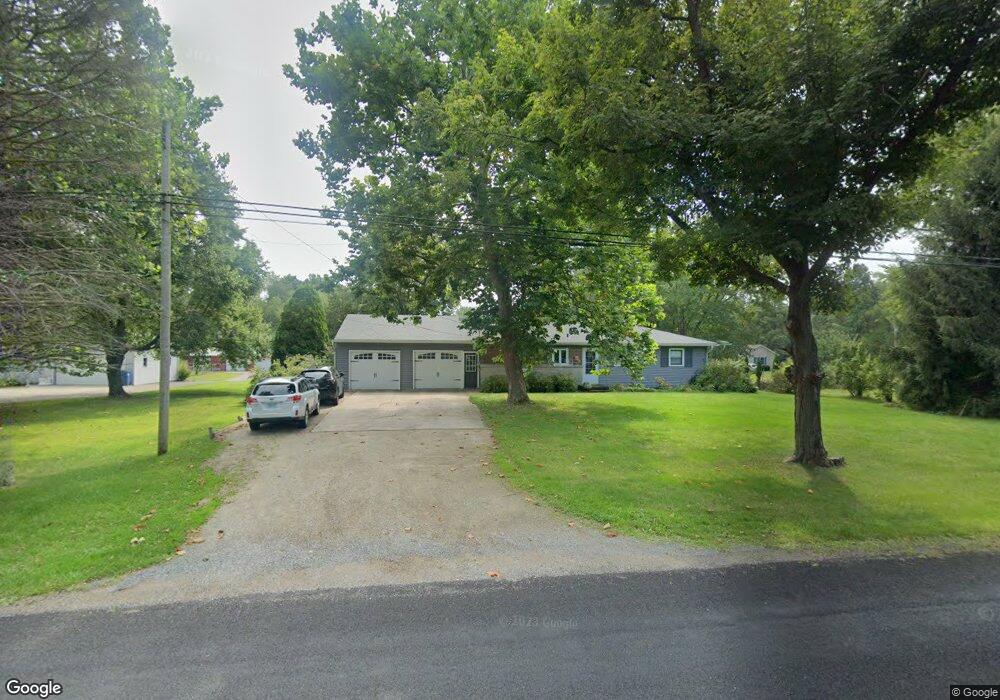

8350 E Main St Galesburg, MI 49053

Estimated Value: $233,000 - $365,000

3

Beds

1

Bath

1,176

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 8350 E Main St, Galesburg, MI 49053 and is currently estimated at $294,101, approximately $250 per square foot. 8350 E Main St is a home located in Kalamazoo County with nearby schools including Comstock Middle School and Comstock High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2023

Sold by

Herwick David and Herwick Jody

Bought by

Herwick Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 14, 2011

Sold by

Sparks Stacey

Bought by

Herwick Jody and Herwick David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,500

Interest Rate

3.97%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 11, 2011

Sold by

Sparks Tonya

Bought by

Sparks Stacey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,500

Interest Rate

3.97%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 19, 2006

Sold by

Munson Virgil H

Bought by

Sparks Stacey

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Herwick Living Trust | -- | -- | |

| Herwick Jody | $90,000 | Devon Title | |

| Sparks Stacey | -- | Devon Title | |

| Sparks Stacey | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Herwick Jody | $85,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,119 | $122,900 | $0 | $0 |

| 2024 | $1,697 | $116,600 | $0 | $0 |

| 2023 | $1,618 | $98,700 | $0 | $0 |

| 2022 | $2,796 | $82,700 | $0 | $0 |

| 2021 | $2,664 | $75,900 | $0 | $0 |

| 2020 | $2,510 | $70,800 | $0 | $0 |

| 2019 | $2,319 | $63,700 | $0 | $0 |

| 2018 | $2,236 | $60,900 | $0 | $0 |

| 2017 | $0 | $59,700 | $0 | $0 |

| 2016 | -- | $62,100 | $0 | $0 |

| 2015 | -- | $52,300 | $14,400 | $37,900 |

| 2014 | -- | $52,300 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1049 Antler

- 1353 N 30th St

- 8181 Fawn Meadow Trail

- 7862 E Main St

- 147 Station Hill St

- 134 Grandview Unit 47

- 233 Depot Cir

- 222 Station Hill St

- 2813 N 30th St

- 207 Station Hill St

- 8464 E Michigan Ave

- 221 Sparks St

- 3539 Wildgrass Ln

- 359 Elliot Rd

- 9438 E H Ave

- 9095 Marsh Creek Cir

- 7222 Gleason St

- 1925 Prescott Trail

- 7138 Gleason St

- 2669 Hunters Bluff Unit L23