8503 Hana Rd Edison, NJ 08817

Estimated Value: $492,975 - $551,000

2

Beds

2

Baths

1,590

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 8503 Hana Rd, Edison, NJ 08817 and is currently estimated at $510,244, approximately $320 per square foot. 8503 Hana Rd is a home located in Middlesex County with nearby schools including John Marshall Elementary School, Thomas Jefferson Middle School, and Edison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2019

Sold by

Vyas Nirav

Bought by

Pattani Milan F and Patni Sapnarati

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Outstanding Balance

$236,894

Interest Rate

4.4%

Mortgage Type

New Conventional

Estimated Equity

$273,350

Purchase Details

Closed on

Jan 8, 2013

Sold by

Dunovan Shaun

Bought by

Vyas Nirav

Purchase Details

Closed on

Feb 8, 2012

Sold by

Johnson Leona

Bought by

New Jersey Housing And Mortgage Finance

Purchase Details

Closed on

Sep 26, 2008

Sold by

Morrison Darlene S

Bought by

Johnson Leona

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

6.43%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 6, 1996

Sold by

Pagano Anthony

Bought by

Morrison Darlene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,000

Interest Rate

7.62%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pattani Milan F | $285,000 | Passaic Valley Title Service | |

| Vyas Nirav | $185,000 | None Available | |

| New Jersey Housing And Mortgage Finance | -- | None Available | |

| Johnson Leona | $276,000 | First American Title Ins Co | |

| Morrison Darlene | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pattani Milan F | $270,000 | |

| Previous Owner | Johnson Leona | $272,000 | |

| Previous Owner | Morrison Darlene | $107,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,727 | $113,000 | $31,600 | $81,400 |

| 2024 | $6,691 | $113,000 | $31,600 | $81,400 |

| 2023 | $6,691 | $113,000 | $31,600 | $81,400 |

| 2022 | $6,693 | $113,000 | $31,600 | $81,400 |

| 2021 | $6,422 | $113,000 | $31,600 | $81,400 |

| 2020 | $6,609 | $113,000 | $31,600 | $81,400 |

| 2019 | $5,871 | $113,000 | $31,600 | $81,400 |

| 2018 | $5,877 | $113,000 | $31,600 | $81,400 |

| 2017 | $5,821 | $113,000 | $31,600 | $81,400 |

| 2016 | $5,713 | $113,000 | $31,600 | $81,400 |

| 2015 | $5,496 | $113,000 | $31,600 | $81,400 |

| 2014 | $5,340 | $113,000 | $31,600 | $81,400 |

Source: Public Records

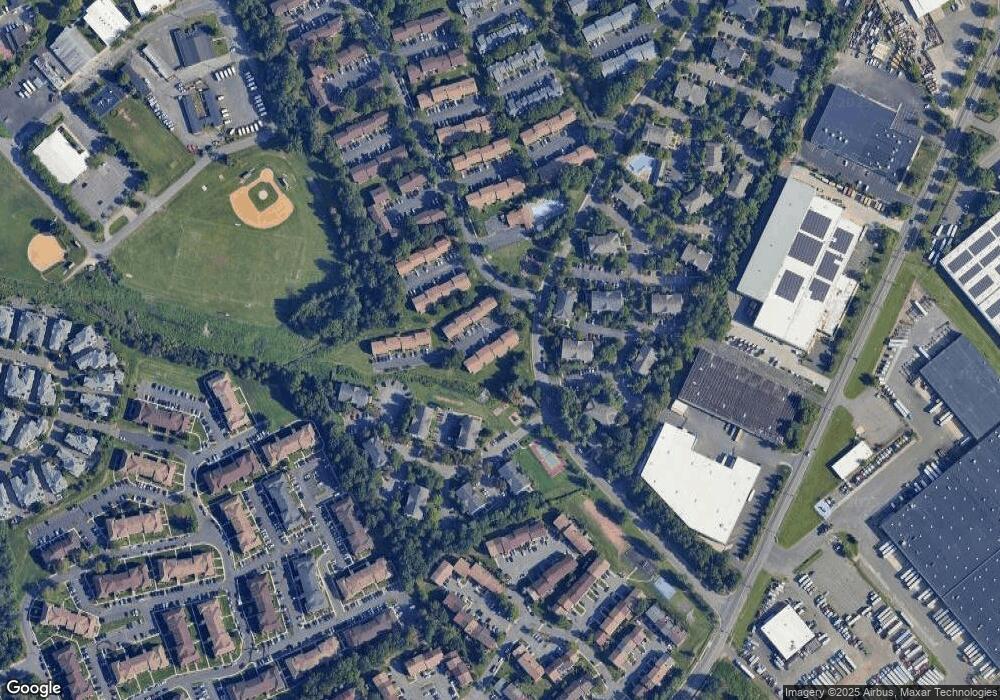

Map

Nearby Homes

- 1308 Merrywood Dr

- 2102 Amanda Ct Unit 2102

- 1702 Amanda Ct

- 2704 Jesse Way

- 0-142&134 Ethel Rd

- 2910 Jesse Way

- 3004 Jesse Way

- 1617 Raspberry Ct

- 1730 Raspberry Ct

- 176 Nebula Rd

- 524 Doral Ct

- 449 Plainfield Ave

- 35 Masters Blvd

- 6 Jennifer Ct

- 2 Arlington Place

- 271 Central Ave

- 1420 Shadyside Place

- 121 Dunham Ave

- 123 Dunham Ave Unit E123

- 1409 Durham Ave