8350 Cheviot Rd Cincinnati, OH 45247

Estimated Value: $261,000 - $292,000

3

Beds

3

Baths

1,368

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 8350 Cheviot Rd, Cincinnati, OH 45247 and is currently estimated at $274,663, approximately $200 per square foot. 8350 Cheviot Rd is a home located in Hamilton County with nearby schools including White Oak Middle School, Colerain High School, and Our Lady of Grace Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 20, 2002

Sold by

Odle Edward E and Odle Theresa A

Bought by

Huellemeier Thomas N and Huellemeier Rosemary F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.16%

Purchase Details

Closed on

Jul 18, 1996

Sold by

Bratton Betty O and Bratton Ernest H

Bought by

Odle Edward E and Odle Theresa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,450

Interest Rate

8.31%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Huellemeier Thomas N | $155,000 | -- | |

| Odle Edward E | $91,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Huellemeier Thomas N | $75,000 | |

| Previous Owner | Odle Edward E | $86,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,761 | $79,737 | $11,165 | $68,572 |

| 2023 | $3,814 | $79,737 | $11,165 | $68,572 |

| 2022 | $3,397 | $59,941 | $11,067 | $48,874 |

| 2021 | $3,370 | $59,941 | $11,067 | $48,874 |

| 2020 | $3,403 | $59,941 | $11,067 | $48,874 |

| 2019 | $2,827 | $48,339 | $8,925 | $39,414 |

| 2018 | $2,539 | $48,339 | $8,925 | $39,414 |

| 2017 | $2,407 | $48,339 | $8,925 | $39,414 |

| 2016 | $2,739 | $53,337 | $9,450 | $43,887 |

| 2015 | $2,765 | $53,337 | $9,450 | $43,887 |

| 2014 | $2,771 | $53,337 | $9,450 | $43,887 |

| 2013 | $2,638 | $53,337 | $9,450 | $43,887 |

Source: Public Records

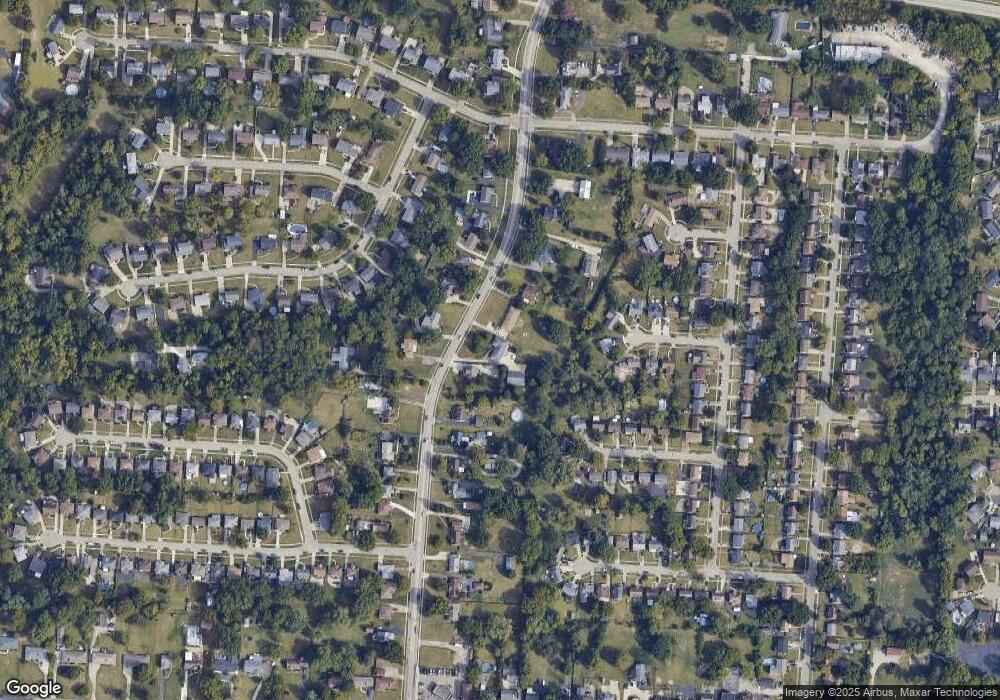

Map

Nearby Homes

- 8344 Firshade Terrace

- 3757 Donata Dr

- 8474 Chesswood Dr

- 3693 W Galbraith Rd

- 3701 W Galbraith Rd

- 8747 Cheviot Rd

- 3369 W Galbraith Rd

- 8530 Wuest Rd

- 3388 Bauerwoods Dr

- 3950 Olde Savannah Dr

- 8269 Sandy Ln

- 3397 Nandale Dr

- 7640 Cheviot Rd

- 8843 Carrousel Park Cir

- 8812 Carrousel Park Cir

- 3277 Warfield Ave

- 7776 Cella Dr

- 7404 Applebud Dr

- 7448 Locust View Ln

- 3677 Poole Rd

- 8342 Cheviot Rd

- 8394 Cheviot Rd

- 8336 Cheviot Rd

- 3548 Edvera Ln

- 3554 Edvera Ln

- 8318 Cheviot Rd

- 8371 Cheviot Rd

- 3537 Jimmar Ct

- 8345 Cheviot Rd

- 3542 Edvera Ln

- 8383 Cheviot Rd

- 3536 Jimmar Ct

- 8430 Cheviot Rd

- 3555 Edvera Ln

- 3531 Jimmar Ct

- 8306 Cheviot Rd

- 3536 Edvera Ln

- 8399 Cheviot Rd

- 8296 Cheviot Rd

- 8432 Cheviot Rd