8526 Sea Pines Ln Unit 1892 Dayton, OH 45458

Estimated Value: $171,000 - $212,000

2

Beds

2

Baths

1,260

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 8526 Sea Pines Ln Unit 1892, Dayton, OH 45458 and is currently estimated at $194,364, approximately $154 per square foot. 8526 Sea Pines Ln Unit 1892 is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Magsig Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2016

Sold by

Darling Jerome P

Bought by

Jackson Gary W and Jackson Mary Ann

Current Estimated Value

Purchase Details

Closed on

Oct 5, 2016

Sold by

Estate Of Iva Jean Darling

Bought by

Darling Jerome P

Purchase Details

Closed on

Jun 25, 2008

Sold by

Gooding Mark A and Gooding Teresa M

Bought by

Darling Jerome P and Darling Iva J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 23, 2007

Sold by

Gooding Chester A and Gooding Mark A

Bought by

Gooding Mark A and Gooding Teresa M

Purchase Details

Closed on

Oct 6, 2000

Sold by

Gooding Mark A

Bought by

Gooding Mark A and Gooding Chester A

Purchase Details

Closed on

Jun 16, 2000

Sold by

Gooding Chester A and Gooding Dorothy A

Bought by

Gooding Mark A

Purchase Details

Closed on

Apr 6, 2000

Sold by

Fraley Stephen A and Fraley Jo Mary

Bought by

Gooding Chester A and Gooding Dorothy A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson Gary W | $110,000 | Landmark Title Agency South | |

| Darling Jerome P | -- | None Available | |

| Darling Jerome P | $109,000 | Attorney | |

| Gooding Mark A | -- | Attorney | |

| Gooding Mark A | -- | -- | |

| Gooding Mark A | -- | -- | |

| Gooding Chester A | $96,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Darling Jerome P | $70,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,891 | $55,890 | $10,780 | $45,110 |

| 2023 | $2,891 | $55,890 | $10,780 | $45,110 |

| 2022 | $2,162 | $36,320 | $7,000 | $29,320 |

| 2021 | $2,168 | $36,320 | $7,000 | $29,320 |

| 2020 | $2,165 | $36,320 | $7,000 | $29,320 |

| 2019 | $1,831 | $29,550 | $7,000 | $22,550 |

| 2018 | $1,637 | $29,550 | $7,000 | $22,550 |

| 2017 | $1,620 | $29,550 | $7,000 | $22,550 |

| 2016 | $1,521 | $27,140 | $7,000 | $20,140 |

| 2015 | $1,497 | $27,140 | $7,000 | $20,140 |

| 2014 | $1,497 | $27,140 | $7,000 | $20,140 |

| 2012 | -- | $32,800 | $7,000 | $25,800 |

Source: Public Records

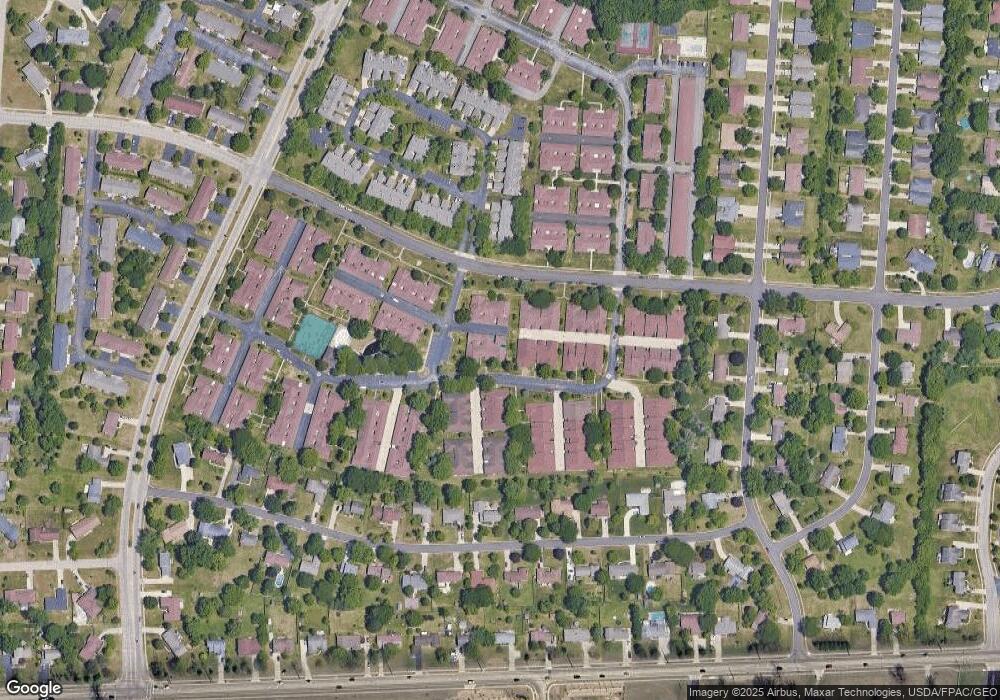

Map

Nearby Homes

- 688 Pine Needles Dr Unit 24118

- 8836 Washington Colony Dr Unit 16

- 8869 Washington Colony Dr Unit 19

- 8768 Washington Colony Dr Unit 12

- 8738 Washington Colony Dr Unit 832

- 755 Hidden Cir Unit 623

- 8749 Shadycreek Dr Unit 8751

- 8760 Shadycreek Dr Unit 8758

- 8713 Washington Colony Dr Unit 311

- 9229 Bottega S Unit 62

- 9219 Bottega S Unit 65

- 9250 Bottega S Unit 43

- 9019 Sorrento Place Unit 28

- 9041 Sorrento Place Unit 23

- 9022 Sorrento Place Unit 4

- 9215 Bottega S

- 9230 Bottega S

- 9019 Sorrento Place

- 9041 Sorrento Place

- 9211 Bottega S

- 8524 Sea Pines Ln Unit 1891

- 8522 Sea Pines Ln Unit 1890

- 597 Pine Needles Dr Unit 28141

- 8520 Sea Pines Ln Unit 1889

- 591 Pine Needles Dr Unit 28144

- 8506 Sea Pines Ln Unit 1785

- 8504 Sea Pines Ln Unit 1786

- 8502 Sea Pines Ln Unit 1787

- 593 Pine Needles Dr Unit 28143

- 8500 Sea Pines Ln Unit 1788

- 720 Pine Needles Dr Unit 20100

- 575 Pine Needles Dr Unit 27139

- 573 Pine Needles Dr Unit 27138

- 577 Pine Needles Dr Unit 27140

- 571 Pine Needles Dr Unit 27137

- 724 Pine Needles Dr Unit 2098

- 587 Pine Needles Dr Unit 30149

- 742 Pine Needles Dr Unit 1994

- 742 Pine Needles Dr Unit 742 Pine Needles Dr

- 700 Pine Needles Dr Unit 23109