84 Sherman Oaks Dr Hamilton, OH 45013

Estimated Value: $582,000 - $646,000

4

Beds

6

Baths

5,026

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 84 Sherman Oaks Dr, Hamilton, OH 45013 and is currently estimated at $618,776, approximately $123 per square foot. 84 Sherman Oaks Dr is a home located in Butler County with nearby schools including Ridgeway Elementary School, Wilson Middle School, and Hamilton Freshman School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2022

Sold by

Cabel Corp

Bought by

Bange Matthew Hardwick and Bange Molly Jane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$380,587

Interest Rate

5.1%

Mortgage Type

New Conventional

Estimated Equity

$238,189

Purchase Details

Closed on

Sep 15, 2009

Sold by

Ruppert Rupert E

Bought by

Cabel Corp

Purchase Details

Closed on

Nov 19, 2007

Sold by

Rose J R

Bought by

Ruppert Rupert E

Purchase Details

Closed on

Dec 12, 1999

Sold by

Hogan Patrick W and Holbrock Jonh G

Bought by

Rose J R

Purchase Details

Closed on

Dec 2, 1996

Sold by

Sloneker John G

Bought by

Nin Clara C

Purchase Details

Closed on

Oct 1, 1992

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bange Matthew Hardwick | $500,000 | Elam Jenni B | |

| Bange Matthew Hardwick | $500,000 | Elam Jenni B | |

| Cabel Corp | $440,000 | Attorney | |

| Ruppert Rupert E | -- | Attorney | |

| Rose J R | $61,000 | -- | |

| Nin Clara C | $45,000 | -- | |

| -- | $39,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bange Matthew Hardwick | $400,000 | |

| Closed | Bange Matthew Hardwick | $400,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,358 | $175,000 | $39,890 | $135,110 |

| 2023 | $6,324 | $175,000 | $39,890 | $135,110 |

| 2022 | $6,771 | $156,020 | $39,890 | $116,130 |

| 2021 | $5,959 | $151,130 | $39,890 | $111,240 |

| 2020 | $6,221 | $151,130 | $39,890 | $111,240 |

| 2019 | $10,579 | $154,330 | $35,280 | $119,050 |

| 2018 | $5,850 | $154,330 | $35,280 | $119,050 |

| 2017 | $5,850 | $154,330 | $35,280 | $119,050 |

| 2016 | $5,475 | $140,260 | $35,280 | $104,980 |

| 2015 | $5,447 | $140,260 | $35,280 | $104,980 |

| 2014 | $5,486 | $140,260 | $35,280 | $104,980 |

| 2013 | $5,486 | $140,420 | $24,360 | $116,060 |

Source: Public Records

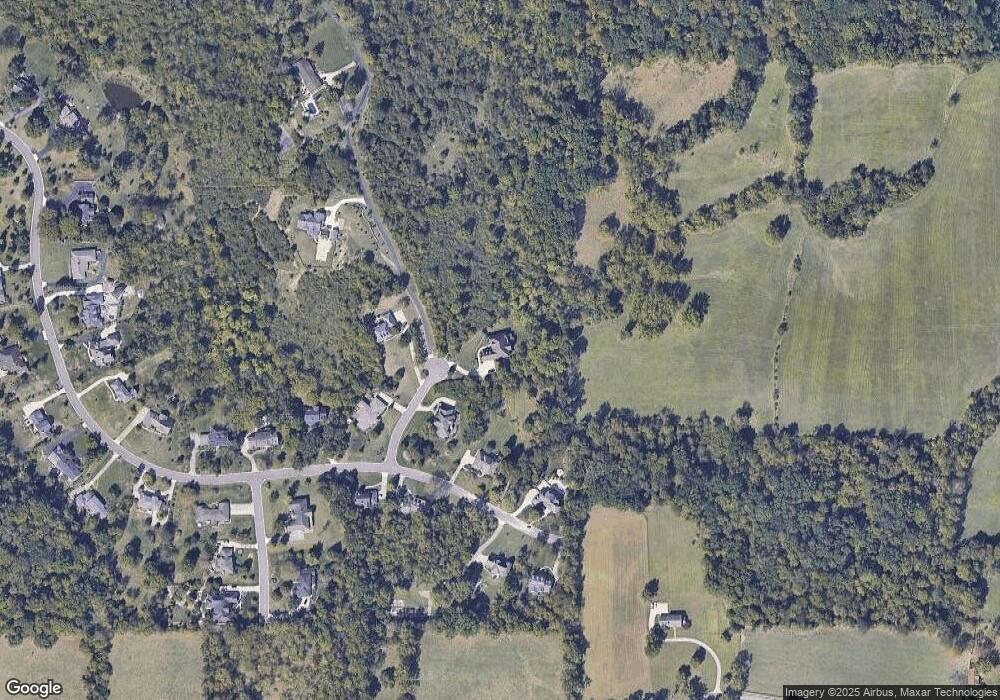

Map

Nearby Homes

- 2055 Little Turtle Ct

- 1399 Treaty Ct

- 2189 Morrow Trail

- 236 Fairborn Dr

- 213 Heathrow Ct

- 992 Richwood Cir

- 163 Kensington Dr

- 1136 Briarwood Dr

- 1601 Hine Rd

- 630 History Bridge Ln

- 27 W Fairway Dr

- 672 Glenway Dr

- 7 Victor Ct

- 1280 Elizabeth Dr

- 501 Gorham Dr

- 236 S Gersam Ave

- 58 Flamingo Dr

- 15 Ohio Ave

- 1281 Millville Ave

- 2440 Salvatore Place

- 74 Sherman Oaks Ct

- 94 Sherman Oaks Dr

- 360 Heathwood Ln

- 83 Sherman Oaks Dr

- 93 Sherman Oaks Dr

- 0 Sherman Oaks Dr

- 380 Heathwood Ln

- 310 Heathwood Ln

- 341 Heathwood Ln

- 321 Heathwood Ln

- 79 Sherman Oaks Dr

- 371 Heathwood Ln

- 300 Heathwood Ln

- 301 Heathwood Ln

- 381 Heathwood Ln

- 280 Heathwood Ln

- 8 Churchill St

- 281 Heathwood Ln

- 73 Sherman Oaks Dr

- 260 Heathwood Ln