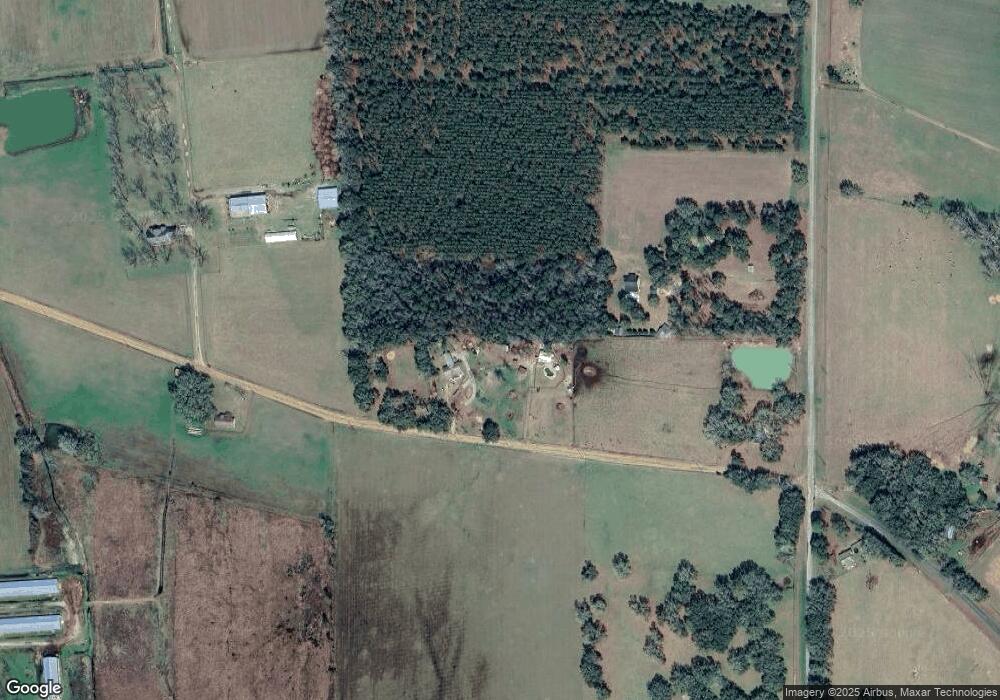

837 Seven Oaks Rd Alapaha, GA 31622

Estimated Value: $123,000 - $323,000

--

Bed

1

Bath

1,008

Sq Ft

$243/Sq Ft

Est. Value

About This Home

This home is located at 837 Seven Oaks Rd, Alapaha, GA 31622 and is currently estimated at $244,689, approximately $242 per square foot. 837 Seven Oaks Rd is a home located in Berrien County with nearby schools including Berrien Primary School, Berrien Elementary School, and Berrien Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2013

Sold by

Harper Ken

Bought by

Harper Kenneth Steven and Harper Kristie Darlene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,712

Outstanding Balance

$121,941

Interest Rate

4.43%

Mortgage Type

New Conventional

Estimated Equity

$122,748

Purchase Details

Closed on

Apr 30, 2007

Sold by

Southern Communications Sv

Bought by

Harper Ken and Harper Kristie T

Purchase Details

Closed on

Oct 31, 2006

Sold by

Jernigan Willaford

Bought by

Harper Ken and Harper Kristie T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,157

Interest Rate

6.25%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harper Kenneth Steven | -- | -- | |

| Harper Ken | $36,192 | -- | |

| Harper Ken | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harper Kenneth Steven | $163,712 | |

| Previous Owner | Harper Ken | $100,157 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,064 | $67,963 | $8,000 | $59,963 |

| 2023 | $2,075 | $67,963 | $8,000 | $59,963 |

| 2022 | $2,075 | $67,963 | $8,000 | $59,963 |

| 2021 | $2,088 | $67,963 | $8,000 | $59,963 |

| 2020 | $2,092 | $67,963 | $8,000 | $59,963 |

| 2019 | $2,092 | $67,963 | $8,000 | $59,963 |

| 2018 | $2,094 | $67,963 | $8,000 | $59,963 |

| 2017 | $2,092 | $67,963 | $8,000 | $59,963 |

| 2016 | $2,032 | $67,963 | $8,000 | $59,963 |

| 2015 | -- | $67,963 | $8,000 | $59,963 |

| 2014 | -- | $67,963 | $8,000 | $59,963 |

| 2013 | -- | $67,963 | $8,000 | $59,963 |

Source: Public Records

Map

Nearby Homes

- . Alapaha River Dr

- 525 Church St

- 21803 Main St

- 0 Quail Ln

- 49 Quail Ln

- 2264 Spurlock Rd

- 1508 Lawton McMillan Rd

- 2000 Coochee Creek Rd

- 395 Harris St

- 2242 U S 82

- 1922 Turner Church Rd

- 0 Nashville Enigma Rd

- 339 Chapel Hill Cir Unit 15

- 339 Chapel Hill Cir

- 72 Cheyenne Rd

- 440 Holt Rd

- 0 June Hendley Rd

- 820 Main St W

- 117 Joe Myrick Rd

- 287 Brookfield Nashville Rd