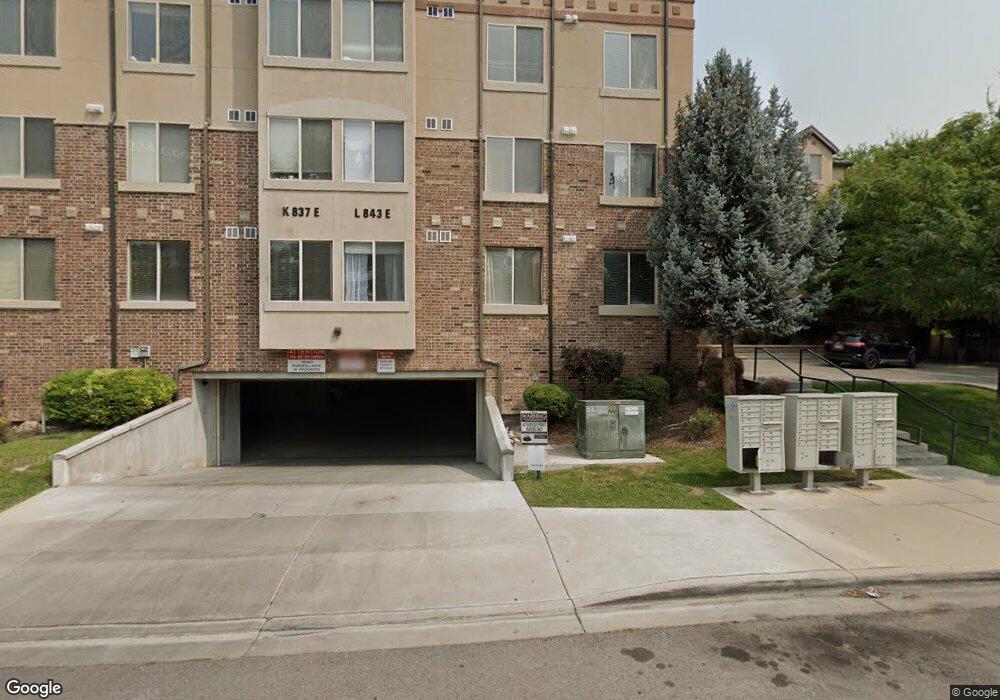

843 E 620 N Unit L3 Provo, UT 84606

Joaquin NeighborhoodEstimated Value: $433,312 - $500,000

4

Beds

2

Baths

1,098

Sq Ft

$425/Sq Ft

Est. Value

About This Home

This home is located at 843 E 620 N Unit L3, Provo, UT 84606 and is currently estimated at $466,828, approximately $425 per square foot. 843 E 620 N Unit L3 is a home located in Utah County with nearby schools including Provo Peaks School, Centennial Middle School, and Timpview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2018

Sold by

Forrest Alfred E and Forrest Alfred E

Bought by

Forrest Alfred E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Outstanding Balance

$124,705

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$342,124

Purchase Details

Closed on

Dec 12, 2005

Sold by

Urban Development Group Llc

Bought by

Forrest Alfred E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,850

Interest Rate

6.36%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Forrest Alfred E | -- | Metro National Title | |

| Forrest Alfred E | -- | Title West Title Company | |

| Urban Development Group Llc | -- | Title West Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Forrest Alfred E | $143,000 | |

| Closed | Forrest Alfred E | $178,850 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,013 | $401,600 | $44,600 | $357,000 |

| 2024 | $4,013 | $395,000 | $0 | $0 |

| 2023 | $4,180 | $405,600 | $0 | $0 |

| 2022 | $4,173 | $408,300 | $40,800 | $367,500 |

| 2021 | $3,508 | $329,300 | $39,500 | $289,800 |

| 2020 | $3,461 | $304,500 | $36,500 | $268,000 |

| 2019 | $1,656 | $275,600 | $33,000 | $242,600 |

| 2018 | $1,633 | $275,600 | $33,000 | $242,600 |

| 2017 | $1,530 | $141,900 | $0 | $0 |

| 2016 | $1,464 | $126,500 | $0 | $0 |

| 2015 | $1,354 | $118,250 | $0 | $0 |

| 2014 | $1,299 | $118,250 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 785 E 560 N Unit 405

- 515 N 790 E Unit 312

- 611 N 700 E Unit 5

- 655 E 600 N Unit 6

- 915 E 820 N Unit 24

- 907 E 820 N Unit 11

- 541 E 500 N Unit 12

- 1051 E 300 N

- 364 N 500 E

- 532 N Seven Peaks Blvd Unit 302

- 864 E 200 N

- 734 Hillsdale Ln

- 240 N 500 East St

- 240 E 600 N

- 722 N 200 E Unit 6

- 635 N Ridge Dr Unit 25

- 466 N 200 E

- 747 N 200 E Unit 1

- 990 Cedar Ave

- 1175 N Locust Ln

- 843 E 620 N Unit L4

- 843 E 620 N Unit L2

- 843 E 620 N Unit L1

- 843 E 620 N Unit 39

- 843 E 620 N Unit 38

- 859 E 620 N Unit H4

- 859 E 620 N Unit H3

- 859 E 620 N Unit H2

- 837 E 620 N Unit K3

- 837 E 620 N Unit K2

- 837 E 620 N Unit K1

- 837 E 620 N Unit 35

- 837 E 620 N Unit 34

- 871 E 620 N Unit J4

- 871 E 620 N Unit J3

- 871 E 620 N Unit J2

- 825 E 620 N

- 866 E 700 N Unit C4

- 866 E 700 N Unit C3

- 866 E 700 N Unit C2