Estimated Value: $421,000 - $431,000

3

Beds

2

Baths

1,113

Sq Ft

$382/Sq Ft

Est. Value

About This Home

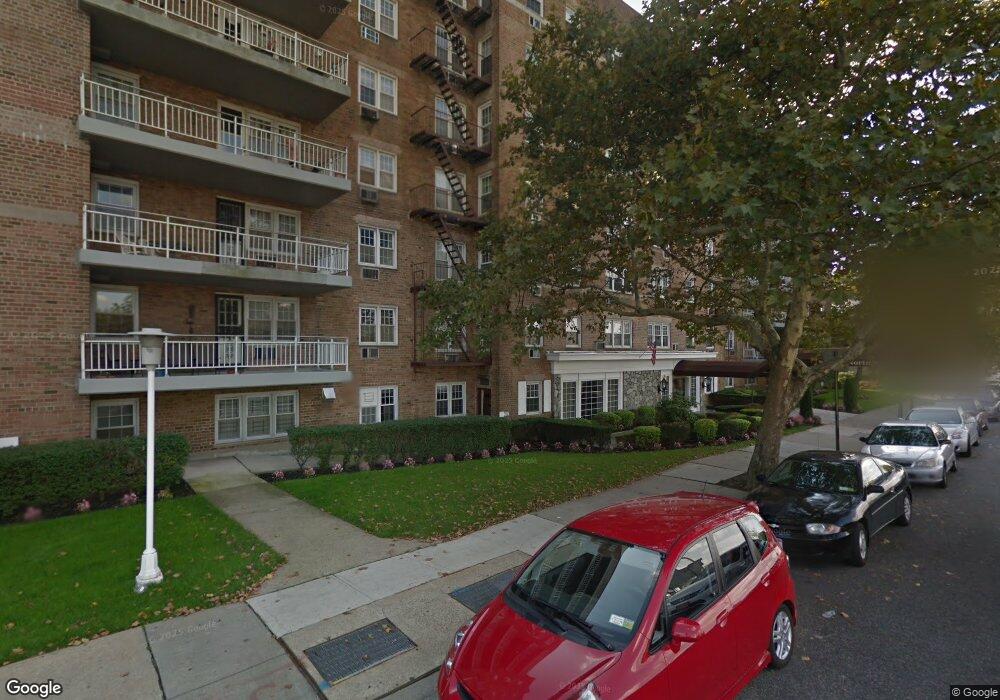

This home is located at 8710 149th Ave Unit 3H, Howard Beach, NY 11414 and is currently estimated at $425,240, approximately $382 per square foot. 8710 149th Ave Unit 3H is a home located in Queens County with nearby schools including P.S. 232 - Lindenwood, Windy River Elementary School, and Robert H. Goddard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2025

Sold by

Lufulwabo Aime M and Lufulwabo Rebekah

Bought by

Gonzalez Judith

Current Estimated Value

Purchase Details

Closed on

Apr 1, 2021

Sold by

Lufulwabo Aime M and Mbelu Mbayabu Gisele

Bought by

Grace Lufulwabo Rebekah and Lufulwabo Aime M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,000

Interest Rate

3.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 12, 2018

Sold by

Bonus Amante and Bonus Evelyn

Bought by

Lufulwabo Aime M and Mbayabu Gisele N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 26, 2000

Sold by

Morano Geraldine B

Bought by

Bonus Amante and Bonus Evelyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,500

Interest Rate

7.89%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzalez Judith | $420,000 | -- | |

| Grace Lufulwabo Rebekah | -- | -- | |

| Grace Lufulwabo Rebekah | -- | -- | |

| Lufulwabo Aime M | $320,000 | -- | |

| Lufulwabo Aime M | $320,000 | -- | |

| Bonus Amante | $130,000 | Fidelity National Title Ins | |

| Bonus Amante | $130,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Grace Lufulwabo Rebekah | $372,000 | |

| Previous Owner | Lufulwabo Aime M | $304,000 | |

| Previous Owner | Bonus Amante | $123,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,620 | $45,705 | $6,004 | $39,701 |

| 2024 | $5,620 | $44,955 | $6,004 | $38,951 |

| 2023 | $5,495 | $43,951 | $6,004 | $37,947 |

| 2022 | $5,288 | $45,695 | $6,004 | $39,691 |

| 2021 | $4,486 | $38,939 | $6,004 | $32,935 |

| 2020 | $4,914 | $46,273 | $6,004 | $40,269 |

| 2019 | $4,639 | $42,999 | $6,004 | $36,995 |

| 2018 | $4,303 | $36,156 | $6,004 | $30,152 |

| 2017 | $4,024 | $33,360 | $6,004 | $27,356 |

| 2016 | $3,822 | $33,360 | $6,004 | $27,356 |

| 2015 | $2,591 | $31,394 | $6,428 | $24,966 |

| 2014 | $2,591 | $31,294 | $6,640 | $24,654 |

Source: Public Records

About This Building

Map

Nearby Homes

- 87-10 149th Ave Unit 5D

- 149-30 88th St Unit 4A

- 88-08 151st Ave Unit 3H

- 88-08 151st Ave Unit 5C

- 8509 151st Ave Unit 3N

- 8509 151st Ave Unit 5H

- 8509 151st Ave Unit 5A

- 8509 151st Ave Unit 2D

- 151-20 88th St Unit 5M

- 86-10 151st Ave Unit 4G

- 86-10 151st Ave Unit 1L

- 86-10 151st Ave Unit 6B

- 86-10 151st Ave Unit 3F

- 88-8 151st Ave Unit 1K

- 15023 89th St Unit 8

- 88-12 151st Ave Unit 4B

- 88-12 151st Ave

- 85-10 151st Ave Unit 3M

- 8510 151st Ave Unit 5J

- 8510 151st Ave Unit 3K

- 8710 149th Ave Unit 5

- 8710 149th Ave Unit 5F

- 8710 149th Ave Unit 2F

- 8710 149th Ave Unit 4F

- 8710 149th Ave Unit 6N

- 8710 149th Ave Unit 6M

- 8710 149th Ave Unit 6L

- 8710 149th Ave Unit 6K

- 8710 149th Ave Unit 6J

- 8710 149th Ave Unit 6H

- 8710 149th Ave Unit 6G

- 8710 149th Ave Unit 6F

- 8710 149th Ave Unit 6E

- 8710 149th Ave Unit 6D

- 8710 149th Ave Unit 6B

- 8710 149th Ave Unit 6A

- 8710 149th Ave Unit 5N

- 8710 149th Ave Unit 5M

- 8710 149th Ave Unit 5L

- 8710 149th Ave Unit 5K