8355 Miramar Way Unit 8355 Lakewood Ranch, FL 34202

Estimated Value: $375,000 - $429,202

3

Beds

2

Baths

2,024

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 8355 Miramar Way Unit 8355, Lakewood Ranch, FL 34202 and is currently estimated at $396,801, approximately $196 per square foot. 8355 Miramar Way Unit 8355 is a home located in Manatee County with nearby schools including Robert Willis Elementary School, Lakewood Ranch High School, and R. Dan Nolan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2024

Sold by

Conklin Martha T

Bought by

Burr Charles C and Burr Joy A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,400,040

Outstanding Balance

$2,372,829

Interest Rate

6.86%

Mortgage Type

New Conventional

Estimated Equity

-$1,976,028

Purchase Details

Closed on

May 31, 2017

Sold by

Santopetro Joseph M and Santopetro Mary

Bought by

Conklin Martha T

Purchase Details

Closed on

Aug 15, 2011

Sold by

Gehle Max D and Gehle Kristine A

Bought by

Santopetro Joseph M and Santopetro Mary

Purchase Details

Closed on

May 31, 2006

Sold by

Whitehall Homes At Miramar Ltd

Bought by

Gehle Max D and Gehle Kristine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,000

Interest Rate

7.62%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burr Charles C | $430,000 | Opus Title | |

| Burr Charles C | $430,000 | Opus Title | |

| Conklin Martha T | $283,000 | None Available | |

| Santopetro Joseph M | $190,000 | Integrity Title Services Inc | |

| Gehle Max D | $333,100 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Burr Charles C | $2,400,040 | |

| Closed | Burr Charles C | $2,400,040 | |

| Previous Owner | Gehle Max D | $333,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,262 | $344,250 | -- | $344,250 |

| 2024 | $4,262 | $262,254 | -- | -- |

| 2023 | $4,262 | $254,616 | $0 | $0 |

| 2022 | $4,159 | $247,200 | $0 | $0 |

| 2021 | $2,000 | $240,000 | $0 | $240,000 |

| 2020 | $4,141 | $240,000 | $0 | $240,000 |

| 2019 | $4,215 | $240,000 | $0 | $240,000 |

| 2018 | $4,457 | $237,000 | $0 | $0 |

| 2017 | $4,717 | $236,300 | $0 | $0 |

| 2016 | $4,683 | $236,300 | $0 | $0 |

| 2015 | $4,019 | $214,800 | $0 | $0 |

| 2014 | $4,019 | $183,594 | $0 | $0 |

| 2013 | $3,730 | $162,619 | $1 | $162,618 |

Source: Public Records

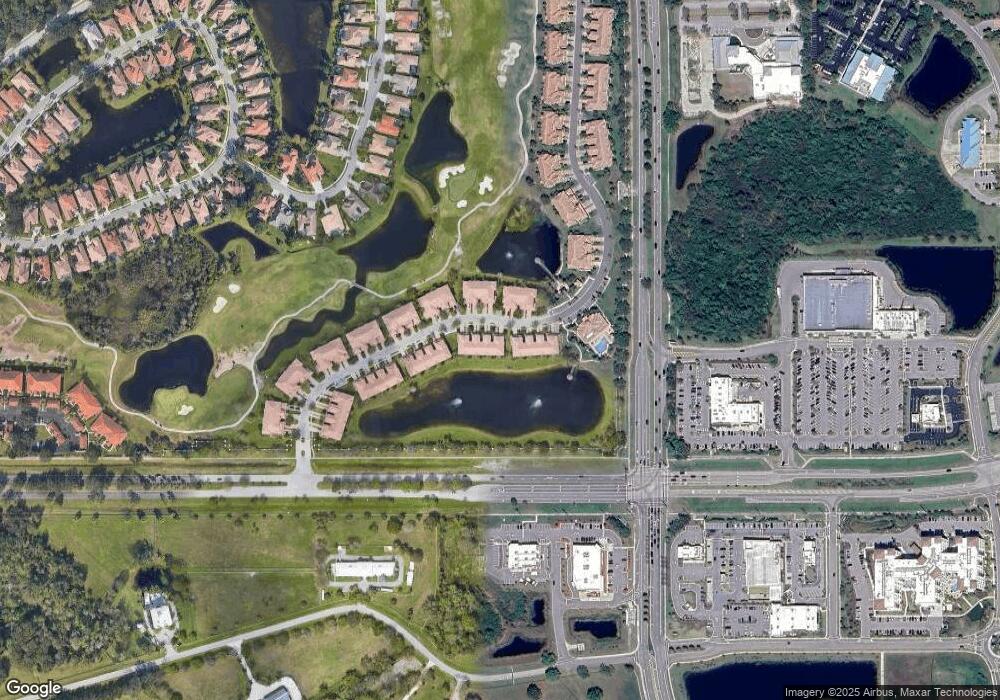

Map

Nearby Homes

- 8451 Miramar Way Unit 101

- 8261 Miramar Way Unit 202

- 7187 Boca Grove Place Unit 202

- 7179 Boca Grove Place Unit 202

- 7155 Boca Grove Place Unit 202

- 7180 Whitemarsh Cir

- 8161 Miramar Way Unit 8161

- 8115 Miramar Way Unit 202

- 7115 Boca Grove Place Unit 204

- 8414 Wethersfield Run Unit 102

- 160 Eagleston Ln

- 164 Eagleston Ln

- 8310 Tartan Fields Cir

- 168 Eagleston Ln

- 8422 Wethersfield Run Unit 103

- 172 Eagleston Ln

- 176 Eagleston Ln

- 180 Eagleston Ln

- 9015 Rothman Ln

- 9031 Duany Ln

- 8359 Miramar Way Unit n/a

- 8457 Miramar Way Unit 8457

- 8453 Miramar Way Unit 8354

- 8449 Miramar Way Unit 8449

- 8419 Miramar Way Unit 204

- 8359 Miramar Way

- 8461 Miramar Way Unit 104

- 8449 Miramar Way Unit 201

- 8453 Miramar Way Unit 102

- 8355 Miramar Way

- 8367 Miramar Way Unit 104

- 8441 Miramar Way Unit 204

- 8457 Miramar Way Unit 203

- 8459 Miramar Way Unit 103

- 8459 Miramar Way Unit IU

- 8451 Miramar Way Unit 8451

- 8359 Miramar Way Unit 8359

- 8367 Miramar Way Unit 8367

- 8453 Miramar Way Unit 8453

- 8409 Miramar Way Unit 8409