Estimated Value: $248,166 - $272,000

3

Beds

2

Baths

965

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 8475 SW 156th Ct Unit 333, Miami, FL 33193 and is currently estimated at $264,792, approximately $274 per square foot. 8475 SW 156th Ct Unit 333 is a home located in Miami-Dade County with nearby schools including Dante B. Fascell Elementary School, Hammocks Middle School, and Felix Varela Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 14, 2024

Sold by

Lopez Linda Diane

Bought by

Lopez Linda Diane and Xiques Juan Miguel

Current Estimated Value

Purchase Details

Closed on

May 13, 2005

Sold by

Alonso Aurelio

Bought by

Lopez Linda Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,800

Interest Rate

5.69%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 2, 2005

Sold by

Brunely Roberto J and Alonso Aurelio

Bought by

Alonso Aurelio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,800

Interest Rate

5.69%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 1, 2000

Sold by

Francisco and Mogollon Alicia

Bought by

Brunely Roberto J and Alonso Aurelio

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Linda Diane | -- | Citation Title | |

| Lopez Linda Diane | $155,000 | Great Country Title Services | |

| Alonso Aurelio | -- | -- | |

| Brunely Roberto J | $55,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lopez Linda Diane | $123,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,947 | $191,355 | -- | -- |

| 2024 | $2,787 | $149,124 | -- | -- |

| 2023 | $2,787 | $135,568 | $0 | $0 |

| 2022 | $2,403 | $123,244 | $0 | $0 |

| 2021 | $2,176 | $112,040 | $0 | $0 |

| 2020 | $2,006 | $131,000 | $0 | $0 |

| 2019 | $1,893 | $128,000 | $0 | $0 |

| 2018 | $1,735 | $126,024 | $0 | $0 |

| 2017 | $1,539 | $76,527 | $0 | $0 |

| 2016 | $1,422 | $69,570 | $0 | $0 |

| 2015 | $1,268 | $63,246 | $0 | $0 |

| 2014 | -- | $57,497 | $0 | $0 |

Source: Public Records

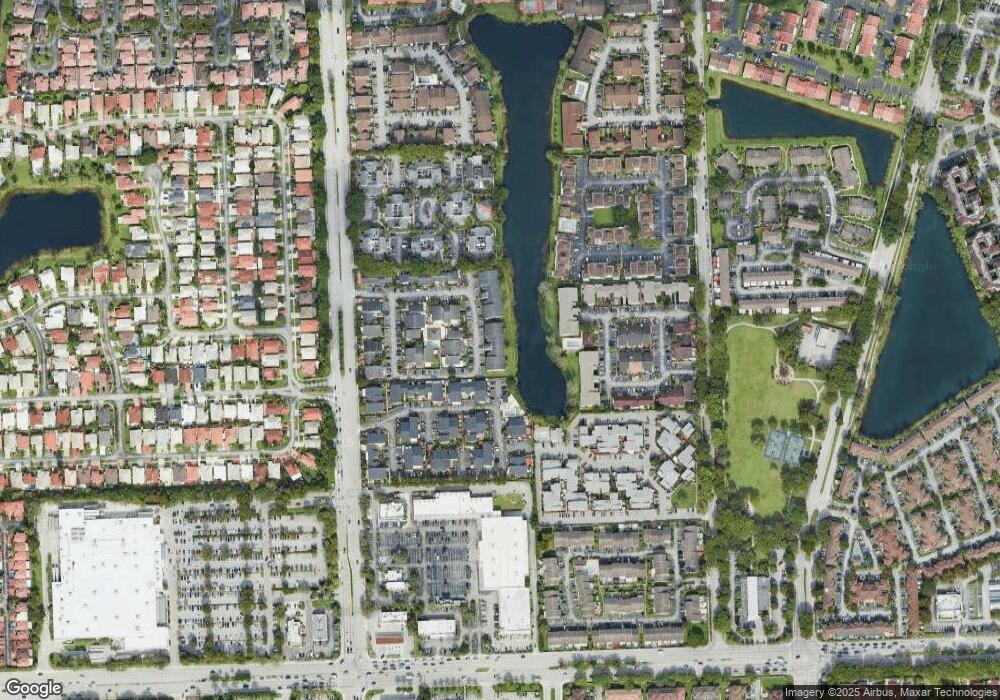

Map

Nearby Homes

- 8475 SW 156th Ct Unit 321

- 8485 SW 156th Place Unit 106

- 15685 SW 84th Terrace Unit 801

- 8610 SW 156th Ct Unit 115

- 8301 SW 157th Ave Unit 205

- 8331 SW 157th Ave Unit 405

- 8420 SW 154th Cir Ct Unit 512

- 8420 SW 154th Cir Ct Unit 536

- 8450 SW 154th Cir Ct Unit 207

- 15408 SW 85th Terrace Unit 184

- 15665 SW 82nd Cir Ln Unit 4-4

- 15665 SW 82nd Cir Ln Unit 415

- 15685 SW 82nd Cir Ln Unit 28

- 15434 SW 85th Ln Unit 154

- 15655 SW 82nd Cir Ln Unit 512

- 15428 SW 85th Terrace Unit 189

- 15921 SW 82nd St

- 8310 SW 154th Ave Unit 27

- 15430 SW 82nd Ln Unit 625

- 15763 SW 82nd St

- 8475 SW 156th Ct

- 8435 SW 156th Ct Unit 1032

- 8470 SW 156th Ct Unit 204

- 8475 SW 156th Ct Unit 322

- 8470 SW 156th Ct Unit 201

- 8435 SW 156th Ct Unit 1023

- 8435 SW 156th Ct Unit 1020

- 8435 SW 156th Ct Unit 1015

- 8475 SW 156th Ct Unit 311

- 8475 SW 156th Ct Unit 330

- 8450 SW 156th Ct Unit 403

- 8450 SW 156th Ct Unit 404

- 8475 SW 156th Ct Unit 315

- 8475 SW 156th Ct Unit 326

- 8475 SW 156th Ct Unit 310

- 8435 SW 156th Ct Unit 1016

- 8435 SW 156th Ct Unit 1031

- 8450 SW 156th Ct Unit 401

- 8435 SW 156th Ct Unit 1012