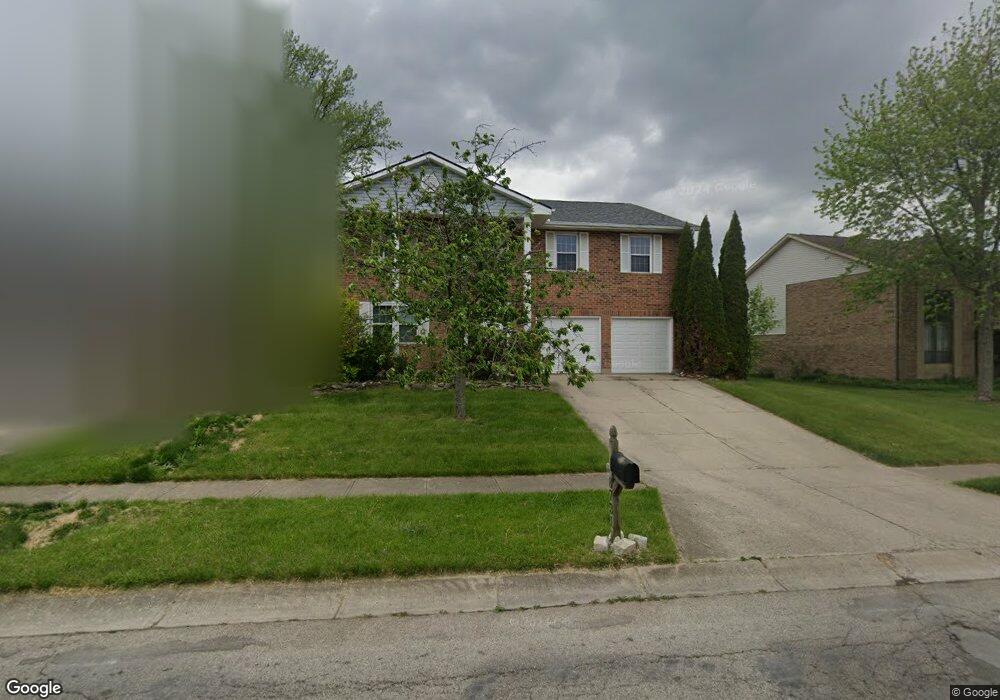

8731 Deer Plains Way Dayton, OH 45424

Estimated Value: $325,000 - $346,000

4

Beds

3

Baths

2,800

Sq Ft

$121/Sq Ft

Est. Value

About This Home

This home is located at 8731 Deer Plains Way, Dayton, OH 45424 and is currently estimated at $338,907, approximately $121 per square foot. 8731 Deer Plains Way is a home located in Montgomery County with nearby schools including Wayne High School and Huber Heights Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2006

Sold by

Randle Dossie and Randle Linda J

Bought by

Richmond Nathaniel Mark and Richmond Cheryl Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,050

Outstanding Balance

$108,190

Interest Rate

6.3%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$230,717

Purchase Details

Closed on

Jun 30, 2000

Sold by

Varner Anthony E

Bought by

Randle Dossie and Randle Linda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,900

Interest Rate

8.64%

Purchase Details

Closed on

Feb 9, 1999

Sold by

Huber Investment Corp

Bought by

Varner Anthony E and Varner Chungnam

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,886

Interest Rate

6.88%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richmond Nathaniel Mark | $197,000 | None Available | |

| Randle Dossie | $179,900 | -- | |

| Varner Anthony E | $156,200 | Dayton Title Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Richmond Nathaniel Mark | $191,050 | |

| Previous Owner | Randle Dossie | $170,900 | |

| Previous Owner | Varner Anthony E | $160,886 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,889 | $93,140 | $15,710 | $77,430 |

| 2023 | $4,889 | $93,140 | $15,710 | $77,430 |

| 2022 | $4,577 | $68,480 | $11,550 | $56,930 |

| 2021 | $4,619 | $68,480 | $11,550 | $56,930 |

| 2020 | $4,623 | $68,480 | $11,550 | $56,930 |

| 2019 | $4,778 | $62,630 | $12,080 | $50,550 |

| 2018 | $4,794 | $62,630 | $12,080 | $50,550 |

| 2017 | $4,765 | $62,630 | $12,080 | $50,550 |

| 2016 | $4,621 | $60,810 | $10,500 | $50,310 |

| 2015 | $4,562 | $60,810 | $10,500 | $50,310 |

| 2014 | $4,562 | $60,810 | $10,500 | $50,310 |

| 2012 | -- | $58,590 | $10,500 | $48,090 |

Source: Public Records

Map

Nearby Homes

- 6938 Charlesgate Rd

- 6809 Casa Grande Ct

- 8848 Deer Hollow Dr

- 7191 Honeylocust St

- 4264 Forestedge St

- 7113 Honeylocust St

- 7185 Honeylocust St

- 2036 Cedar Lake Dr

- 2024 Cedar Lake Dr

- 1235 Gable Way

- The Rosewood Plan at Gables of Huber Heights - The Gables of Huber Heights

- The Gable Plan at Gables of Huber Heights - The Gables of Huber Heights

- The Cedar Plan at Gables of Huber Heights - The Gables of Huber Heights

- 6991 Salon Cir Unit 4444

- 6652 Loblolly Dr

- 5073 Catalpa Dr

- 8930 Century Ln

- 3290 Dry Run St

- 8830 Christygate Ln

- 6334 Shull Rd

- 8721 Deer Plains Way

- 8741 Deer Plains Way

- 8810 Cabin Croft Ct

- 8801 Cabin Croft Ct

- 6979 Deer Bluff Dr

- 8751 Deer Plains Way

- 6837 Charlesgate Rd

- 6827 Charlesgate Rd

- 6980 Deer Bluff Dr

- 6847 Charlesgate Rd

- 6770 Deer Meadows Dr

- 6971 Deer Bluff Dr

- 6760 Deer Meadows Dr

- 6780 Deer Meadows Dr

- 8811 Cabin Croft Ct

- 6970 Deer Bluff Dr

- 6807 Charlesgate Rd

- 6857 Charlesgate Rd

- 8750 Deer Plains Way

- 6959 Deer Bluff Dr