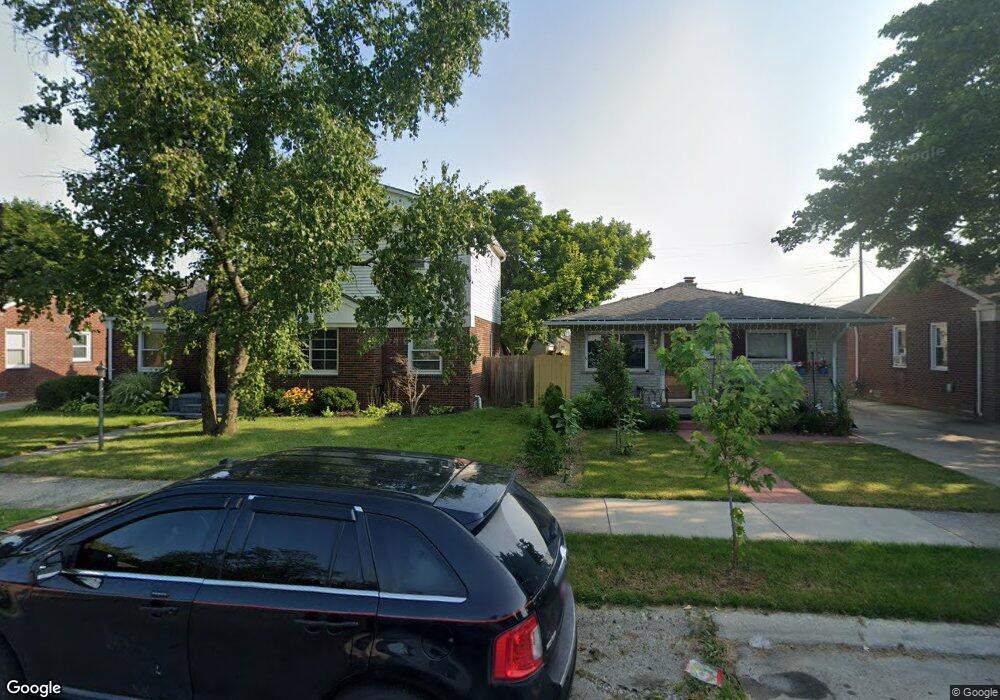

860 Cleophus Pkwy Lincoln Park, MI 48146

Estimated Value: $130,000 - $147,000

3

Beds

1

Bath

936

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 860 Cleophus Pkwy, Lincoln Park, MI 48146 and is currently estimated at $137,993, approximately $147 per square foot. 860 Cleophus Pkwy is a home located in Wayne County with nearby schools including Keppen School, Lincoln Park Middle School, and Lincoln Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2024

Sold by

Calzada Rosalinda

Bought by

Calzada Eleazar

Current Estimated Value

Purchase Details

Closed on

Oct 2, 2008

Sold by

Federal Deposit Insurance Corporation

Bought by

Indymac Federal Bank Fsb

Purchase Details

Closed on

Jan 16, 2008

Sold by

Springer Michelle J

Bought by

Indymac Bank Fsb

Purchase Details

Closed on

Oct 28, 2004

Sold by

Selke Francis B

Bought by

Springer Michelle J

Purchase Details

Closed on

May 23, 2003

Sold by

Grp/Ag Reo 2002-1 Llc

Bought by

Selke Francis B

Purchase Details

Closed on

May 29, 2002

Sold by

Bayview Financial Tradin

Bought by

Grp Ag Reo 2002 1 Llc

Purchase Details

Closed on

May 9, 2002

Sold by

Karpinski Francis R

Bought by

First Union National Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calzada Eleazar | -- | None Listed On Document | |

| Calzada Eleazar | -- | None Listed On Document | |

| Indymac Federal Bank Fsb | -- | Parks Title | |

| Indymac Bank Fsb | $95,400 | None Available | |

| Springer Michelle J | $135,000 | Tri County Title Agency Inc | |

| Selke Francis B | $72,000 | Multiple | |

| Grp Ag Reo 2002 1 Llc | -- | -- | |

| First Union National Bank | $65,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,812 | $58,900 | $0 | $0 |

| 2024 | $1,812 | $52,200 | $0 | $0 |

| 2023 | $1,720 | $48,200 | $0 | $0 |

| 2022 | $1,916 | $38,900 | $0 | $0 |

| 2021 | $1,870 | $36,100 | $0 | $0 |

| 2020 | $1,389 | $26,300 | $0 | $0 |

| 2019 | $1,097 | $26,900 | $0 | $0 |

| 2018 | $988 | $25,800 | $0 | $0 |

| 2017 | $734 | $24,100 | $0 | $0 |

| 2016 | $1,283 | $24,100 | $0 | $0 |

| 2015 | $2,360 | $23,600 | $0 | $0 |

| 2013 | $2,420 | $24,700 | $0 | $0 |

| 2012 | $1,488 | $26,000 | $5,100 | $20,900 |

Source: Public Records

Map

Nearby Homes

- 880 White Ave

- 776 Cleophus Pkwy

- 1622 Wilson Ave

- 1673 Ferris Ave

- 764 White Ave

- 881 Garfield Ave

- 1027 Park Ave

- 817 Lincoln Ave

- 1581 Empire Ave

- 650 Cleophus Pkwy

- 1529 Grant Ave

- 637 Park Ave

- 1654 Chandler Ave

- 1554 Austin Ave

- 1582 Chandler Ave

- 853 Mill St

- 1473 Austin Ave

- 615 Garfield Ave

- 1187 Park Ave

- 1375 Wilson Ave

- 864 Cleophus Pkwy

- 852 Cleophus Pkwy

- 872 Cleophus Pkwy

- 881 Southfield Rd

- 836 Cleophus Pkwy

- 863 Cleophus Pkwy

- 886 Cleophus Pkwy

- 855 Cleophus Pkwy

- 885 Cleophus Pkwy

- 832 Cleophus Pkwy

- 839 Cleophus Pkwy

- 835 Cleophus Pkwy

- 908 Cleophus Pkwy

- 870 Park Ave

- 860 Park Ave

- 856 Park Ave

- 888 Southfield Rd

- 888 Southfield Rd

- 823 Cleophus Pkwy

- 880 Park Ave