8554 11th Rd Plymouth, IN 46563

Estimated Value: $173,000 - $231,000

3

Beds

1

Bath

1,848

Sq Ft

$109/Sq Ft

Est. Value

About This Home

This home is located at 8554 11th Rd, Plymouth, IN 46563 and is currently estimated at $202,000, approximately $109 per square foot. 8554 11th Rd is a home located in Marshall County with nearby schools including Plymouth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2023

Sold by

Larry R Greer Revocable Trust

Bought by

Allen Donald F and Nen Sandi L

Current Estimated Value

Purchase Details

Closed on

Feb 13, 2022

Sold by

Larry R Greer Revocable Trust

Bought by

Larry R Greer Revocable Trust and Lukenbill

Purchase Details

Closed on

Sep 17, 2020

Sold by

Larry R Greer Revocable Trust

Bought by

Cd Greer Family Farm Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,209

Interest Rate

6.43%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Allen Donald F | -- | None Listed On Document | |

| Mullet Daniel R | -- | None Listed On Document | |

| Larry R Greer Revocable Trust | -- | None Listed On Document | |

| Cd Greer Family Farm Llc | $213,356 | None Listed On Document | |

| Greer Larry R | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cd Greer Family Farm Llc | $84,209 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,093 | $22,300 | $17,500 | $4,800 |

| 2022 | $3,093 | $187,300 | $88,500 | $98,800 |

| 2021 | $732 | $157,300 | $74,300 | $83,000 |

| 2020 | $741 | $152,700 | $72,200 | $80,500 |

| 2019 | $801 | $154,400 | $75,500 | $78,900 |

| 2018 | $1,061 | $145,700 | $74,700 | $71,000 |

| 2017 | $1,014 | $146,100 | $77,600 | $68,500 |

| 2016 | $1,008 | $144,200 | $77,800 | $66,400 |

| 2014 | $856 | $132,600 | $69,100 | $63,500 |

Source: Public Records

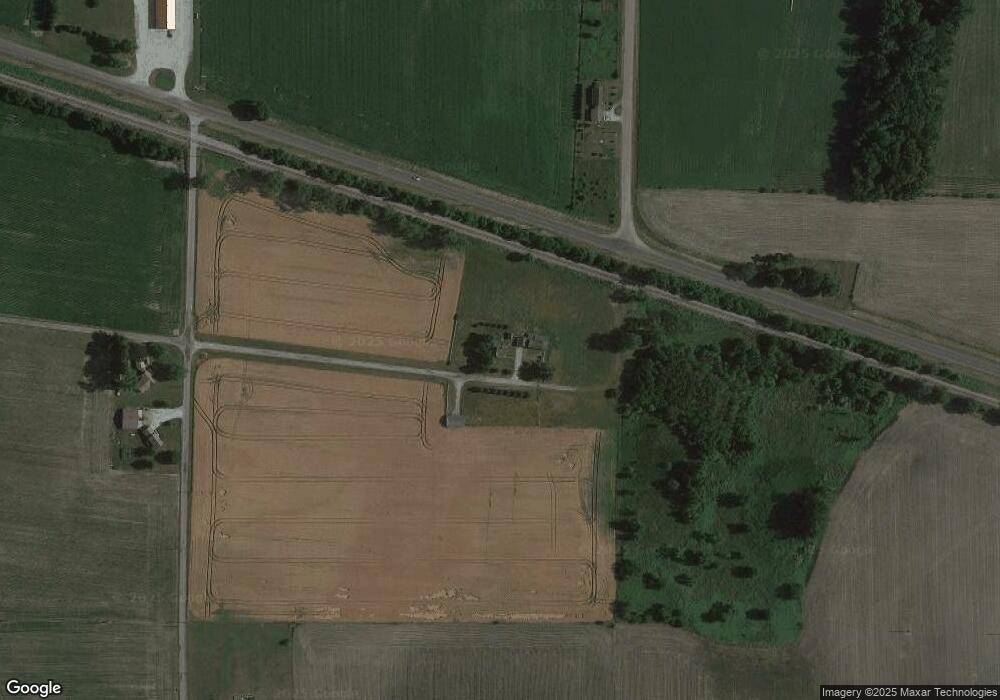

Map

Nearby Homes

- 10682 Hawthorn Rd Unit 8

- 8585 8a Rd

- 11090 Manor Dr

- 11846 Michigan Rd

- 11878 Ridgeview Dr

- 11887 Red Bud Dr

- 300 Juniper Ln

- 16256 Lincoln Hwy

- 12250 Lupine Ln

- 10893 Michigan Rd

- 122 Candy Ln

- 1072 Lincoln Hwy

- 0 Columbus Dr

- 10644 Kimberly Ct

- 316 Marlou Place

- 1105 Solomon Ct

- 1055 Solomon Ct

- 623 Ferndale St

- 618 E Laporte St

- 615 E Laporte St