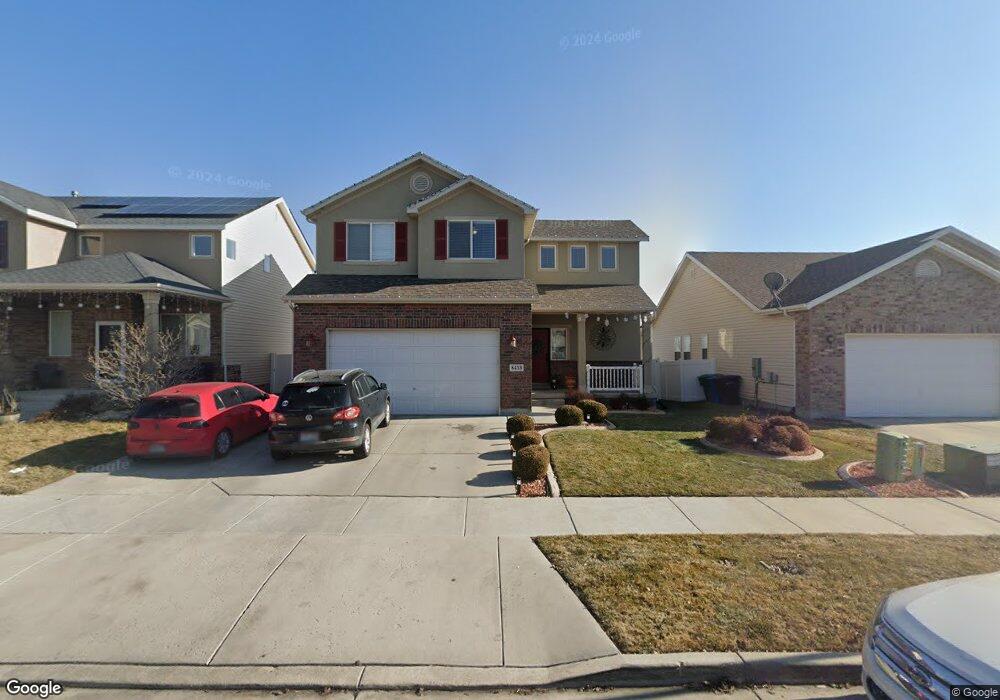

8433 S 6430 W West Jordan, UT 84081

Jordan Hills NeighborhoodEstimated Value: $531,894 - $579,000

3

Beds

3

Baths

2,394

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 8433 S 6430 W, West Jordan, UT 84081 and is currently estimated at $549,224, approximately $229 per square foot. 8433 S 6430 W is a home located in Salt Lake County with nearby schools including Oakcrest Elementary School, Sunset Ridge Middle School, and Copper Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2020

Sold by

Sorensen Gregory James and Sorensen Jeidy D

Bought by

Edwards Joshua and Edwards Alisa

Current Estimated Value

Purchase Details

Closed on

Feb 26, 2014

Sold by

Velez Jared B and Velez Heidi B

Bought by

Sorensen Gregory James and Sorensen Jeidy D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Interest Rate

4.38%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 25, 2004

Sold by

Richmond American Homes Of Utah Inc

Bought by

Velez Jared B and Velez Heidi B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,325

Interest Rate

6.29%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Edwards Joshua | -- | Old Republic Ttl Draper Orem | |

| Sorensen Gregory James | -- | Premium Title & Escrow | |

| Velez Jared B | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sorensen Gregory James | $176,000 | |

| Previous Owner | Velez Jared B | $183,325 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,461 | $490,900 | $97,100 | $393,800 |

| 2024 | $2,461 | $473,400 | $93,800 | $379,600 |

| 2023 | $2,645 | $479,600 | $92,000 | $387,600 |

| 2022 | $2,710 | $483,400 | $90,200 | $393,200 |

| 2021 | $2,214 | $359,600 | $71,500 | $288,100 |

| 2020 | $2,098 | $319,700 | $71,500 | $248,200 |

| 2019 | $2,058 | $307,600 | $71,500 | $236,100 |

| 2018 | $1,931 | $286,200 | $69,400 | $216,800 |

| 2017 | $1,800 | $265,700 | $69,400 | $196,300 |

| 2016 | $1,753 | $243,100 | $69,400 | $173,700 |

| 2015 | $1,603 | $216,700 | $70,700 | $146,000 |

| 2014 | $1,468 | $195,400 | $67,400 | $128,000 |

Source: Public Records

Map

Nearby Homes

- 8457 S 6430 W

- 8356 S Four Elm Cir

- 8497 S 6465 W

- 8329 S 6430 W

- 7622 Iron Canyon Unit 343

- 7628 S Clipper Hill Rd W Unit 303

- 7068 W Terrain Rd Unit 163

- 6819 S Clever Peak Dr Unit 272

- 6039 W Garnet Grove Way S Unit 221

- 6033 W Garnet Grove Way Unit 223

- 8953 S Smoky Hollow Rd

- 5973 W Hal Row Unit 112

- 6543 W Oak Bridge Dr

- 8368 S Oak Gate Dr

- 8559 Sunrise Oak Dr

- 8246 S Oak Acorn Ct

- 8269 S 6555 W

- 6466 W Pin Oak Dr

- 6647 W Merlot Way

- 8457 Ivy Springs Ln

- 8423 S 6430 W

- 8449 S 6430 W

- 8417 S 6430 W

- 8434 S 6430 W

- 8409 S 6430 W

- 8442 S 6430 W

- 8424 S 6430 W

- 8452 S 6430 W

- 8416 S 6430 W

- 8463 S 6430 W

- 8403 S 6430 W

- 8438 S Rundlestone Dr

- 8458 S 6430 W

- 8408 S 6430 W

- 8418 S Rundlestone Dr

- 8456 S Rundlestone Dr Unit LOT102

- 8456 S Rundlestone Dr

- 8462 S 6430 W

- 8433 S 6465 W

- 8393 S 6430 W