839 Wood Ave Edison, NJ 08820

Estimated Value: $791,000 - $1,135,000

--

Bed

--

Bath

2,927

Sq Ft

$342/Sq Ft

Est. Value

About This Home

This home is located at 839 Wood Ave, Edison, NJ 08820 and is currently estimated at $1,000,939, approximately $341 per square foot. 839 Wood Ave is a home located in Middlesex County with nearby schools including James Madison Primary School, James Madison Intermediate School, and John Adams Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2021

Sold by

Nagpal Sushil K

Bought by

Nagpal Sushil K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Outstanding Balance

$166,912

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$834,027

Purchase Details

Closed on

Oct 25, 2018

Sold by

Lyszczasz Benjamin and The Estate Of Diane Jean Kremp

Bought by

Nagpal Sushil K and Nagpal Renu

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,000

Interest Rate

4.7%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nagpal Sushil K | -- | Lemonbrew Abstract Llc | |

| Nagpal Sushil K | -- | Lemonbrew Abstract | |

| Nagpal Sushil K | $390,000 | Westcor Land Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nagpal Sushil K | $270,000 | |

| Closed | Nagpal Sushil K | $270,000 | |

| Previous Owner | Nagpal Sushil K | $312,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,014 | $269,000 | $88,600 | $180,400 |

| 2024 | $15,927 | $269,000 | $88,600 | $180,400 |

| 2023 | $15,927 | $269,000 | $88,600 | $180,400 |

| 2022 | $10,442 | $176,300 | $88,600 | $87,700 |

| 2021 | $9,718 | $176,300 | $88,600 | $87,700 |

| 2020 | $10,312 | $176,300 | $88,600 | $87,700 |

| 2019 | $9,339 | $176,300 | $88,600 | $87,700 |

| 2018 | $9,169 | $176,300 | $88,600 | $87,700 |

| 2017 | $9,081 | $176,300 | $88,600 | $87,700 |

| 2016 | $8,914 | $176,300 | $88,600 | $87,700 |

| 2015 | $8,575 | $176,300 | $88,600 | $87,700 |

| 2014 | $8,332 | $176,300 | $88,600 | $87,700 |

Source: Public Records

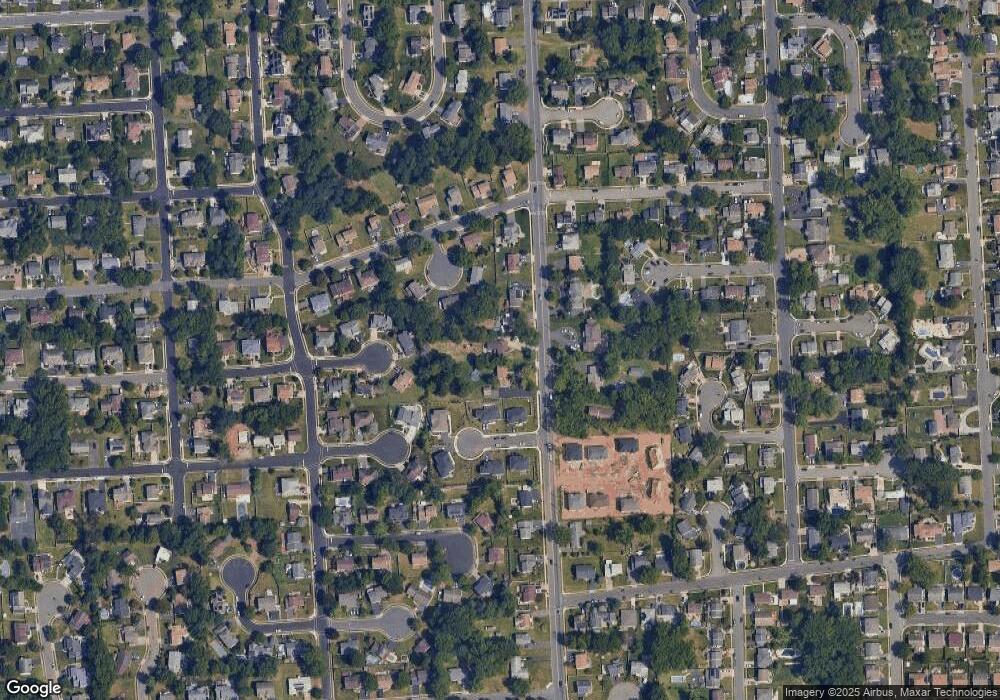

Map

Nearby Homes

- 11 Bernice St

- 12 W Clark Place

- 14 Bonnie Ln

- 868 Inman Ave

- 41 Clover Ave

- 47 Preston Rd

- 38 Revere Blvd

- 80 Gaywood Ave

- 984 Feather Bed Ln

- 35 Revere Blvd

- 37 E Hegel Ave

- 39 Marlboro Ln

- 91 Amherst Ave

- 47 Marlboro Ln

- 266 Amherst Ave

- 53 Sterling Dr

- 24 Sandalwood Dr

- 86 Normandy Rd

- 64 W Francis St

- 7 Oberlin Ct