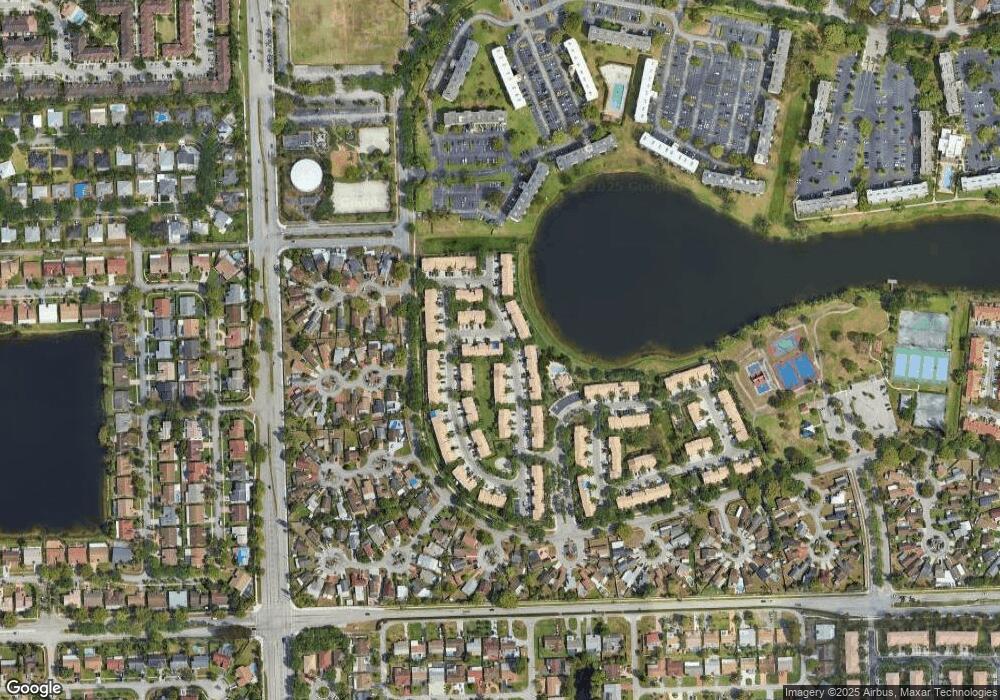

8712 SW 21st Ct Miramar, FL 33025

Lakeshore at University Park NeighborhoodEstimated Value: $402,000 - $444,921

3

Beds

2

Baths

1,570

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 8712 SW 21st Ct, Miramar, FL 33025 and is currently estimated at $427,730, approximately $272 per square foot. 8712 SW 21st Ct is a home located in Broward County with nearby schools including Fairway Elementary School, New Renaissance Middle School, and Miramar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2017

Sold by

Sandollar Investment Group Inc

Bought by

Ortiz Alberto and Perez Vanessa Florez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,160

Outstanding Balance

$176,107

Interest Rate

4.75%

Mortgage Type

FHA

Estimated Equity

$251,623

Purchase Details

Closed on

Mar 8, 2017

Sold by

Lakeview Townhomes

Bought by

Sandllar Investment Group Inc

Purchase Details

Closed on

Jan 1, 2017

Bought by

Ortiz Luis Alberto

Purchase Details

Closed on

Jan 2, 2007

Sold by

Williams Rupert

Bought by

Williams Rupert and Kinglock Marrio

Purchase Details

Closed on

Aug 2, 2006

Sold by

Fidelity International Development Inc

Bought by

Williams Rupert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,100

Interest Rate

6.68%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Nov 6, 1998

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ortiz Alberto | $212,000 | Independence Title Inc | |

| Sandllar Investment Group Inc | $154,900 | None Available | |

| Ortiz Luis Alberto | $154,900 | -- | |

| Williams Rupert | -- | Attorney | |

| Williams Rupert | $160,800 | Attorney | |

| Available Not | $1,683,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ortiz Alberto | $208,160 | |

| Previous Owner | Williams Rupert | $32,100 | |

| Previous Owner | Williams Rupert | $128,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,609 | $265,560 | -- | -- |

| 2024 | $6,486 | $258,080 | -- | -- |

| 2023 | $6,486 | $250,570 | $0 | $0 |

| 2022 | $4,522 | $243,280 | $0 | $0 |

| 2021 | $4,443 | $236,200 | $0 | $0 |

| 2020 | $4,393 | $232,940 | $0 | $0 |

| 2019 | $4,338 | $227,710 | $0 | $0 |

| 2018 | $4,172 | $223,470 | $40,870 | $182,600 |

| 2017 | $4,149 | $183,300 | $0 | $0 |

| 2016 | $3,938 | $166,660 | $0 | $0 |

| 2015 | $3,648 | $151,510 | $0 | $0 |

| 2014 | $3,338 | $137,740 | $0 | $0 |

| 2013 | -- | $128,460 | $34,060 | $94,400 |

Source: Public Records

Map

Nearby Homes

- 8730 SW 21st St

- 8902 SW 19th St

- 8915 SW 19th St Unit 8915

- 8540 N Sherman Cir Unit 204

- 8540 N Sherman Cir Unit 408

- 8740 N Sherman Cir Unit 308

- 8700 N Sherman Cir Unit 305

- 8750 N Sherman Cir Unit 102

- 8550 N Sherman Cir Unit 105

- 8730 N Sherman Cir Unit 307

- 8560 N Sherman Cir Unit 208

- 8550 N Sherman Cir Unit 506

- 8560 N Sherman Cir Unit 402

- 8750 N Sherman Cir Unit 408

- 8610 N Sherman Cir Unit 103

- 8560 N Sherman Cir Unit 105

- 1832 SW 89th Terrace

- 8922 SW 18th St

- 8928 SW 18th St

- 1701 SW 86th Terrace

- 8722 SW 21st Ct

- 8732 SW 21st Ct

- 2202 SW 87th Terrace

- 8742 SW 21st Ct

- 2153 SW 87th Terrace

- 2143 SW 87th Terrace

- 2163 SW 87th Terrace

- 2173 SW 87th Terrace

- 8752 SW 21st Ct

- 2133 SW 87th Terrace

- 2203 SW 87th Terrace

- 2222 SW 87th Terrace

- 2123 SW 87th Terrace

- 2211 SW 87th Terrace

- 8723 SW 21st Ct

- 2201 SW 87th Way

- 2232 SW 87th Terrace

- 8762 SW 21st Ct

- 2113 SW 87th Terrace