839 N 550 E Logan, UT 84321

Adams NeighborhoodEstimated Value: $375,297 - $411,000

3

Beds

2

Baths

1,357

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 839 N 550 E, Logan, UT 84321 and is currently estimated at $392,324, approximately $289 per square foot. 839 N 550 E is a home located in Cache County with nearby schools including Adams Elementary School, Mount Logan Middle School, and Logan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2019

Sold by

Lund Greg O and Lund Shelly

Bought by

Clyde Mark E and Clyde Susan P

Current Estimated Value

Purchase Details

Closed on

May 22, 2009

Sold by

Poulsen Construction Inc

Bought by

Lund Greg O and Lund Shelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,920

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 31, 2007

Sold by

Harris David C

Bought by

Poulsen Construction Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.96%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clyde Mark E | -- | Hickman Land Title Logan | |

| Lund Greg O | -- | American Secure Title | |

| Poulsen Construction Inc | -- | Pinnacle Title Ins Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lund Greg O | $135,920 | |

| Previous Owner | Poulsen Construction Inc | $150,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,584 | $204,875 | $0 | $0 |

| 2023 | $1,708 | $203,885 | $0 | $0 |

| 2022 | $1,829 | $203,885 | $0 | $0 |

| 2021 | $1,274 | $219,528 | $42,500 | $177,028 |

| 2020 | $1,267 | $196,438 | $42,500 | $153,938 |

| 2019 | $1,324 | $196,438 | $42,500 | $153,938 |

| 2018 | $1,329 | $179,945 | $42,500 | $137,445 |

| 2017 | $1,332 | $95,370 | $0 | $0 |

| 2016 | $1,381 | $86,935 | $0 | $0 |

| 2015 | $1,260 | $86,935 | $0 | $0 |

| 2014 | $1,139 | $86,935 | $0 | $0 |

| 2013 | -- | $86,935 | $0 | $0 |

Source: Public Records

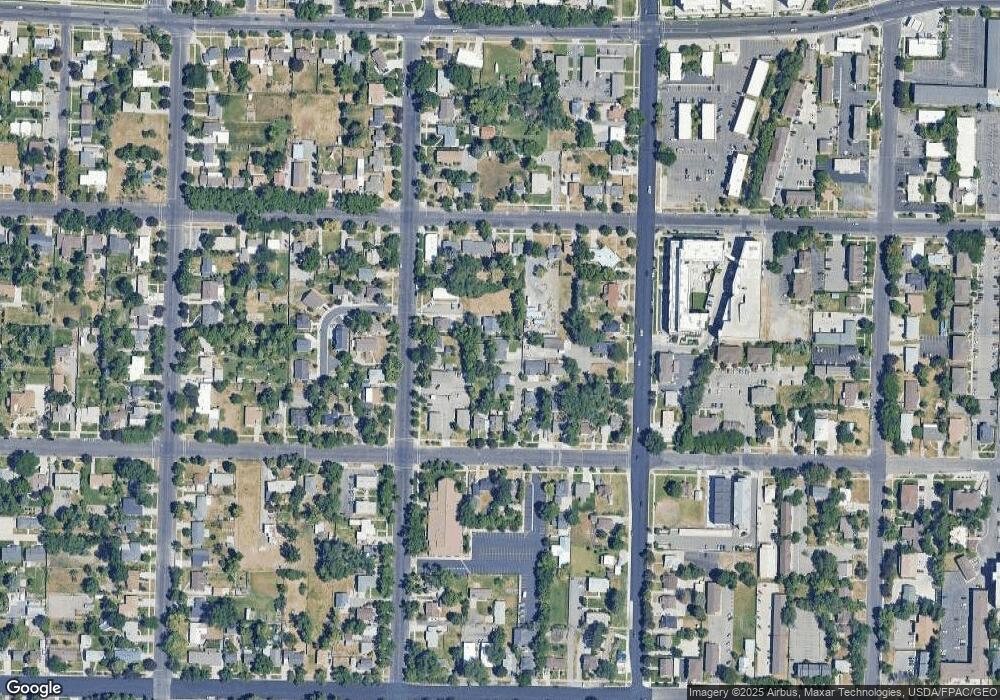

Map

Nearby Homes

Your Personal Tour Guide

Ask me questions while you tour the home.