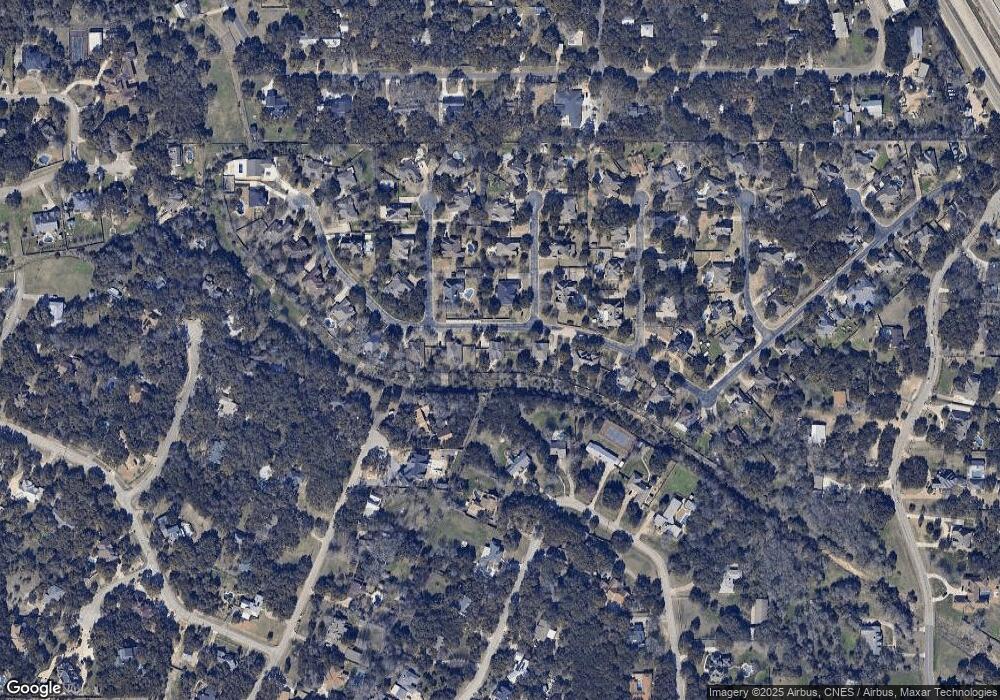

8508 Traciney Blvd San Antonio, TX 78255

Scenic Oaks NeighborhoodEstimated Value: $541,639 - $594,000

3

Beds

2

Baths

2,329

Sq Ft

$246/Sq Ft

Est. Value

About This Home

This home is located at 8508 Traciney Blvd, San Antonio, TX 78255 and is currently estimated at $572,410, approximately $245 per square foot. 8508 Traciney Blvd is a home located in Bexar County with nearby schools including Aue Elementary School, Rawlinson Middle School, and Clark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2017

Sold by

Lampis Samuel J and Lampis Samuel

Bought by

Satxes Llc

Current Estimated Value

Purchase Details

Closed on

Jun 5, 2015

Sold by

Miles Douglas E and Miles Annemarie K

Bought by

Hage Bryan J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,400

Interest Rate

3.82%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 15, 2007

Sold by

Bruetsch Annette Yvonne and Bruetsch William J

Bought by

Miles Douglas E and Miles Annemarie K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$211,200

Interest Rate

6.09%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 31, 1997

Sold by

Scott Felder Ltd Partnership

Bought by

Bruetsch Annette Yvonne and Bruetsch William J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,650

Interest Rate

7%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Satxes Llc | -- | None Available | |

| Hage Bryan J | -- | None Available | |

| Miles Douglas E | -- | Alamo Title | |

| Bruetsch Annette Yvonne | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hage Bryan J | $260,400 | |

| Previous Owner | Miles Douglas E | $211,200 | |

| Previous Owner | Bruetsch Annette Yvonne | $194,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,514 | $520,811 | $139,960 | $380,851 |

| 2024 | $7,514 | $505,780 | $139,960 | $392,040 |

| 2023 | $7,514 | $459,800 | $139,960 | $350,040 |

| 2022 | $8,299 | $418,000 | $121,220 | $358,270 |

| 2021 | $7,925 | $384,710 | $62,130 | $322,580 |

| 2020 | $7,479 | $355,350 | $62,130 | $293,220 |

| 2019 | $7,831 | $359,780 | $62,130 | $297,650 |

| 2018 | $7,359 | $338,040 | $62,130 | $275,910 |

| 2017 | $6,729 | $308,090 | $62,130 | $245,960 |

| 2016 | $6,577 | $301,160 | $62,130 | $239,030 |

| 2015 | $6,048 | $304,160 | $50,030 | $254,130 |

| 2014 | $6,048 | $282,410 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 26308 Reyglen Dr

- 8615 Traciney Blvd

- 8612 Flint Rock Dr

- 26042 Cypress Oaks

- 8707 Paisano Pass

- 8618 Indian Hills Ln

- 26018 Hazy Hollow

- 8718 Paisano Pass

- 25851 Warbler View

- 8735 Paseo Oaks

- 25802 Hazy Hollow

- 8715 Buckskin Dr

- 8905 Soaring Oak

- 8211 Snowdeal Ln

- 25827 Enchanted Dawn

- 25551 River Ranch

- 25764 Velvet Creek

- 8318 Cactus Wren Ln

- 25534 River Ranch

- 8923 Painted Oak

- 8512 Traciney Blvd

- 8504 Traciney Blvd

- 26303 Tiffnilee Ln

- 26304 Reyglen Dr

- 8516 Traciney Blvd

- 8428 Traciney Blvd

- 26034 Goldfinch Trail

- 8518 Classic Oaks Ln

- 26049 Cypress Oaks

- 26307 Tiffnilee Ln

- 26303 Reyglen Dr

- 26307 Stefnianne St

- 8520 Traciney Blvd

- 26308 Tiffnilee Ln

- 8424 Traciney Blvd

- 26311 Stefnianne St

- 8522 Classic Oaks Ln

- 26307 Reyglen Dr

- 26311 Tiffnilee Ln

- 26312 Reyglen Dr