833 Kauska Way The Villages, FL 32163

Estimated Value: $714,738 - $876,000

3

Beds

2

Baths

2,450

Sq Ft

$326/Sq Ft

Est. Value

About This Home

This home is located at 833 Kauska Way, The Villages, FL 32163 and is currently estimated at $799,185, approximately $326 per square foot. 833 Kauska Way is a home with nearby schools including Fruitland Park Elementary School, Carver Middle School, and Leesburg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2024

Sold by

Prusha Robert J and Prusha Leslie R

Bought by

Lewis Family Trust and Lewis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$595,000

Outstanding Balance

$588,909

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$210,276

Purchase Details

Closed on

May 16, 2022

Sold by

Prusha Robert J and Prusha Leslie R

Bought by

Prusha Robert J

Purchase Details

Closed on

Dec 31, 2020

Sold by

Lansing Kevin J and Lansing Kathleen

Bought by

Prusha Robert J and Prusha Leslie R

Purchase Details

Closed on

Sep 26, 2016

Sold by

The Villages Of Lake Sumter Inc

Bought by

Lansing Kevin J and Lansing Kathleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$363,752

Interest Rate

3.43%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lewis Family Trust | $795,000 | Peninsula Land & Title | |

| Lewis Family Trust | $795,000 | Peninsula Land & Title | |

| Prusha Robert J | -- | Millhorn & Shanawany Law Firm | |

| Prusha Robert J | $610,000 | Peninsula Land & Title | |

| Prusha Robert J | $610,000 | Peninsula Land & Title | |

| Lansing Kevin J | $404,200 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lewis Family Trust | $595,000 | |

| Closed | Lewis Family Trust | $595,000 | |

| Previous Owner | Lansing Kevin J | $363,752 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,433 | $542,060 | $125,000 | $417,060 |

| 2024 | $9,433 | $542,060 | $125,000 | $417,060 |

| 2023 | $9,433 | $532,619 | $125,000 | $407,619 |

| 2022 | $8,247 | $376,714 | $51,750 | $324,964 |

| 2021 | $7,501 | $319,387 | $51,750 | $267,637 |

| 2020 | $6,280 | $272,756 | $0 | $0 |

| 2019 | $6,250 | $266,624 | $0 | $0 |

| 2018 | $6,089 | $261,653 | $0 | $0 |

| 2017 | $6,913 | $265,969 | $0 | $0 |

| 2016 | $3,514 | $84,000 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

Source: Public Records

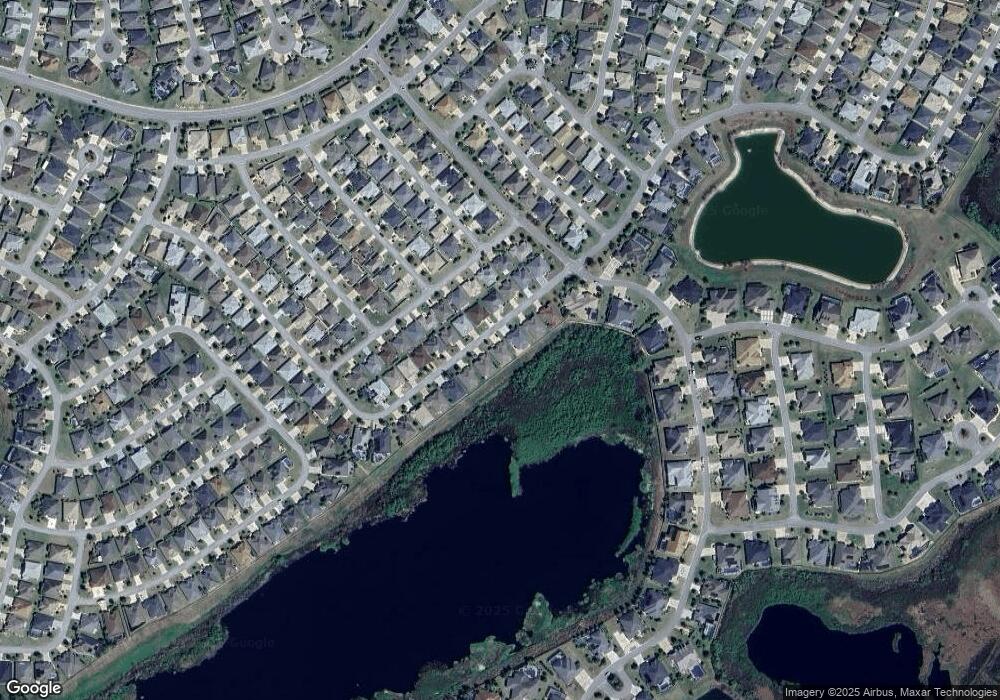

Map

Nearby Homes

- 3427 Conservation Trail

- 937 Kauska Way

- 939 Koller Ct

- 963 Hart Dr

- 3258 Iiams Ct

- 3247 Joy Ln

- 3591 Conservation Trail

- 3233 Lowe Ct

- 3283 Delk Dr

- 3161 Dressendorfer Dr

- 3092 Kramer Ct

- 1963 Bell Creek Loop

- 3261 Wise Way

- 1092 Incorvaia Way

- 1813 Forest Glen Dr

- 1803 Daybreak Dr

- 2998 Kramer Ct

- 807 Glen Creek Ct

- 1704 Hoofprint Ct

- 1702 Hoofprint Ct

- 839 Kauska Way

- 827 Kauska Way

- 845 Kauska Way

- 821 Kauska Way

- 832 Kauska Way

- 838 Kauska Way

- 826 Kauska Way

- 844 Kauska Way

- 851 Kauska Way

- 820 Kauska Way

- 815 Kauska Way

- 848 Kauska Way

- 848 Wiechens Way

- 852 Wiechens Way

- 842 Wiechens Way

- 814 Kauska Way

- 858 Wiechens Way

- 857 Kauska Way

- 838 Wiechens Way

- 854 Kauska Way