8580 SW Larson Rd Gaston, OR 97119

Estimated Value: $796,000 - $963,354

4

Beds

3

Baths

2,639

Sq Ft

$333/Sq Ft

Est. Value

About This Home

This home is located at 8580 SW Larson Rd, Gaston, OR 97119 and is currently estimated at $879,677, approximately $333 per square foot. 8580 SW Larson Rd is a home located in Washington County with nearby schools including Gaston Elementary School and Gaston Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 11, 2013

Sold by

Seeberger Charles T and Seeberger Ronda D

Bought by

Cisneros Osbaldo M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Outstanding Balance

$284,347

Interest Rate

4.36%

Mortgage Type

New Conventional

Estimated Equity

$595,330

Purchase Details

Closed on

May 25, 1995

Sold by

Trees Turnbull Doug

Bought by

Seeberger Charles T and Seeberger Ronda D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

8.43%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cisneros Osbaldo M | $480,000 | First American | |

| Seeberger Charles T | -- | Chicago Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cisneros Osbaldo M | $384,000 | |

| Previous Owner | Seeberger Charles T | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,049 | $248,910 | -- | -- |

| 2025 | $3,049 | $241,780 | -- | -- |

| 2024 | $2,883 | $235,010 | -- | -- |

| 2023 | $2,883 | $228,150 | $0 | $0 |

| 2022 | $2,805 | $228,150 | $0 | $0 |

| 2021 | $2,743 | $215,430 | $0 | $0 |

| 2020 | $2,664 | $209,290 | $0 | $0 |

| 2019 | $2,587 | $203,310 | $0 | $0 |

| 2018 | $2,530 | $197,520 | $0 | $0 |

| 2017 | $2,439 | $191,890 | $0 | $0 |

| 2016 | $2,387 | $186,430 | $0 | $0 |

| 2015 | $1,895 | $181,130 | $0 | $0 |

| 2014 | $2,007 | $189,440 | $0 | $0 |

Source: Public Records

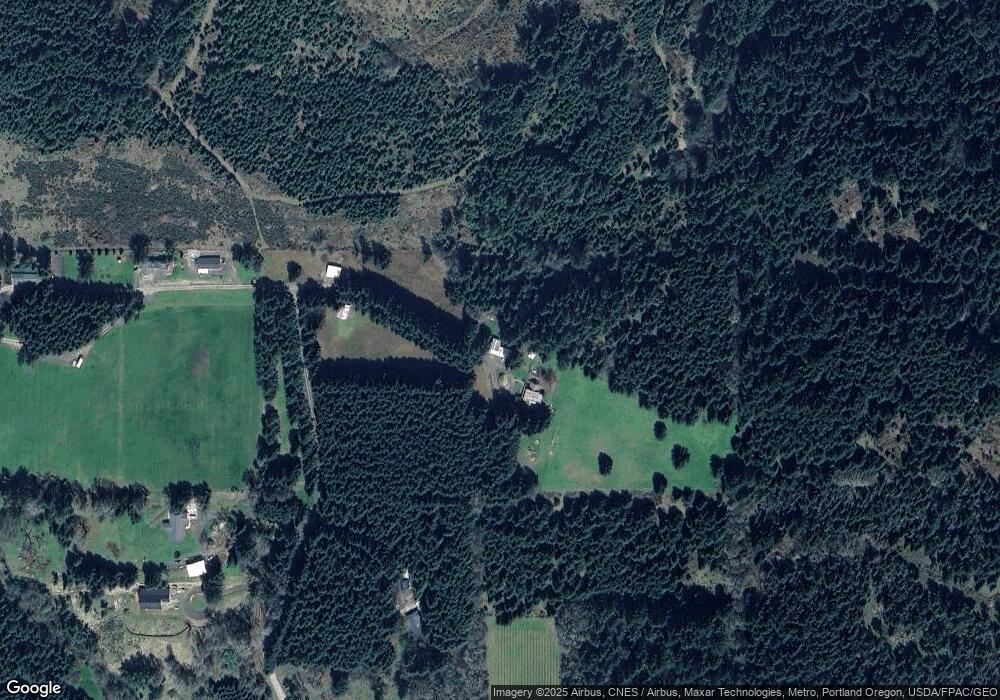

Map

Nearby Homes

- 55563 SW Cherry Grove Dr

- 55308 SW Lovegren Dr

- 56220 SW Lee Falls Rd

- 54839 SW South Rd

- 55556 SW Horner Ln

- 54600 SW South Rd

- 0 SW Mill Rd

- 0 NW Williams Canyon Rd Unit 24564627

- 55778 SW Scoggins Valley Rd

- 0 SW Stepien Rd

- 45500 SW Seghers Rd

- 45723 SW Saddleback Dr

- 410 Church St

- 47266 SW Carpenter Creek Rd

- 23896 NW Mount Richmond Rd

- 45245 SW Saddleback Dr

- 14620 NW Tupper Rd

- 47980 NW Waldheim Way

- 727 SW Stringtown Rd

- 0000 NW Crane (4) Rd

- 8818 SW Larson Rd

- 8991 SW Larson Rd

- 8887 SW Larson Rd

- 0 SW Larson Rd

- 8575 SW Larson Rd

- 9244 SW Larson Rd

- 0 Larson R

- 54909 SW Patton Ave

- 9500 SW Larson Rd

- 9259 SW Larson Rd

- 54895 SW Patton Ave

- 9224 SW Larson Rd Unit 202

- 9298 SW Larson Rd

- 9150 SW Midland Ave

- 54933 SW Patton Ave

- 9412 SW Midland Ave

- 54900 SW Patton Ave

- 9584 SW Midland Ave

- 9520 SW Larson Rd

- 54880 SW Patton Ave

Your Personal Tour Guide

Ask me questions while you tour the home.