8400 NW 10th St Unit 92 Oklahoma City, OK 73127

WesTen NeighborhoodEstimated Value: $80,000 - $97,000

3

Beds

2

Baths

1,100

Sq Ft

$81/Sq Ft

Est. Value

About This Home

This home is located at 8400 NW 10th St Unit 92, Oklahoma City, OK 73127 and is currently estimated at $89,134, approximately $81 per square foot. 8400 NW 10th St Unit 92 is a home located in Oklahoma County with nearby schools including Council Grove Elementary School, Western Heights Middle School, and Western Heights High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2009

Sold by

Wright Kerri M and Wright Tom

Bought by

Becerra Fabian A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,687

Outstanding Balance

$31,628

Interest Rate

4.9%

Mortgage Type

New Conventional

Estimated Equity

$57,506

Purchase Details

Closed on

Apr 27, 2007

Sold by

Rodriguez Connie

Bought by

Bivins Kerri M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,500

Interest Rate

6.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 31, 2006

Sold by

Mescall Taliessa Jean

Bought by

Rodriguez Connie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

6.15%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jul 15, 2005

Sold by

Mescall Mary Leveta and Mescall Taliessa Jean

Bought by

Mescall Mary Leveta and Mescall Taliessa Jean

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Becerra Fabian A | $51,500 | Multiple | |

| Bivins Kerri M | $52,500 | The Oklahoma City Abstract & | |

| Rodriguez Connie | $46,000 | Stewart Abstract & Title Of | |

| Mescall Mary Leveta | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Becerra Fabian A | $48,687 | |

| Previous Owner | Bivins Kerri M | $52,500 | |

| Previous Owner | Rodriguez Connie | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $546 | $4,910 | $347 | $4,563 |

| 2023 | $546 | $4,677 | $436 | $4,241 |

| 2022 | $526 | $4,455 | $528 | $3,927 |

| 2021 | $540 | $4,455 | $528 | $3,927 |

| 2020 | $536 | $4,565 | $591 | $3,974 |

| 2019 | $575 | $4,840 | $591 | $4,249 |

| 2018 | $608 | $5,082 | $0 | $0 |

| 2017 | $577 | $4,839 | $591 | $4,248 |

| 2016 | $549 | $4,652 | $607 | $4,045 |

| 2015 | $573 | $4,816 | $607 | $4,209 |

| 2014 | $560 | $4,737 | $607 | $4,130 |

Source: Public Records

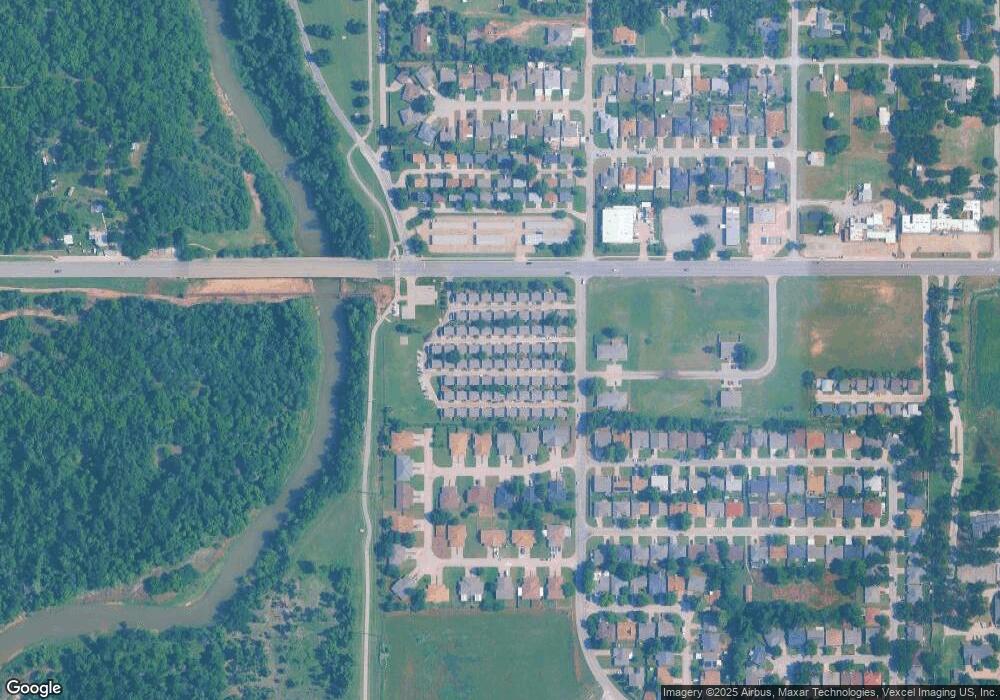

Map

Nearby Homes

- 8300 NW 10th St Unit 32

- 10352 NW 17th St

- 8017 NW 8th Terrace Unit 196

- 10501 NW 10th St

- 1516 N Markwell Place

- 1601 N Markwell Place

- 8029 NW 15th St

- 7815 NW 6th St

- 7818 NW 8th St

- 7804 NW 5th St

- 521 Skylark Dr

- 501 N Tompkins Dr

- 509 Flamingo Ave

- 2121 N Markwell Ave

- 8004 NW 20th St

- 7529 NW 11th St

- 2312 Overholser Ct

- 822 Greenvale Rd

- 0 S Overholser Rd

- 7609 NW 14th St

- 8400 NW 10th St Unit 112

- 8400 NW 10th St Unit 110

- 8400 NW 10th St Unit 108

- 8400 NW 10th St Unit 96

- 8400 NW 10th St Unit 90

- 8400 NW 10th St Unit 88

- 8400 NW 10th St Unit 86

- 8400 NW 10th St Unit 72

- 8400 NW 10th St Unit 68

- 8400 NW 10th St Unit 62

- 8400 NW 10th St Unit 56

- 8400 NW 10th St Unit 52

- 8400 NW 10th St Unit 50

- 8400 NW 10th St Unit 38

- 8400 NW 10th St Unit 12

- 8400 NW 10th St Unit 82

- 8400 NW 10th St Unit 18

- 8400 NW 10th St Unit 16

- 8300 NW 10th St Unit 158

- 8300 NW 10th St Unit 144