Estimated Value: $989,000 - $1,449,788

7

Beds

6

Baths

5,754

Sq Ft

$207/Sq Ft

Est. Value

About This Home

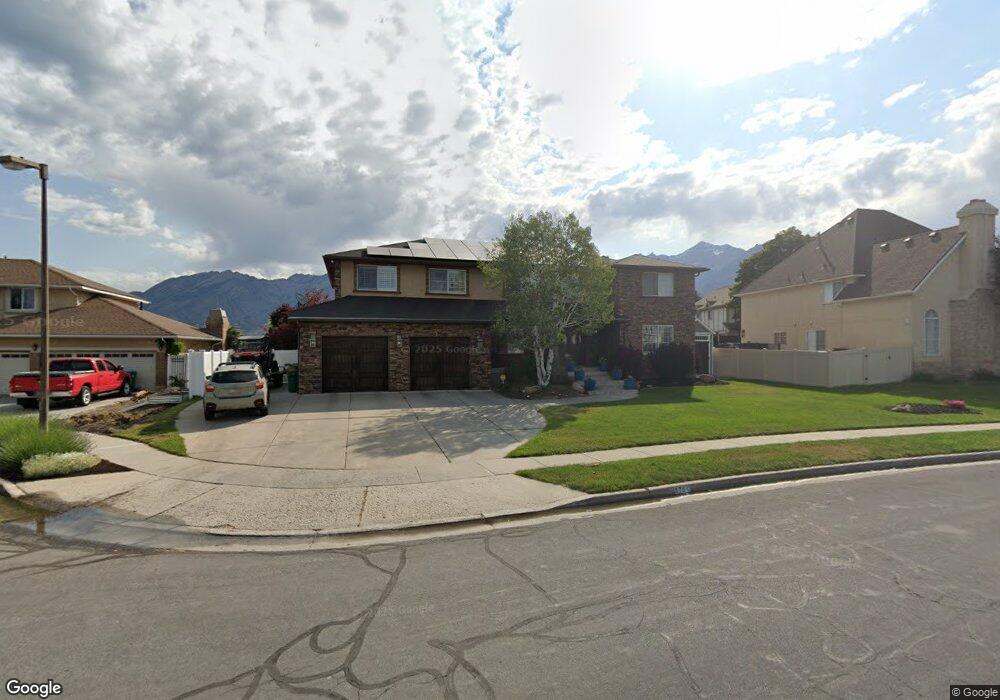

This home is located at 8701 Glider Ln, Sandy, UT 84093 and is currently estimated at $1,191,947, approximately $207 per square foot. 8701 Glider Ln is a home located in Salt Lake County with nearby schools including Silver Mesa Elementary School, Albion Middle School, and Hillcrest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2019

Sold by

Swapp David W and Swapp Stacy D

Bought by

Young Jacob and Young Stacy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$570,000

Outstanding Balance

$500,568

Interest Rate

3.62%

Mortgage Type

New Conventional

Estimated Equity

$691,379

Purchase Details

Closed on

Apr 14, 2017

Sold by

Rutheford Scott and Rutheford Rachelle D

Bought by

Swapp David W and Swapp Stacy D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$597,000

Interest Rate

4.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 10, 2015

Sold by

Rutherford Scott and Rutherford Rachelle Darlene

Bought by

Rutherford Scott and Rutherford Rachelle D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.61%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 17, 2012

Sold by

Rutherford Rachelle Darlene and Rutherford Scott

Bought by

Rutherford Scott and Rutherford Rachelle Darlene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$557,844

Interest Rate

3.37%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 14, 2009

Sold by

Rutherford Rachelle D

Bought by

Rutherford Rachelle Darlene and Rutherford Scott

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$424,297

Interest Rate

5.17%

Mortgage Type

FHA

Purchase Details

Closed on

May 12, 2005

Sold by

Scarpa Ronald and Scarpa Mary L

Bought by

Rutherford Rachelle Darlene and Rutherford Scott

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$373,600

Interest Rate

6.02%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 23, 2002

Sold by

Scarpa Ronald J and Scarpa Mary L

Bought by

Scarpa Ronald and Scarpa Mary L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,532

Interest Rate

6.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Young Jacob | -- | Eagle Gate Title Ins Agcy | |

| Swapp David W | -- | Vanguard Title | |

| Rutherford Scott | -- | Titan Title Ins Agcy Inc | |

| Rutherford Scott | -- | Titan Title Ins Agc Inc | |

| Rutherford Rachelle Darlene | -- | Investors Title Ins Agency | |

| Rutherford Rachelle D | -- | Investors Title Ins Agency | |

| Rutherford Rachelle Darlene | -- | Guardian Title | |

| Scarpa Ronald | -- | Surety Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Young Jacob | $570,000 | |

| Previous Owner | Swapp David W | $597,000 | |

| Previous Owner | Rutherford Scott | $417,000 | |

| Previous Owner | Rutherford Scott | $557,844 | |

| Previous Owner | Rutherford Rachelle D | $424,297 | |

| Previous Owner | Rutherford Rachelle Darlene | $373,600 | |

| Previous Owner | Scarpa Ronald | $300,532 | |

| Closed | Scarpa Ronald | $52,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,883 | $1,146,200 | $356,100 | $790,100 |

| 2024 | $5,883 | $1,102,800 | $342,700 | $760,100 |

| 2023 | $5,154 | $964,400 | $329,600 | $634,800 |

| 2022 | $5,349 | $984,600 | $323,100 | $661,500 |

| 2021 | $4,885 | $765,500 | $256,300 | $509,200 |

| 2020 | $4,995 | $738,600 | $256,300 | $482,300 |

| 2019 | $4,988 | $719,700 | $241,800 | $477,900 |

| 2016 | $3,998 | $557,800 | $217,900 | $339,900 |

Source: Public Records

Map

Nearby Homes

- 1891 Richard Rd

- 8642 S Cessna Cir

- 8638 Piper Ln

- 1924 E Viscounti Cove

- 1990 E Terra Vista Way

- 1579 E 8730 S

- 8483 Terrace Dr

- 8492 S Mesa Dr

- 8857 S Capella Way

- 8797 S Capella Way

- 1430 E 8685 S

- 1627 E Mulberry Way

- 8411 S 1475 E

- 1371 Sudbury Ave

- 1482 Waters Ln

- 2156 E Falcon Way

- 9078 S Daybreak Dr

- 2152 E Creek Rd

- 8081 Beaumont Dr

- 8266 S Creek Hollow Cove

- 8701 S Glider Ln

- 8691 S Glider Ln

- 8691 Glider Ln

- 8711 Glider Ln

- 8711 S Glider Ln

- 1867 E Summer Park Cir

- 1867 Summer Park Cir

- 1827 Glider Ln

- 1877 E Summer Park Cir

- 1877 Summer Park Cir

- 8704 Glider Ln

- 8704 S Glider Ln

- 8714 S Glider Ln

- 8714 Glider Ln

- 1818 E Glider Ln

- 1818 Glider Ln

- 1817 Glider Ln

- 1887 Summer Park Cir

- 8735 Glider Ln

- 1870 Summer Park Cir

Your Personal Tour Guide

Ask me questions while you tour the home.