8363 Fossil Dr Unit 8363 Sylvania, OH 43560

Estimated Value: $260,000 - $264,000

2

Beds

2

Baths

1,755

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 8363 Fossil Dr Unit 8363, Sylvania, OH 43560 and is currently estimated at $262,405, approximately $149 per square foot. 8363 Fossil Dr Unit 8363 is a home located in Lucas County with nearby schools including Highland Elementary School, Sylvania McCord Junior High School, and Sylvania Northview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2018

Sold by

Chalmers Ryan Christopher and Hambidge Kelly Lynn

Bought by

Lucien Marlene A and The Marlene Lucien Restated And Amended

Current Estimated Value

Purchase Details

Closed on

Oct 22, 2017

Sold by

Frederick Christopher Dell and Frederick Susan Gail

Bought by

Frederick Christopher Dell and Frederick Susan Gail

Purchase Details

Closed on

Jun 24, 2017

Sold by

Herr Denny R and Herr Dennis R

Bought by

Frederick Christopher Dell and Frederick Susan Gail

Purchase Details

Closed on

Aug 6, 2012

Sold by

Wang Pei Ju

Bought by

Herr Denny R and Herr Dennis R

Purchase Details

Closed on

Jan 23, 2008

Sold by

Herr Denny R and Wang Pei Ju

Bought by

Herr Denny R and Wang Pei Ju

Purchase Details

Closed on

Jan 13, 2006

Sold by

Quarrys Edge I Llc

Bought by

Herr Dennis R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,400

Interest Rate

5.87%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lucien Marlene A | $165,000 | Louisville Title Agency | |

| Frederick Christopher Dell | -- | None Available | |

| Frederick Christopher Dell | $168,000 | None Available | |

| Herr Denny R | -- | None Available | |

| Herr Denny R | -- | Attorney | |

| Herr Dennis R | $188,500 | A.R.E.A. Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Herr Dennis R | $150,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,374 | $86,450 | $6,720 | $79,730 |

| 2023 | $3,415 | $56,630 | $5,110 | $51,520 |

| 2022 | $3,450 | $56,630 | $5,110 | $51,520 |

| 2021 | $3,535 | $56,630 | $5,110 | $51,520 |

| 2020 | $3,844 | $55,090 | $4,690 | $50,400 |

| 2019 | $3,697 | $55,090 | $4,690 | $50,400 |

| 2018 | $3,623 | $55,090 | $4,690 | $50,400 |

| 2017 | $3,028 | $43,610 | $5,985 | $37,625 |

| 2016 | $2,966 | $124,600 | $17,100 | $107,500 |

| 2015 | $2,787 | $124,600 | $17,100 | $107,500 |

| 2014 | $2,757 | $43,620 | $5,990 | $37,630 |

| 2013 | $2,757 | $43,620 | $5,990 | $37,630 |

Source: Public Records

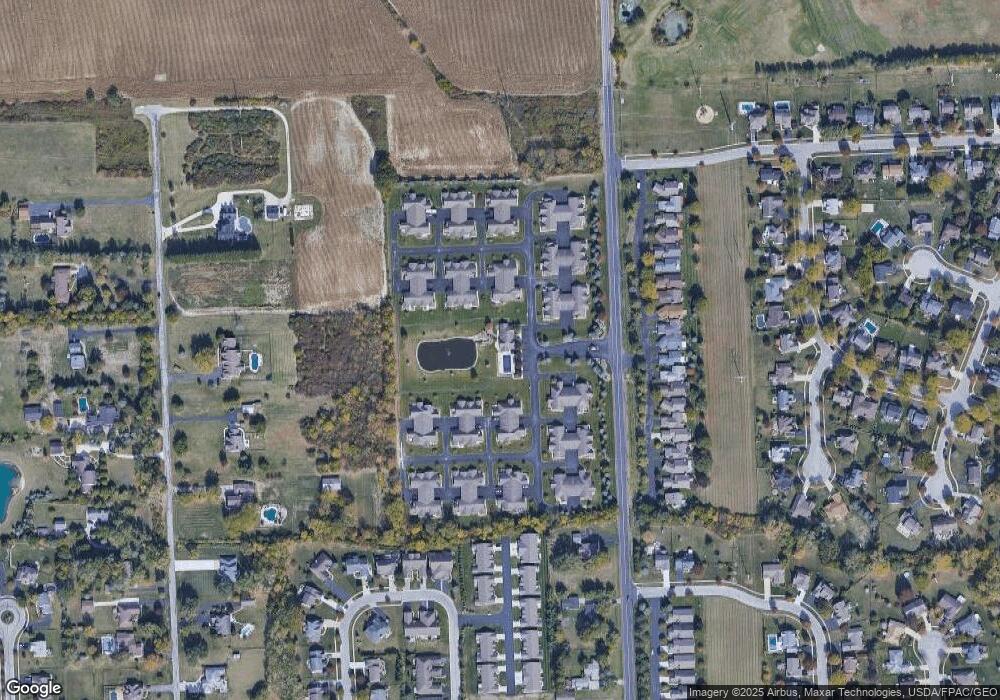

Map

Nearby Homes

- 8367 Fossil Ave

- 8334 Ledgestone Ave Unit 8334

- 8362 Sylvania Metamora Rd

- 5646 Breezy Porch Dr

- 6025 Hawthorne Dr

- 8753 N Stone Mill Rd

- 7858 Erie St

- 5666 Fox Hollow Ct

- 6129 Burrwood Dr

- 9011 Bear Creek Dr

- 5434 Willow Cir

- 6200 Yankee Rd

- 6047 Peppermill Dr

- 8134 Little Rd

- 5346 Palisades Dr

- 5360 Brint Crossing Blvd

- 8917 Creekdale Rd

- 5724 Sunset Lake Dr

- 5235 Brookfield Ln

- 9344 Rocky Water Ct

- 8359 Fossil Dr Unit 8359

- 8367 Fossil Dr Unit 8367

- 8367 Fossil Ave Unit 8367

- 8355 Fossil Dr Unit 8355

- 8364 Fossil Dr Unit 8364

- 8360 Fossil Dr

- 8348 Fossil Ave

- 8351 Fossil Dr Unit 8351

- 8348 Fossil Dr Unit 8348

- 8343 Fossil Ave

- 8347 Fossil Dr Unit 8347

- 8343 Fossil Dr Unit 8343

- 8352 Fossil Dr Unit 8352

- 8356 Fossil Dr Unit 8356

- 8368 Fossil Dr Unit 8368

- 8356 Fossil Ave Unit 8356

- 8344 Fossil Dr Unit 8344

- 8339 Fossil Dr Unit 8339

- 8344 Fossil Ave

- 8360 Meghan Dr