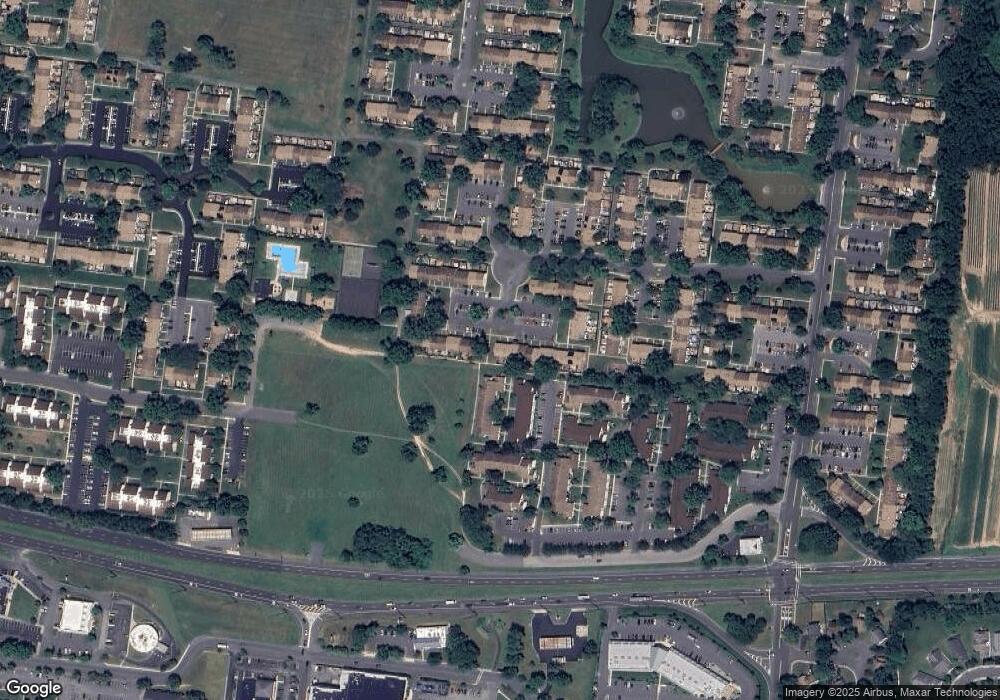

860 Jamestown Rd East Windsor, NJ 08520

Estimated Value: $418,392 - $437,000

--

Bed

--

Bath

1,620

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 860 Jamestown Rd, East Windsor, NJ 08520 and is currently estimated at $429,848, approximately $265 per square foot. 860 Jamestown Rd is a home located in Mercer County with nearby schools including Oak Tree Elementary School, Monroe Township Middle School, and Monroe Township High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2005

Sold by

Mikaeal Michael

Bought by

Tsodikov Gregory and Tsodikov Tatyana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,500

Outstanding Balance

$111,204

Interest Rate

5.78%

Estimated Equity

$318,644

Purchase Details

Closed on

Nov 13, 2001

Sold by

Mischner Phyllis

Bought by

Mikaeal Michael and Nassri Randa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,161

Interest Rate

6.64%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tsodikov Gregory | $277,500 | -- | |

| Mikaeal Michael | $168,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tsodikov Gregory | $207,500 | |

| Previous Owner | Mikaeal Michael | $163,161 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,440 | $206,900 | $92,100 | $114,800 |

| 2024 | $7,030 | $206,900 | $92,100 | $114,800 |

| 2023 | $7,030 | $206,900 | $92,100 | $114,800 |

| 2022 | $6,842 | $206,900 | $92,100 | $114,800 |

| 2021 | $6,790 | $206,900 | $92,100 | $114,800 |

| 2020 | $6,799 | $206,900 | $92,100 | $114,800 |

| 2019 | $6,735 | $206,900 | $92,100 | $114,800 |

| 2018 | $6,900 | $206,900 | $92,100 | $114,800 |

| 2017 | $6,894 | $206,900 | $92,100 | $114,800 |

| 2016 | $6,540 | $206,900 | $92,100 | $114,800 |

| 2015 | $6,410 | $206,900 | $92,100 | $114,800 |

| 2014 | $6,331 | $206,900 | $92,100 | $114,800 |

Source: Public Records

Map

Nearby Homes

- 857 Jamestown Rd

- 842 Jamestown Rd

- 2 T-2 Avon

- U7 Avon Dr

- 942 Jamestown Rd

- 4 Avon Dr E

- 4 Avon Dr

- 4 Avon Dr Unit F

- 10 Avon Dr

- 542 Fairfield Rd

- 479 Fairfield Rd

- 476 Fairfield Rd

- 197 Canterbury Ct

- 203 Canterbury Ct

- 322 Twin Rivers Dr N

- 13 Avon Dr Unit P

- 174 Canterbury Ct

- 234 Probasco Rd

- 16 Twin Rivers Dr N

- 7 Twin Rivers Dr N