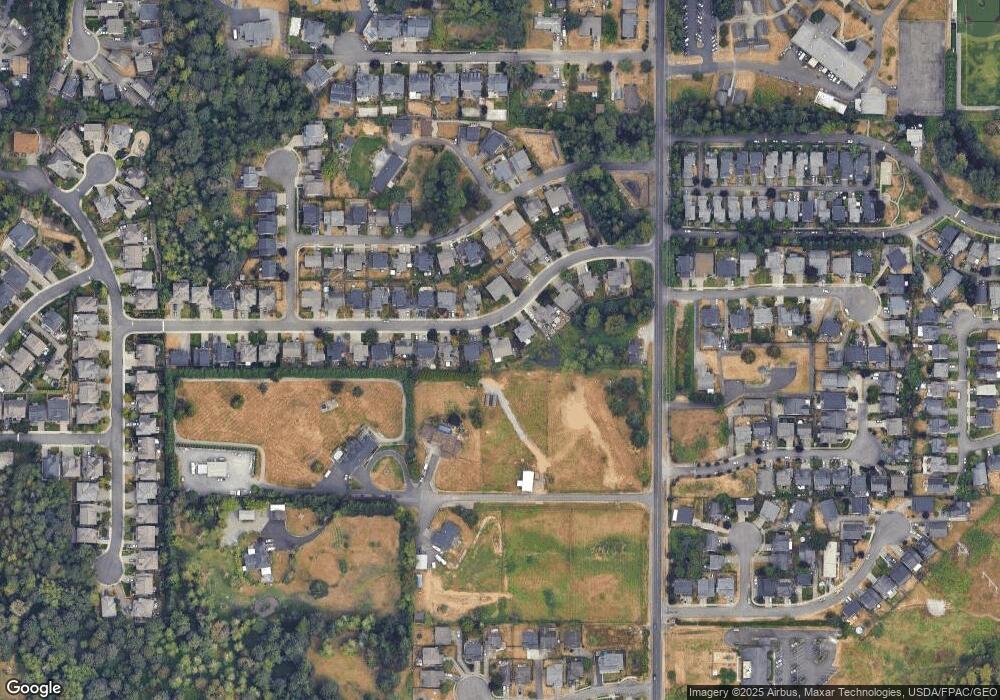

8416 133rd St E Puyallup, WA 98373

Estimated Value: $525,701 - $560,000

3

Beds

2

Baths

1,804

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 8416 133rd St E, Puyallup, WA 98373 and is currently estimated at $545,175, approximately $302 per square foot. 8416 133rd St E is a home located in Pierce County with nearby schools including Dessie F. Evans Elementary School, Ballou Junior High School, and Gov. John Rogers High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2025

Sold by

Tacy Robert E and Tacy Connie S

Bought by

Tacy Family Trust and Tacy

Current Estimated Value

Purchase Details

Closed on

Jan 30, 2009

Sold by

Tacy Robert E

Bought by

Tacy Robert E and Tacy Connie S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.04%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 9, 2002

Sold by

Myers Alice

Bought by

Tacy Robert E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,200

Interest Rate

7.08%

Purchase Details

Closed on

Aug 23, 2000

Sold by

Pacific Northwest Home Construction Llc

Bought by

Myers Alice J and The Myers Family Revocable Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tacy Family Trust | -- | None Listed On Document | |

| Tacy Robert E | -- | None Available | |

| Tacy Robert E | $186,500 | Transnation Title Insurance | |

| Myers Alice J | $174,950 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tacy Robert E | $150,000 | |

| Previous Owner | Tacy Robert E | $149,200 | |

| Closed | Tacy Robert E | $27,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,943 | $494,400 | $166,600 | $327,800 |

| 2024 | $4,943 | $483,600 | $162,900 | $320,700 |

| 2023 | $4,943 | $469,300 | $162,900 | $306,400 |

| 2022 | $4,741 | $481,700 | $182,700 | $299,000 |

| 2021 | $4,490 | $347,300 | $136,900 | $210,400 |

| 2019 | $3,883 | $317,200 | $112,800 | $204,400 |

| 2018 | $3,895 | $296,900 | $97,900 | $199,000 |

| 2017 | $3,573 | $266,100 | $84,300 | $181,800 |

| 2016 | $3,269 | $213,400 | $66,900 | $146,500 |

| 2014 | $2,950 | $202,000 | $58,000 | $144,000 |

| 2013 | $2,950 | $180,600 | $51,400 | $129,200 |

Source: Public Records

Map

Nearby Homes

- 8005 134th Street Ct E

- 12911 83rd Avenue Ct E

- 8728 136th St E

- Stella Plan at Heritage Heights

- Hadley Plan at Heritage Heights

- Caymen Plan at Heritage Heights

- Warren Plan at Heritage Heights

- Asher Plan at Heritage Heights

- 8705 126th (Lot 40) Street Ct E

- 8709 126th (Lot 39) Street Ct E

- 8710 126th (Lot 3) Street Ct E

- 8719 126th (Lot 37) Street Ct E

- 8815 126th (Lot 32) Street Ct E

- 8714 126th (Lot 4) St E

- 8803 126th (Lot 35) Street Ct E

- 8812 126th (Lot 8) Street Ct E

- 8804 St E

- 8812 126th St E

- 8715 Ct E

- 8808 126th (Lot 7) St E

- 8412 133rd St E

- 8502 133rd St E

- 8502 133rd St E

- 8408 133rd St E

- 8508 133rd St E

- 8415 133rd St E

- 8407 133rd St E

- 8404 133rd St E

- 8507 133rd St E

- 8514 133rd St E

- 8403 133rd St E

- 8414 132nd Street Ct E

- 8318 133rd St E

- 8318 133rd St E

- 8410 132nd Street Ct E

- 8513 133rd St E

- 8414 E 132nd St Ct

- 8418 132nd Street Ct E

- 8520 133rd St E