8372 Agnew Valley Ct Las Vegas, NV 89178

Mountains Edge NeighborhoodEstimated Value: $747,727 - $773,000

3

Beds

4

Baths

3,465

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 8372 Agnew Valley Ct, Las Vegas, NV 89178 and is currently estimated at $756,682, approximately $218 per square foot. 8372 Agnew Valley Ct is a home located in Clark County with nearby schools including Carolyn S. Reedom Elementary School, Desert Oasis High School, and Doral Academy Cactus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2016

Sold by

Dickerson Eric

Bought by

Freeman Ronald

Current Estimated Value

Purchase Details

Closed on

Dec 6, 2010

Sold by

Freeman Abby

Bought by

Freeman Ronald L

Purchase Details

Closed on

Dec 5, 2010

Sold by

Freeman Ronald L

Bought by

Dickerson Eric

Purchase Details

Closed on

May 4, 2007

Sold by

Hall Brian J and Hall Carrie L

Bought by

Freeman Ronald L and Freeman Abby

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$617,500

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 30, 2005

Sold by

Beazer Homes Holdings Corp

Bought by

Hall Brian J and Hall Carrie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$573,750

Interest Rate

5%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Freeman Ronald | $397,857 | None Available | |

| Freeman Ronald L | -- | Nevada Title Las Vegas | |

| Dickerson Eric | $285,000 | Nevada Title Las Vegas | |

| Freeman Ronald L | $650,000 | Ticor Title Of Nevada Inc | |

| Hall Brian J | $532,013 | First Amer Title Co Of Nv |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Freeman Ronald L | $617,500 | |

| Previous Owner | Hall Brian J | $573,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,284 | $227,616 | $47,250 | $180,366 |

| 2024 | $3,968 | $227,616 | $47,250 | $180,366 |

| 2023 | $3,968 | $219,430 | $49,000 | $170,430 |

| 2022 | $3,674 | $193,795 | $38,500 | $155,295 |

| 2021 | $3,402 | $169,406 | $35,000 | $134,406 |

| 2020 | $3,156 | $161,176 | $38,500 | $122,676 |

| 2019 | $2,958 | $156,749 | $34,650 | $122,099 |

| 2018 | $2,822 | $141,371 | $28,350 | $113,021 |

| 2017 | $3,981 | $135,732 | $25,550 | $110,182 |

| 2016 | $2,642 | $127,406 | $20,300 | $107,106 |

| 2015 | $2,637 | $99,677 | $17,500 | $82,177 |

| 2014 | $2,555 | $84,512 | $10,500 | $74,012 |

Source: Public Records

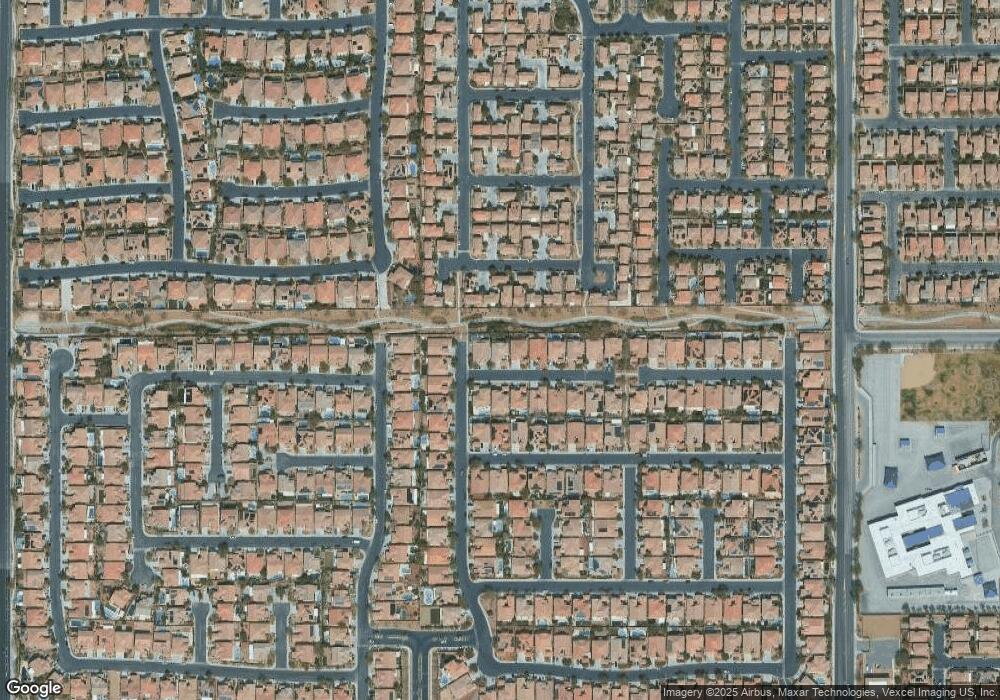

Map

Nearby Homes

- 8396 Waylon Ave

- 7680 Pirouette Ave

- 7711 Pirouette Ave

- 7651 Pirouette Ave

- 7661 Pirouette Ave

- 7671 Pirouette Ave

- 7690 Pirouette Ave

- 8347 Campbell Springs Ave

- 9738 Elk Grove Valley St

- 8547 Benidorm Ave

- 9715 Aleutian St

- 8348 Mokena Ave

- 8316 Mokena Ave

- 8169 Skytop Ledge Ave

- 8626 Anderson Dale Ave

- 9827 High Alpine St

- 9620 Bella di Mora St

- 8050 Allensford Ave

- 8034 Torremolinos Ave

- 8047 Cavazzo Ave

- 8362 Agnew Valley Ct

- 8382 Agnew Valley Ct

- 8352 Agnew Valley Ct

- 8373 Agnew Valley Ct

- 8363 Waylon Ave

- 8363 Agnew Valley Ct

- 8383 Agnew Valley Ct

- 8357 Waylon Ave

- 8342 Agnew Valley Ct

- 8339 Waylon Ave

- 8339 Waylon Ave

- 8369 Waylon Ave

- 8333 Waylon Ave

- 8353 Agnew Valley Ct

- 9909 Portula Valley St

- 9919 Portula Valley St

- 9929 Portula Valley St

- 8351 Waylon Ave

- 8327 Waylon Ave

- 8343 Agnew Valley Ct