Cascades of Norridge II 8560 W Foster Ave Unit 603 Norridge, IL 60706

Estimated Value: $294,000 - $319,000

2

Beds

2

Baths

1,295

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 8560 W Foster Ave Unit 603, Norridge, IL 60706 and is currently estimated at $308,602, approximately $238 per square foot. 8560 W Foster Ave Unit 603 is a home located in Cook County with nearby schools including Pennoyer Elementary School, Maine South High School, and Brickton Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2017

Sold by

Lymperopulos Mark J

Bought by

Hurtado Jaime

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,800

Outstanding Balance

$149,288

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$159,314

Purchase Details

Closed on

Oct 15, 2002

Sold by

Kubala Geraldine M

Bought by

Lymperopulos Mark J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,600

Interest Rate

6.29%

Purchase Details

Closed on

May 9, 1994

Sold by

Parkway Bank & Trust Company

Bought by

Kubala Geraldine M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hurtado Jaime | $208,000 | Chicago Title | |

| Lymperopulos Mark J | $232,000 | -- | |

| Kubala Geraldine M | $142,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hurtado Jaime | $176,800 | |

| Previous Owner | Lymperopulos Mark J | $185,600 | |

| Closed | Lymperopulos Mark J | $34,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,870 | $22,000 | $997 | $21,003 |

| 2023 | $4,501 | $22,000 | $997 | $21,003 |

| 2022 | $4,501 | $22,000 | $997 | $21,003 |

| 2021 | $3,766 | $17,003 | $728 | $16,275 |

| 2020 | $3,723 | $17,003 | $728 | $16,275 |

| 2019 | $3,662 | $18,928 | $728 | $18,200 |

| 2018 | $2,843 | $14,318 | $632 | $13,686 |

| 2017 | $3,649 | $14,318 | $632 | $13,686 |

| 2016 | $2,190 | $14,318 | $632 | $13,686 |

| 2015 | $2,616 | $12,757 | $575 | $12,182 |

| 2014 | $2,582 | $12,757 | $575 | $12,182 |

| 2013 | $2,501 | $12,757 | $575 | $12,182 |

Source: Public Records

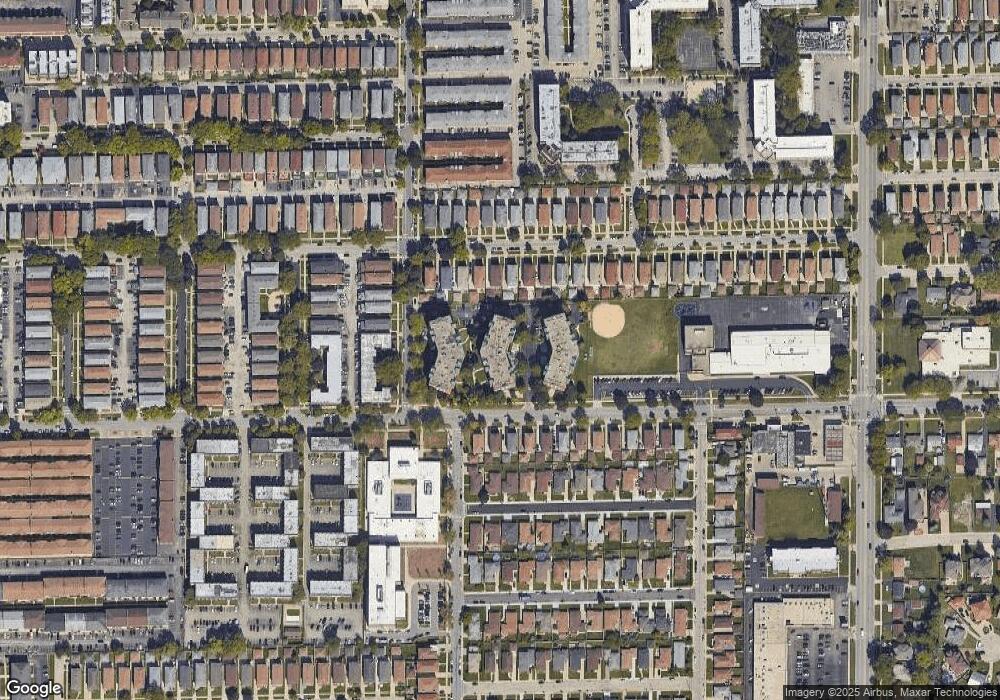

About Cascades of Norridge II

Map

Nearby Homes

- 8540 W Foster Ave Unit 605

- 8540 W Foster Ave Unit 504

- 5323 N Delphia Ave Unit 323

- 8613 W Foster Ave

- 5349 N Delphia Ave Unit 250

- 5349 N Delphia Ave Unit 150

- 8500 W Carmen Ave

- 8622 W Summerdale Ave

- 8646 W Berwyn Ave Unit 1N

- 8517 W Carmen Ave

- 8542 W Winnemac Ave

- 5348 N Cumberland Ave Unit 206

- 8708 W Berwyn Ave Unit 1S

- 5020 N Denal St

- 8729 W Summerdale Ave

- 5117 N East River Rd Unit 1A

- 5159 N East River Rd Unit 212

- 5159 N East River Rd Unit 307D

- 5159 N East River Rd Unit 105

- 5151 N East River Rd Unit 331D

- 8540 W Foster Ave Unit 706

- 8540 W Foster Ave Unit 305

- 8540 W Foster Ave Unit 710

- 8540 W Foster Ave Unit 506

- 8540 W Foster Ave Unit 409

- 8540 W Foster Ave Unit 201

- 8540 W Foster Ave Unit 306

- 8540 W Foster Ave Unit 407

- 8540 W Foster Ave Unit 701

- 8540 W Foster Ave Unit 302

- 8540 W Foster Ave Unit 408

- 8540 W Foster Ave Unit 308

- 8540 W Foster Ave Unit 202

- 8540 W Foster Ave Unit 601

- 8540 W Foster Ave Unit 303

- 8540 W Foster Ave Unit 307

- 8540 W Foster Ave Unit 203

- 8540 W Foster Ave Unit 610

- 8540 W Foster Ave Unit 208

- 8540 W Foster Ave Unit 603