856 Knightsbridge Dr Unit 185 Akron, OH 44313

Northwest Akron NeighborhoodEstimated Value: $294,000 - $325,000

2

Beds

3

Baths

2,354

Sq Ft

$132/Sq Ft

Est. Value

About This Home

This home is located at 856 Knightsbridge Dr Unit 185, Akron, OH 44313 and is currently estimated at $309,588, approximately $131 per square foot. 856 Knightsbridge Dr Unit 185 is a home located in Summit County with nearby schools including Woodridge Middle School, Woodridge High School, and Fairlawn Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2020

Sold by

Medvedeff Christopher Q

Bought by

Haynes Rebecca A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$88,053

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$221,535

Purchase Details

Closed on

May 20, 2010

Sold by

Clark William G and Clark Jennifer

Bought by

Medvedeff Christopher O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

5.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 28, 2002

Sold by

Higgins Paul L and Higgins Margaret A

Bought by

Clark Virginia L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haynes Rebecca A | $150,000 | None Listed On Document | |

| Medvedeff Christopher O | $142,000 | Diamond Title Co | |

| Clark Virginia L | $185,000 | Buckeye Reserve Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Haynes Rebecca A | $100,000 | |

| Previous Owner | Medvedeff Christopher O | $72,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,487 | $93,265 | $9,982 | $83,283 |

| 2024 | $5,487 | $93,265 | $9,982 | $83,283 |

| 2023 | $5,487 | $93,265 | $9,982 | $83,283 |

| 2022 | $4,712 | $71,194 | $7,620 | $63,574 |

| 2021 | $4,754 | $71,194 | $7,620 | $63,574 |

| 2020 | $4,696 | $71,190 | $7,620 | $63,570 |

| 2019 | $4,403 | $61,620 | $7,620 | $54,000 |

| 2018 | $4,480 | $61,620 | $7,620 | $54,000 |

| 2017 | $3,636 | $61,620 | $7,620 | $54,000 |

| 2016 | $3,614 | $52,180 | $7,620 | $44,560 |

| 2015 | $3,636 | $52,180 | $7,620 | $44,560 |

| 2014 | $3,426 | $52,180 | $7,620 | $44,560 |

| 2013 | $3,561 | $54,380 | $7,620 | $46,760 |

Source: Public Records

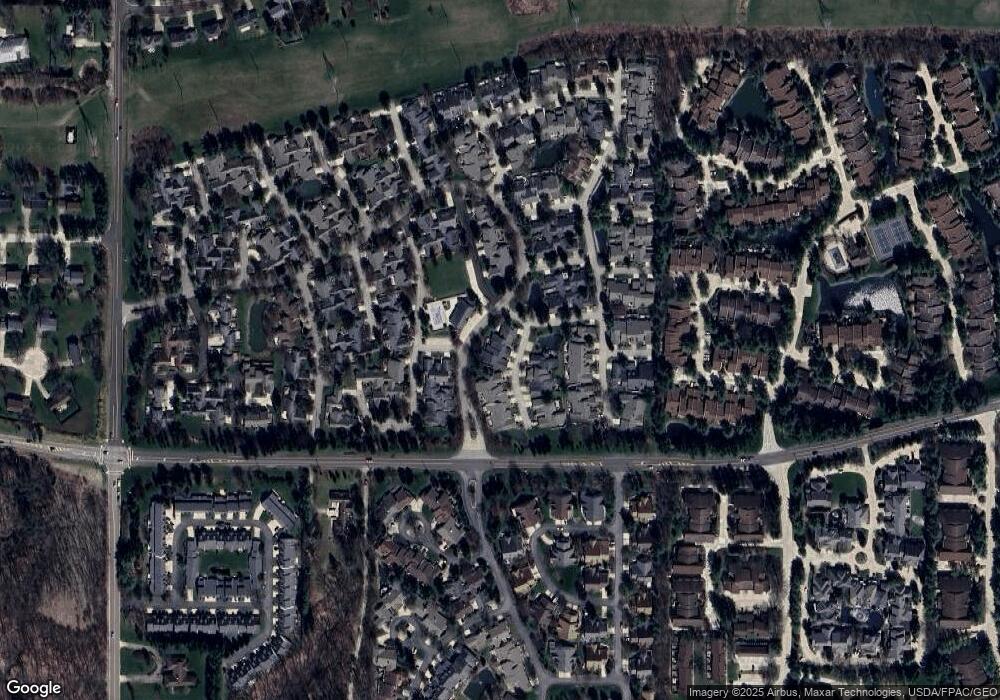

Map

Nearby Homes

- 889 Lynnhaven Ln

- 908 Foxhollow Ct Unit 112

- 718 Winding Way

- 1061 Wycliff Ln

- 987 Hampton Ridge Dr Unit 987

- 755 Sand Run Rd

- 881 Hampton Ridge Dr

- 1091 Sand Run Rd

- 889 Alder Run Way

- 2286 Bent Branch Ct

- 1951 E Woodland Dr

- 2440 Sand Run Pkwy

- 441 Sandhurst Rd

- 2426 Banbury Rd

- 373 Tremont Rd

- 478 Bath Hills Blvd

- 311 Goodhue Dr

- 1785 Fairlawn Knolls Dr

- 2682 Smith Rd

- 1291 N Revere Rd

- 852 Knightsbridge Dr Unit 184

- 864 Knightsbridge Dr

- 848 Knightsbridge Dr Unit 178

- 853 Knightsbridge Dr Unit 183

- 844 Knightsbridge Dr

- 847 Knightsbridge Dr

- 840 Knightsbridge Dr

- 2069 Saxony Dr

- 838 Knightsbridge Dr

- 2064 Saxony Dr Unit 190

- 856 Lynnhaven Ln Unit 188

- 841 Knightsbridge Dr Unit 180

- 837 Knightsbridge Dr Unit 179

- 2068 Bretton Place

- 858 Sutton Place Unit 64

- 850 Sutton Place

- 837 Sutton Place

- 862 Lynnhaven Ln

- 862 Lynnhaven Ln Unit 189

- 850 Lynnhaven Ln