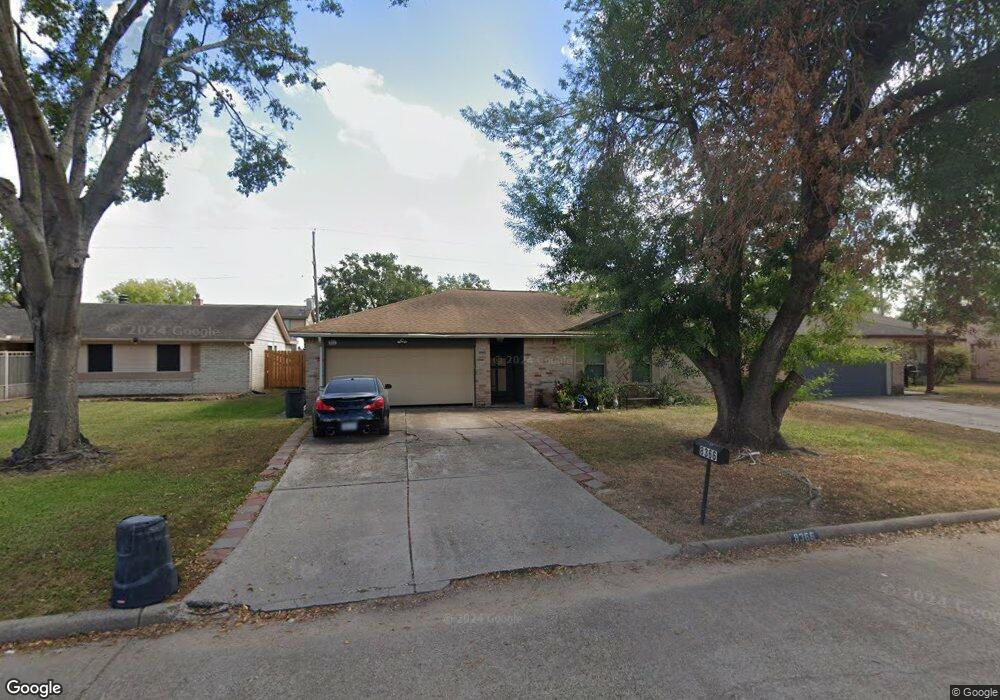

8366 Sorrel Dr Houston, TX 77064

North Houston NeighborhoodEstimated Value: $213,866 - $225,000

3

Beds

2

Baths

1,390

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 8366 Sorrel Dr, Houston, TX 77064 and is currently estimated at $218,967, approximately $157 per square foot. 8366 Sorrel Dr is a home located in Harris County with nearby schools including Frazier Elementary School, Cook Middle School, and Jersey Village High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 13, 2017

Sold by

Edwards Geroge Howard and Edwards Blanche Ellen

Bought by

Castillo Siddharta and Zapata Rosa Liliana Tristan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,250

Outstanding Balance

$105,569

Interest Rate

4.08%

Mortgage Type

New Conventional

Estimated Equity

$113,398

Purchase Details

Closed on

Jul 31, 2014

Sold by

Edwards George H and Edwards Blanche E

Bought by

Edwards Caryn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

4.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 7, 2014

Sold by

Dicken Sandra Kay

Bought by

Edwards George Howard and Edwards Blanche Ellen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

4.19%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castillo Siddharta | -- | Alamo Title Co | |

| Edwards Caryn | -- | -- | |

| Edwards Caryn | -- | -- | |

| Edwards George Howard | -- | Alamo Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castillo Siddharta | $128,250 | |

| Previous Owner | Edwards George Howard | $84,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,798 | $194,994 | $51,198 | $143,796 |

| 2024 | $1,798 | $196,819 | $51,198 | $145,621 |

| 2023 | $1,798 | $194,783 | $51,198 | $143,585 |

| 2022 | $3,895 | $167,137 | $36,570 | $130,567 |

| 2021 | $3,731 | $145,341 | $36,570 | $108,771 |

| 2020 | $3,540 | $132,354 | $30,528 | $101,826 |

| 2019 | $3,452 | $125,266 | $20,988 | $104,278 |

| 2018 | $1,011 | $119,007 | $20,988 | $98,019 |

| 2017 | $3,304 | $119,007 | $20,988 | $98,019 |

| 2016 | $3,049 | $109,827 | $17,490 | $92,337 |

| 2015 | $2,268 | $98,332 | $17,490 | $80,842 |

| 2014 | $2,268 | $79,465 | $12,402 | $67,063 |

Source: Public Records

Map

Nearby Homes

- 8326 Sorrel Dr

- 7615 Fur Market Dr

- 7535 Roaring Springs Dr

- 8406 Daycoach Ln

- 7727 Westbank Ave

- 7911 Bova Rd

- 5715 & 5721 Spindle Dr

- 5624 Spindle Dr

- 7706 Cloverlake Ct

- 7926 Westington Ln

- 7671 Bubbling Spring Ln

- 10515 Ince Ln

- 7510 Bubbling Spring Ln

- 7122 Breen Dr

- 7650 Smiling Wood Ln

- 7602 Smiling Wood Ln

- 8603 Little River Rd

- 8115 Oahu Ct

- 8202 Terrace Brook Dr

- 6508 Redcliff Rd

- 8362 Sorrel Dr

- 8370 Sorrel Dr

- 8379 Pebbledowne Dr

- 8375 Pebbledowne Dr

- 8374 Sorrel Dr

- 8358 Sorrel Dr

- 8383 Pebbledowne Dr

- 8371 Pebbledowne Dr

- 8387 Pebbledowne Dr

- 8367 Sorrel Dr

- 8371 Sorrel Dr

- 8363 Sorrel Dr

- 8378 Sorrel Dr

- 8354 Sorrel Dr

- 8363 Pebbledowne Dr

- 8375 Sorrel Dr

- 8391 Pebbledowne Dr

- 8382 Sorrel Dr

- 8350 Sorrel Dr

- 8379 Sorrel Dr