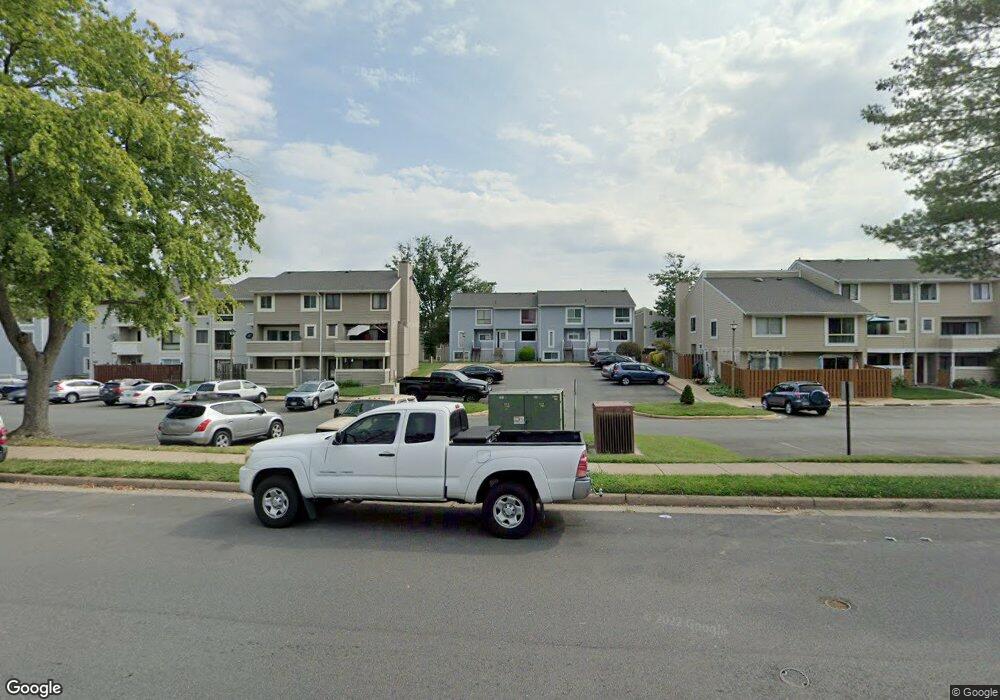

8623 Sacramento Dr Alexandria, VA 22309

Woodlawn NeighborhoodEstimated Value: $271,000 - $293,000

2

Beds

1

Bath

1,062

Sq Ft

$264/Sq Ft

Est. Value

About This Home

This home is located at 8623 Sacramento Dr, Alexandria, VA 22309 and is currently estimated at $280,303, approximately $263 per square foot. 8623 Sacramento Dr is a home located in Fairfax County with nearby schools including Washington Mill Elementary School, Whitman Middle School, and Mount Vernon High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2025

Sold by

Rodriguez Oscar I

Bought by

Rodriguez Oscar I and Padilla-Caballero Oscar Rene

Current Estimated Value

Purchase Details

Closed on

Nov 8, 2024

Sold by

Salguero Mario R and Totten Lee D

Bought by

Rodriguez Oscar I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,100

Interest Rate

6.08%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 30, 2016

Sold by

Astoria Bank

Bought by

Orozco Bertila

Purchase Details

Closed on

Mar 16, 2016

Sold by

Daniels Alice C

Bought by

Astoria Bank

Purchase Details

Closed on

Jun 14, 2002

Sold by

Harris Vickie L

Bought by

Daniels Alice C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,500

Interest Rate

6.8%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Oscar I | -- | Versatile Title | |

| Rodriguez Oscar I | -- | Versatile Title | |

| Rodriguez Oscar I | $269,000 | Versatile Title | |

| Rodriguez Oscar I | $269,000 | Versatile Title | |

| Orozco Bertila | $112,000 | Atlantic Settlement Group | |

| Astoria Bank | $145,600 | None Available | |

| Daniels Alice C | $76,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rodriguez Oscar I | $242,100 | |

| Previous Owner | Daniels Alice C | $76,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,692 | $232,360 | $46,000 | $186,360 |

| 2024 | $2,692 | $232,360 | $46,000 | $186,360 |

| 2023 | $2,341 | $207,460 | $41,000 | $166,460 |

| 2022 | $2,197 | $192,090 | $38,000 | $154,090 |

| 2021 | $2,167 | $184,700 | $37,000 | $147,700 |

| 2020 | $2,082 | $175,900 | $35,000 | $140,900 |

| 2019 | $1,964 | $165,920 | $33,000 | $132,920 |

| 2018 | $1,816 | $157,870 | $32,000 | $125,870 |

| 2017 | $1,833 | $157,870 | $32,000 | $125,870 |

| 2016 | $1,663 | $143,520 | $29,000 | $114,520 |

| 2015 | -- | $143,520 | $29,000 | $114,520 |

| 2014 | -- | $143,520 | $29,000 | $114,520 |

Source: Public Records

Map

Nearby Homes

- 8607 Village Way Unit 7/8607F

- 5376 Bedford Terrace Unit 76D

- 8603 Venoy Ct

- 5758 Village Green Dr Unit E

- 8623 Beekman Place Unit A

- 5526 Sacramento Mews Place

- 8420 Huerta Ct Unit 162

- 8413 Fuerte Ct Unit 127

- 8530 Southlawn Ct

- 5700 Shadwell Ct Unit 81

- 5707 Olde Mill Ct Unit 111

- 8604 Shadwell Dr Unit 36

- 8708 Lukens Ln

- 5005 Rosemont Ave

- 8742 Walutes Cir

- 5503 Teak Ct

- 8426 Woodlawn St

- 8548 Towne Manor Ct

- 8813 Oak Leaf Dr

- 4714 Hanrahan Place

- 8619 Sacramento Dr Unit 1/861

- 8619 Sacramento Dr

- 8621 Sacramento Dr

- 8623 Sacramento Dr Unit B2

- 8623 Sacramento Dr Unit 8623

- 8623 Sacramento Dr Unit 2

- 8627 Sacramento Dr

- 8625 Sacramento Dr Unit 2/862

- 8625 Sacramento Dr

- 8629 Sacramento Dr

- 8622 Village Way Unit 5

- 8622 Village Way Unit 5/862

- 8612 Village Way Unit 4

- 8612 Village Way Unit 4/8612

- 8612 Village Way Unit 4/861

- 8613 Sacramento Dr

- 8615 Sacramento Dr

- 8620 Village Way Unit 5

- 8617 Sacramento Dr

- 8630 Village Way Unit 5