86 E Bourne St Durant, OK 74701

Estimated Value: $147,000 - $207,000

2

Beds

1

Bath

1,020

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 86 E Bourne St, Durant, OK 74701 and is currently estimated at $170,747, approximately $167 per square foot. 86 E Bourne St is a home located in Bryan County with nearby schools including Silo Early Childhood Center, Silo Elementary School, and Silo Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 29, 2015

Sold by

Hicks William and Hicks Gehrounda

Bought by

Cheek Taylor Grant

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Outstanding Balance

$11,161

Interest Rate

4.07%

Mortgage Type

Unknown

Estimated Equity

$159,586

Purchase Details

Closed on

Apr 22, 2010

Sold by

Hicks William and Hicks Gehrounda

Bought by

Cresse Darin Joseph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,000

Interest Rate

5.14%

Mortgage Type

Unknown

Purchase Details

Closed on

Feb 24, 1994

Sold by

Holland Boots

Bought by

Hicks Wm and Hicks Gehrounda

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cheek Taylor Grant | $70,000 | None Available | |

| Cresse Darin Joseph | $56,000 | None Available | |

| Hicks Wm | $8,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cheek Taylor Grant | $60,000 | |

| Previous Owner | Cresse Darin Joseph | $56,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $539 | $7,298 | $1,024 | $6,274 |

| 2024 | $515 | $7,087 | $995 | $6,092 |

| 2023 | $515 | $6,880 | $911 | $5,969 |

| 2022 | $481 | $6,679 | $814 | $5,865 |

| 2021 | $469 | $6,679 | $814 | $5,865 |

| 2020 | $471 | $6,679 | $814 | $5,865 |

| 2019 | $577 | $6,844 | $814 | $6,030 |

| 2018 | $673 | $7,955 | $2,921 | $5,034 |

| 2017 | $558 | $7,577 | $2,921 | $4,656 |

| 2016 | $567 | $7,701 | $2,921 | $4,780 |

| 2015 | $486 | $6,600 | $660 | $5,940 |

| 2014 | $486 | $6,600 | $660 | $5,940 |

Source: Public Records

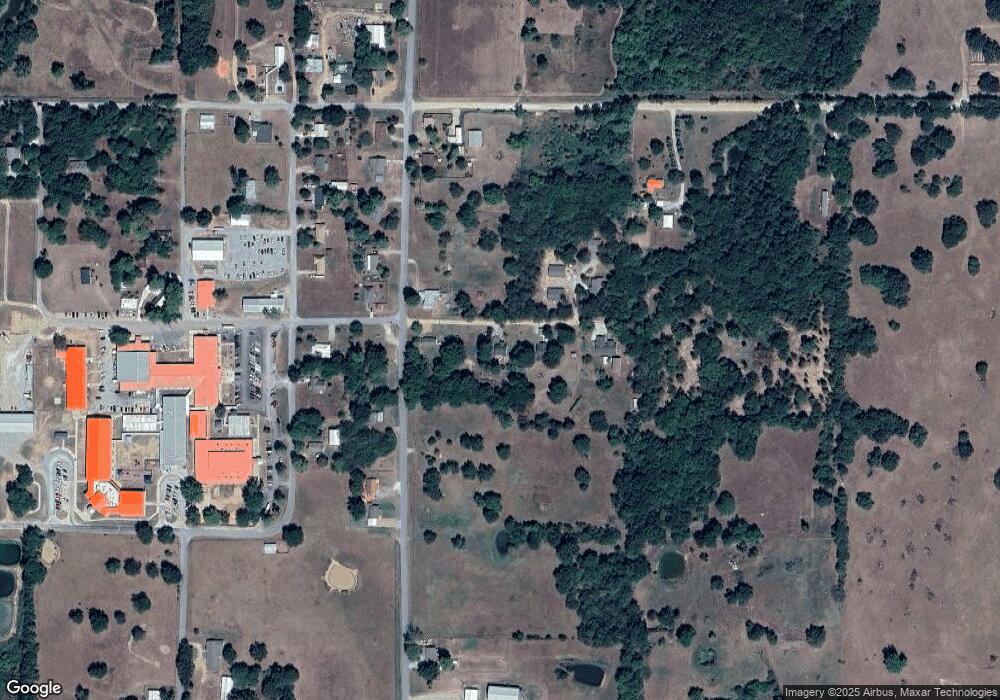

Map

Nearby Homes

- 453 W 2nd St

- 1296 Church Rd

- 1900 Silo Rd

- 49 E 2nd St

- 303 Rawlings Rd

- 83 Oak St

- 1803 Silo Rd

- 365 Tandy Walker Rd

- 000 Bigvalley

- 5174 Silo Rd

- 327 Wilson Pkwy

- 88 Sunshine Ln

- 624 Sunshine Ln

- 11515 Leavenworth Trail

- 6735 Wilson St

- 2247 W Mockingbird Ln

- 5923 Wilson St

- 3668 N 49th St

- 1510 Remington West Cir

- 98 Rancho Sol St

Your Personal Tour Guide

Ask me questions while you tour the home.