8605 Cross Oaks Ln Fairfax Station, VA 22039

Crosspointe NeighborhoodEstimated Value: $1,238,412 - $1,347,000

5

Beds

4

Baths

5,048

Sq Ft

$255/Sq Ft

Est. Value

About This Home

This home is located at 8605 Cross Oaks Ln, Fairfax Station, VA 22039 and is currently estimated at $1,289,603, approximately $255 per square foot. 8605 Cross Oaks Ln is a home located in Fairfax County with nearby schools including Silverbrook Elementary School, South County Middle School, and South County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2009

Sold by

Hammad Ehab H

Bought by

Vergona Patrick

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$273,816

Interest Rate

5.43%

Mortgage Type

New Conventional

Estimated Equity

$1,015,787

Purchase Details

Closed on

Dec 30, 2005

Sold by

William A Fitzgerald Jr T

Bought by

Hammad Ehab H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$695,000

Interest Rate

6.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 21, 1995

Sold by

Mazda Iv Lc

Bought by

Fitzgerald William A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

7.61%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vergona Patrick | $789,000 | -- | |

| Hammad Ehab H | $869,000 | -- | |

| Fitzgerald William A | $372,817 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vergona Patrick | $417,000 | |

| Previous Owner | Hammad Ehab H | $695,000 | |

| Previous Owner | Fitzgerald William A | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $1,134,090 | $451,000 | $683,090 |

| 2024 | $12,834 | $1,107,840 | $391,000 | $716,840 |

| 2023 | $11,773 | $1,075,120 | $391,000 | $684,120 |

| 2022 | $10,536 | $921,350 | $326,000 | $595,350 |

| 2021 | $10,025 | $854,240 | $296,000 | $558,240 |

| 2020 | $9,775 | $825,980 | $284,000 | $541,980 |

| 2019 | $9,614 | $812,350 | $281,000 | $531,350 |

| 2018 | $9,342 | $812,350 | $281,000 | $531,350 |

| 2017 | $9,229 | $794,920 | $266,000 | $528,920 |

| 2016 | $9,229 | $796,610 | $266,000 | $530,610 |

| 2015 | $8,890 | $796,610 | $266,000 | $530,610 |

| 2014 | $8,703 | $781,610 | $251,000 | $530,610 |

Source: Public Records

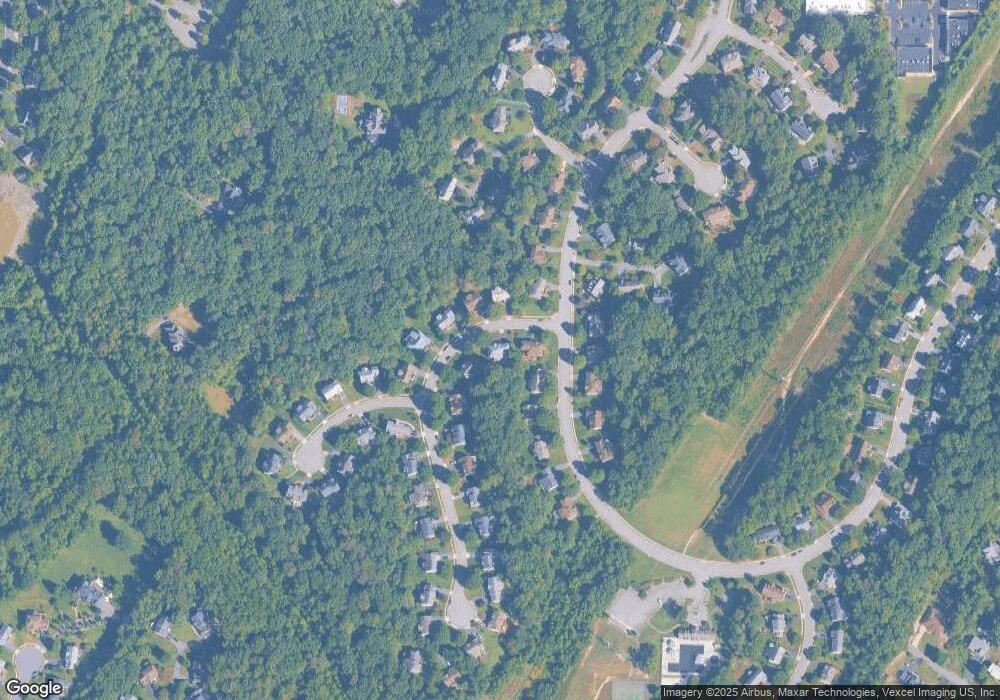

Map

Nearby Homes

- 8625 Oak Chase Cir

- 8622 Cross Chase Ct

- 8521 Century Oak Ct

- 8834 Ox Rd

- 8811 Ox Rd

- 8605 Eagle Glen Terrace

- The Grant Plan at Southern Oaks Reserve

- The Taylor Plan at Southern Oaks Reserve

- 8757 Southern Oaks Place

- 8761 Southern Oaks Place

- 8153 Old Barrington Blvd

- 8603 Rocky Gap Ct

- 8560 Koluder Ct

- 9596 Oakington Dr

- 8011 Treasure Tree Ct

- 9712 Thorn Bush Dr

- 8542 Blue Rock Ln

- 8504 Blue Rock Ln

- 9616 Burnt Oak Dr

- 8503 Bertsky Ln

- 8609 Cross Oaks Ln

- 8601 Cross Oaks Ln

- 8530 Oak Chase Cir

- 8604 Cross Oaks Ln

- 8602 Cross Oaks Ln

- 8611 Cross Oaks Ln

- 8606 Cross Oaks Ln

- 8524 Oak Chase Cir

- 8532 Oak Chase Cir

- 8608 Cross Oaks Ln

- 8613 Cross Oaks Ln

- 8610 Cross Oaks Ln

- 8529 Oak Chase Cir

- 8527 Oak Chase Cir

- 8531 Oak Chase Cir

- 8534 Oak Chase Cir

- 8516 Oak Chase Cir

- 8525 Oak Chase Cir

- 8615 Cross Oaks Ln

- 8533 Oak Chase Cir