136,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,203 | $12,479 | $1,400 | $11,079 |

| 2023 | $1,243 | $7,266 | $1,400 | $5,866 |

| 2022 | $1,232 | $7,266 | $1,400 | $5,866 |

| 2021 | -- | $7,266 | $1,400 | $5,866 |

| 2020 | $1,323 | $7,266 | $0 | $0 |

| 2019 | $1,535 | $7,340 | $0 | $0 |

| 2018 | $1,170 | $11,010 | $0 | $0 |

| 2017 | $3,360 | $7,950 | $0 | $0 |

| 2016 | $1,020 | $7,950 | $0 | $0 |

| 2014 | $753 | $4,960 | $1,120 | $3,840 |

| 2013 | $753 | $6,930 | $1,680 | $5,250 |

Source: Public Records

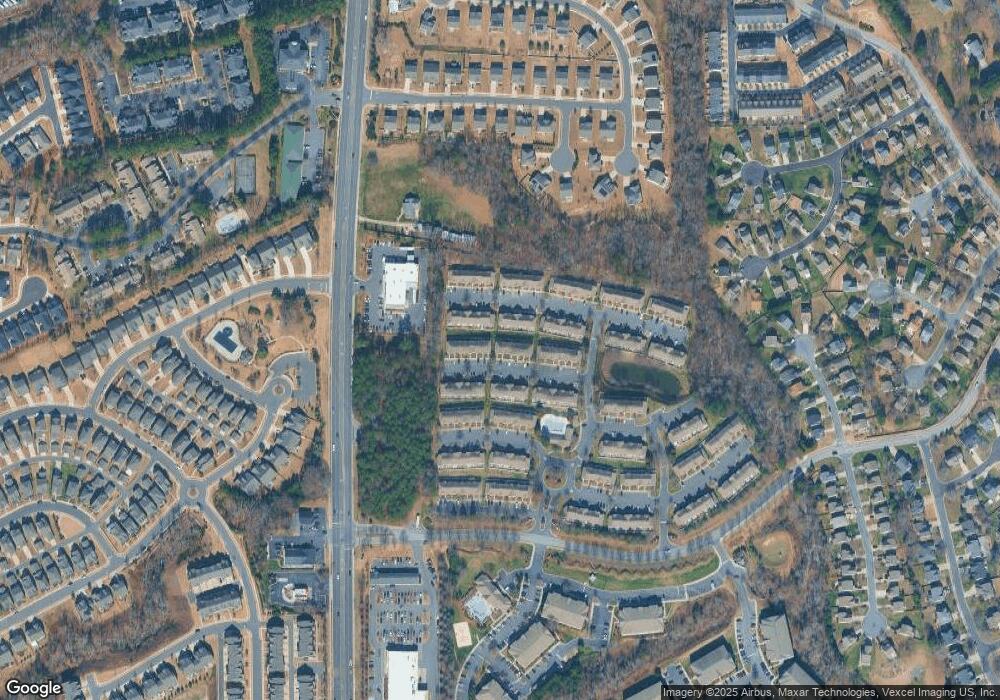

Map

Nearby Homes

- 827 Gentlewinds Ct

- 514 Bent Leaf Ct

- 927 Copperstone Ln

- 643 Brickdust Ct

- 975 Copperstone Ln

- 208 Dawn Mist Ln

- 2330 Mirage Place

- 6187 Cloverdale Dr

- 6249 Cloverdale Dr

- 1707 Kashmir White Ln

- 2103 Midnight Blue Ln

- 3725 Leela Palace Way

- 1119 Sienna Sand Way

- 1107 Sienna Sand Way

- 558 Dulaney Dr

- 4051 Whittier Ln

- 507 Poseidon Way

- 6096 Cloverdale Dr

- 5128 Balsam Bark Ln

- 6507 Black Oasis Cir

- 832 Gentlewinds Ct

- 830 Gentlewinds Ct

- 830 Gentlewinds Ct Unit 830

- 828 Gentlewinds Ct

- 836 Gentlewinds Ct Unit 836

- 836 Gentlewinds Ct

- 826 Gentlewinds Ct

- 838 Gentlewinds Ct

- 824 Gentlewinds Ct

- 824 Gentlewinds Ct Unit 824

- 840 Gentlewinds Ct

- 922 Copperstone Ln

- 920 Copperstone Ln

- 822 Gentlewinds Ct

- 822 Gentlewinds Ct Unit 143

- 916 Copperstone Ln

- 842 Gentlewinds Ct

- 914 Copperstone Ln

- 914 Copperstone Ln Unit 177

- 926 Copperstone Ln