862 Durant Ct Unit 44 West Chester, PA 19380

Estimated Value: $415,942 - $443,000

3

Beds

3

Baths

1,605

Sq Ft

$268/Sq Ft

Est. Value

About This Home

This home is located at 862 Durant Ct Unit 44, West Chester, PA 19380 and is currently estimated at $430,736, approximately $268 per square foot. 862 Durant Ct Unit 44 is a home located in Chester County with nearby schools including Exton Elementary School, J.R. Fugett Middle School, and West Chester East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2009

Sold by

Snow Joshua and Snow Jennifer

Bought by

Misero Kristine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,424

Outstanding Balance

$147,868

Interest Rate

5.14%

Mortgage Type

FHA

Estimated Equity

$282,868

Purchase Details

Closed on

May 29, 2001

Sold by

Nelson Timothy L and Nelson Jeannie S

Bought by

Snow Joshua and Snow Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,550

Interest Rate

7.15%

Mortgage Type

VA

Purchase Details

Closed on

May 29, 1996

Sold by

Tury Stephen D and Tury Traci L

Bought by

Nelson Timothy L and Nelson Jeannie S

Purchase Details

Closed on

Mar 31, 1995

Sold by

Baxter Harold J and Baxter Christine E

Bought by

Tury Stephen D and Tury Traci L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,200

Interest Rate

7.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Misero Kristine | $254,900 | None Available | |

| Snow Joshua | $158,400 | Fidelity National Title Ins | |

| Nelson Timothy L | $123,000 | -- | |

| Tury Stephen D | $119,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Misero Kristine | $233,424 | |

| Previous Owner | Snow Joshua | $161,550 | |

| Previous Owner | Tury Stephen D | $95,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,223 | $111,200 | $20,250 | $90,950 |

| 2024 | $3,223 | $111,200 | $20,250 | $90,950 |

| 2023 | $3,080 | $111,200 | $20,250 | $90,950 |

| 2022 | $3,039 | $111,200 | $20,250 | $90,950 |

| 2021 | $2,994 | $111,200 | $20,250 | $90,950 |

| 2020 | $2,974 | $111,200 | $20,250 | $90,950 |

| 2019 | $2,931 | $111,200 | $20,250 | $90,950 |

| 2018 | $2,866 | $111,200 | $20,250 | $90,950 |

| 2017 | $2,801 | $111,200 | $20,250 | $90,950 |

| 2016 | $2,483 | $111,200 | $20,250 | $90,950 |

| 2015 | $2,483 | $111,200 | $20,250 | $90,950 |

| 2014 | $2,483 | $111,200 | $20,250 | $90,950 |

Source: Public Records

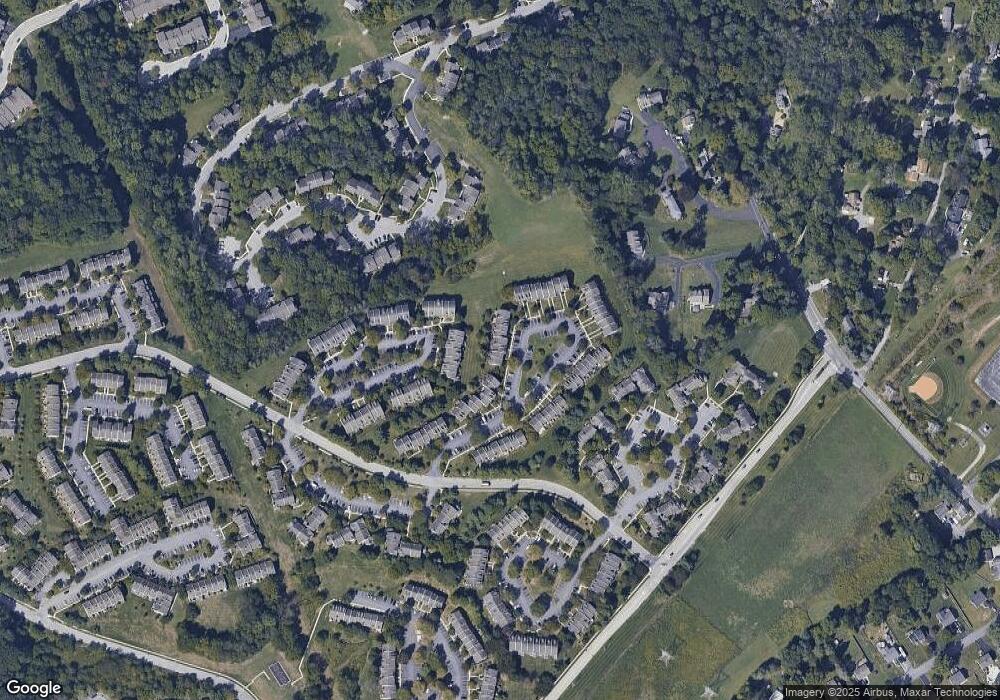

Map

Nearby Homes

- 828 Durant Ct Unit 10

- 390 Lynetree Dr Unit 8D

- 1001 Roundhouse Ct Unit 11

- 591 Coach Hill Ct Unit C32

- 596 Coach Hill Ct Unit C

- 603 Coach Hill Ct Unit B

- 1406 Timber Mill Ln

- 1409 Timber Mill Ln

- 193 Stirling Ct

- 450 Hartford Square Unit 7

- 150 Mountain View Dr

- 150 Brazier Ln

- 304 King Rd

- Santorini Plan at Exton Walk Luxury Singles

- Monaco Plan at Exton Walk Luxury Singles

- Lisbon Plan at Exton Walk Luxury Singles

- 108 Mountain View Dr

- 706 King Rd

- 1402 Redwood Ct Unit 57

- 831 E Cub Hunt Ln

- 863 Durant Ct

- 861 Durant Ct Unit 43

- 864 Durant Ct Unit 46

- 860 Durant Ct Unit 42

- 859 Durant Ct Unit 41

- 858 Durant Ct Unit 40

- 865 Durant Ct Unit 47

- 857 Durant Ct Unit 39

- 867 Durant Ct Unit 49

- R State Highway 13

- X State Highway 13

- 868 Durant Ct Unit 50

- 856 Durant Ct Unit 38

- 869 Durant Ct

- 870 Durant Ct Unit 52

- 854 Durant Ct

- 871 Durant Ct Unit 53

- 853 Durant Ct

- 852 Durant Ct Unit 334

- 872 Durant Ct