863 Stately Oaks Dr Inverness, FL 34453

Estimated Value: $207,787 - $256,000

3

Beds

2

Baths

1,379

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 863 Stately Oaks Dr, Inverness, FL 34453 and is currently estimated at $229,197, approximately $166 per square foot. 863 Stately Oaks Dr is a home located in Citrus County with nearby schools including Hernando Elementary School, Inverness Middle School, and Citrus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2018

Sold by

Ronnie Brantley

Bought by

Maner Joseph and Maner Amelia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Outstanding Balance

$64,993

Interest Rate

4.59%

Estimated Equity

$164,204

Purchase Details

Closed on

May 23, 2003

Sold by

Florida Low Income Housing Assoc Inc

Bought by

Hernandez Sarah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

5.79%

Mortgage Type

USDA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maner Joseph | $80,000 | -- | |

| Hernandez Sarah | $82,500 | American Title Svcs Of Citru |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Maner Joseph | $75,000 | |

| Closed | Maner Joseph | -- | |

| Previous Owner | Hernandez Sarah | $60,000 | |

| Closed | Hernandez Sarah | $14,812 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,241 | $146,986 | $6,000 | $140,986 |

| 2024 | $3,078 | $187,516 | $6,000 | $181,516 |

| 2023 | $3,078 | $188,219 | $6,000 | $182,219 |

| 2022 | $2,603 | $146,080 | $5,500 | $140,580 |

| 2021 | $2,262 | $115,160 | $5,500 | $109,660 |

| 2020 | $2,101 | $106,994 | $5,500 | $101,494 |

| 2019 | $1,941 | $94,834 | $5,500 | $89,334 |

| 2018 | $1,812 | $88,880 | $5,500 | $83,380 |

| 2017 | $1,585 | $69,357 | $5,500 | $63,857 |

| 2016 | $1,484 | $65,779 | $6,040 | $59,739 |

| 2015 | $1,334 | $58,394 | $9,070 | $49,324 |

| 2014 | $697 | $63,560 | $8,715 | $54,845 |

Source: Public Records

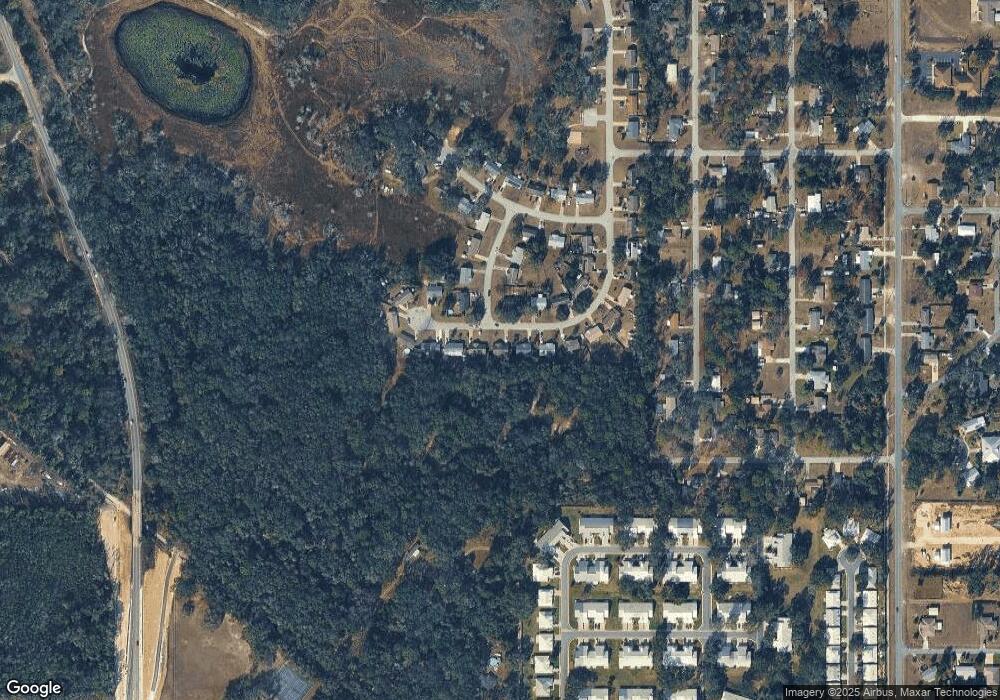

Map

Nearby Homes

- 805 Inverie Dr

- 809 Inverie Dr

- 747 Inverie Dr

- 1001 Jones Ave

- 820 Inverie Dr

- 820 Lanark Dr

- 823 Balmoral Ct

- 806 Windermere Blvd

- 802 Windermere Blvd

- 719 Balmoral Ct

- 716 Balmoral Ct

- 407 Hunting Lodge Dr

- 806 Edgewater Dr

- 1403 Andrew St

- 1317 Carl St

- 222 S Hunting Lodge Dr

- 206 S Hunting Lodge Dr

- 510 Turner Camp Rd

- 47 N Sheltering Oaks Dr

- 96 N Sheltering Oaks Dr

- 875 Stately Oaks Dr

- 859 Stately Oaks Dr

- 845 Stately Oaks Dr

- 887 Stately Oaks Dr

- 969 Hawk Crest Ln

- 884 Stately Oaks Dr

- 837 Stately Oaks Dr

- 899 Stately Oaks Dr

- 982 Hawk Crest Ln

- 896 Stately Oaks Dr

- 975 Hawk Crest Ln

- 832 Stately Oaks Dr

- 986 Hawk Crest Ln

- 967 Stately Oaks Dr

- 932 Stately Oaks Dr

- 983 Hawk Crest Ln

- 820 Stately Oaks Dr

- 810 Stately Oaks Dr

- 897 Duck Cove Path Unit 1