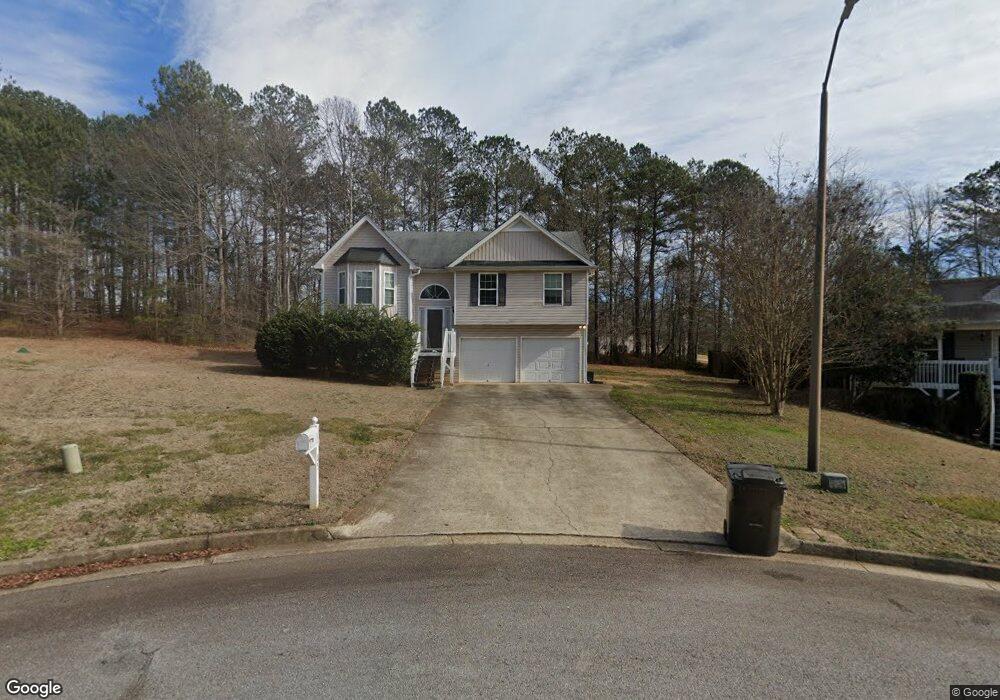

85 Shingle Oak Ct Dallas, GA 30157

Estimated Value: $248,969 - $268,000

3

Beds

2

Baths

1,172

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 85 Shingle Oak Ct, Dallas, GA 30157 and is currently estimated at $256,742, approximately $219 per square foot. 85 Shingle Oak Ct is a home located in Paulding County with nearby schools including Union Elementary School, Carl Scoggins Sr. Middle School, and South Paulding High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2011

Sold by

Federal Natl Mtg Assn Fnma

Bought by

Alexander Joe R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,425

Outstanding Balance

$1,665

Interest Rate

4.71%

Mortgage Type

New Conventional

Estimated Equity

$255,077

Purchase Details

Closed on

Nov 2, 2010

Sold by

Wells Fargo Bk Na

Bought by

Federal Natl Mtg Assn Fnma

Purchase Details

Closed on

Apr 30, 2007

Sold by

Jaco Homes Llc

Bought by

Bailey Claude

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,320

Interest Rate

6.1%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alexander Joe R | $109,884 | -- | |

| Federal Natl Mtg Assn Fnma | -- | -- | |

| Wells Fargo Bk Na | $109,883 | -- | |

| Bailey Claude | $122,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alexander Joe R | $43,425 | |

| Previous Owner | Bailey Claude | $98,320 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,588 | $104,056 | $12,000 | $92,056 |

| 2023 | $2,491 | $95,568 | $12,000 | $83,568 |

| 2022 | $2,204 | $74,192 | $12,000 | $62,192 |

| 2021 | $1,825 | $61,436 | $8,000 | $53,436 |

| 2020 | $1,662 | $55,960 | $8,000 | $47,960 |

| 2019 | $1,567 | $52,000 | $8,000 | $44,000 |

| 2018 | $1,380 | $45,800 | $8,000 | $37,800 |

| 2017 | $1,248 | $40,840 | $8,000 | $32,840 |

| 2016 | $1,243 | $41,120 | $8,000 | $33,120 |

| 2015 | $1,041 | $33,840 | $8,000 | $25,840 |

| 2014 | $870 | $27,556 | $8,000 | $19,556 |

| 2013 | -- | $22,880 | $8,000 | $14,880 |

Source: Public Records

Map

Nearby Homes

- 12 Shingle Oak Ct

- 65 Cynthia Ct

- 232 Cynthia Ct

- 0 Old Yorkville Rd Unit 10574003

- 370 Buchanan Cir Unit TRACT 1

- 370 Buchanan Circle Tract 1

- 2351 Old Yorkville Rd

- 177 Rustin Dr

- 149 Peyton Ln

- 0 Rustin Dr Unit 10617842

- 0 Rustin Dr Unit 7657021

- 128 Tanner Dr

- 877 Georgia 101

- 879 Georgia 101

- 363 Safe Harbor Dr

- 65 Harmony Woods Ln

- 281 Harmony Woods Dr

- 270 Harmony Woods Dr

- 216 Lake Tanisha Dr

- 453 Mulberry Rock Rd

- 93 Shingle Oak Ct

- 79 Shingle Oak Ct

- 167 Shingle Oak Dr

- 167 Shingle Oak Dr Unit 167

- 167 Shingle Oak Dr

- 90 Shingle Oak Ct

- 84 Shingle Oak Ct

- 159 Swafford Dr

- 177 Swafford Dr

- 143 Swafford Dr

- 51 Shingle Oak Ct

- 56 Shingle Oak Ct

- 0 Shingle Oak Ct

- 161 Shingle Oak Dr

- 195 Swafford Dr

- 121 Swafford Dr

- 101 Swafford Dr

- 166 Swafford Dr

- 40 Shingle Oak Ct

- 136 Shingle Oak Dr