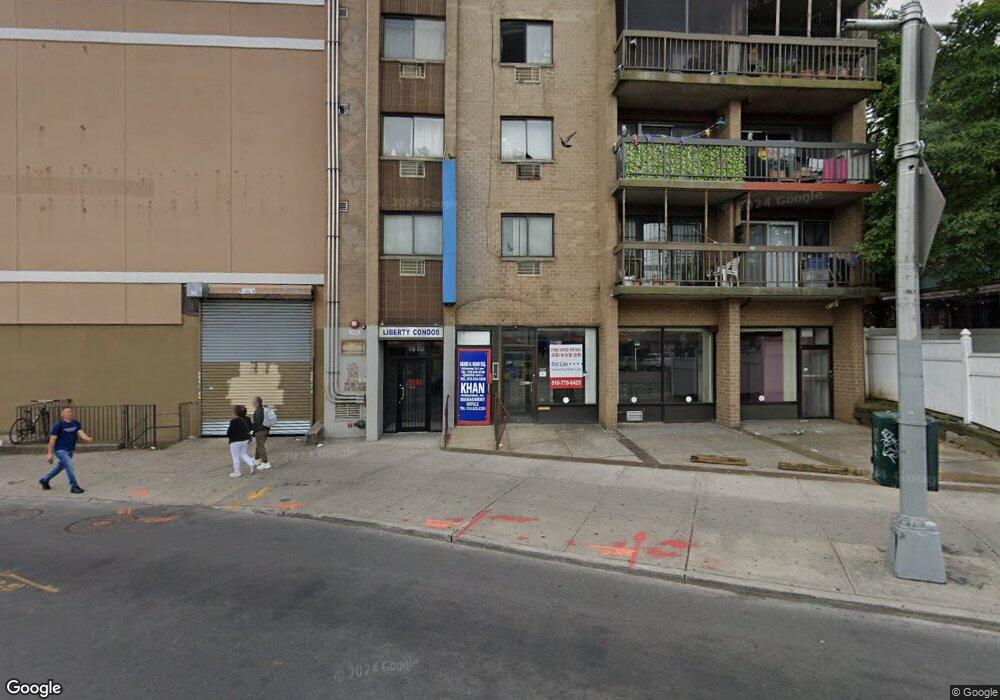

8710 Grand Ave Unit 3A Elmhurst, NY 11373

Elmhurst NeighborhoodEstimated Value: $392,000 - $494,000

--

Bed

--

Bath

685

Sq Ft

$662/Sq Ft

Est. Value

About This Home

This home is located at 8710 Grand Ave Unit 3A, Elmhurst, NY 11373 and is currently estimated at $453,615, approximately $662 per square foot. 8710 Grand Ave Unit 3A is a home located in Queens County with nearby schools including P.S. 102 Bayview, IS 73 - The Frank Sansivieri School, and Newtown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 10, 2016

Sold by

Hamid H Khan & Raufa G Faroqui Living

Bought by

Faroqui Raufa G and Khan Hamid H

Current Estimated Value

Purchase Details

Closed on

Dec 21, 2015

Sold by

Faroqui Raufa G

Bought by

Hamid H Khan & Raufa G Faroqui Living Tr

Purchase Details

Closed on

Jun 21, 2012

Sold by

Giang Lynn and Luu Bi

Bought by

Faroqui Raufa G

Purchase Details

Closed on

Jul 29, 2003

Sold by

Bemonte Augusta H and Borja Clememte M

Bought by

Giang Lynn and Luu Bi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

5.81%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Faroqui Raufa G | -- | -- | |

| Faroqui Raufa G | -- | -- | |

| Faroqui Raufa G | -- | -- | |

| Hamid H Khan & Raufa G Faroqui Living Tr | -- | -- | |

| Hamid H Khan & Raufa G Faroqui Living Tr | -- | -- | |

| Hamid H Khan & Raufa G Faroqui Living Tr | -- | -- | |

| Faroqui Raufa G | $220,000 | -- | |

| Faroqui Raufa G | $220,000 | -- | |

| Giang Lynn | $182,000 | -- | |

| Giang Lynn | $182,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Giang Lynn | $112,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,164 | $26,398 | $6,255 | $20,143 |

| 2024 | $3,164 | $25,308 | $6,255 | $19,053 |

| 2023 | $3,095 | $24,754 | $6,255 | $18,499 |

| 2022 | $3,408 | $28,925 | $6,255 | $22,670 |

| 2021 | $2,966 | $24,181 | $6,255 | $17,926 |

| 2020 | $3,424 | $28,925 | $6,255 | $22,670 |

| 2019 | $3,195 | $28,791 | $6,255 | $22,536 |

| 2018 | $2,923 | $22,981 | $6,254 | $16,727 |

| 2017 | $2,661 | $20,922 | $6,254 | $14,668 |

| 2016 | $2,457 | $20,922 | $6,254 | $14,668 |

| 2015 | $1,858 | $18,973 | $6,255 | $12,718 |

| 2014 | $1,858 | $19,510 | $6,255 | $13,255 |

Source: Public Records

Map

Nearby Homes

- 53-13 Seabury St

- 86-34 Grand Ave

- 86-38 54th Ave

- 86-41 55th Ave

- 52-22 van Loon St

- 84-09 Queens Blvd Unit 4B

- 88-08 Justice Ave Unit 15N

- 51-21 Goldsmith St

- 86-04 Grand Ave Unit 2D

- 8808 Justice Ave Unit 13M

- 8808 Justice Ave Unit 15M

- 8808 Justice Ave Unit 16H

- 8420 51st Ave Unit 2E

- 86-15 Broadway Unit 4D

- 86-15 Broadway Unit 4B

- 41-24 , 41-28 76th St

- 84-20 51st Ave Unit 5C

- 84-20 51st Ave Unit 6H

- 84-20 51st Ave Unit 5L

- 84-20 51st Ave Unit 2M

- 8710 Grand Ave Unit 3D

- 8710 Grand Ave Unit 6D

- 8710 Grand Ave Unit 6C

- 8710 Grand Ave Unit 6B

- 8710 Grand Ave Unit 6A

- 8710 Grand Ave Unit 5D

- 8710 Grand Ave Unit 5C

- 8710 Grand Ave Unit 5B

- 8710 Grand Ave Unit 87-12

- 8710 Grand Ave Unit 4D

- 8710 Grand Ave Unit 4C

- 8710 Grand Ave Unit 4B

- 8710 Grand Ave Unit 4A

- 8710 Grand Ave Unit 3C

- 8710 Grand Ave Unit 3B

- 8710 Grand Ave Unit 2D

- 8710 Grand Ave Unit 2C

- 8710 Grand Ave Unit 2B

- 8710 Grand Ave Unit 2A

- 8710 Grand Ave Unit 1