8752 Mesquite Row Lone Tree, CO 80124

Estimated Value: $564,000 - $609,000

3

Beds

3

Baths

1,509

Sq Ft

$384/Sq Ft

Est. Value

About This Home

This home is located at 8752 Mesquite Row, Lone Tree, CO 80124 and is currently estimated at $579,797, approximately $384 per square foot. 8752 Mesquite Row is a home located in Douglas County with nearby schools including Eagle Ridge Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2002

Sold by

Cole Elizabeth T

Bought by

Mayer Daniel B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,250

Outstanding Balance

$94,061

Interest Rate

6.76%

Estimated Equity

$485,736

Purchase Details

Closed on

Sep 27, 2000

Sold by

Baker June

Bought by

Cole Elizabeth T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,650

Interest Rate

7.97%

Purchase Details

Closed on

Oct 31, 1994

Sold by

Ostrowski Kenneth P

Bought by

Baker June

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,415

Interest Rate

8.73%

Purchase Details

Closed on

Nov 4, 1988

Sold by

Trust Properties Mgmt Ltd

Bought by

Ostrowski Kenn

Purchase Details

Closed on

Sep 21, 1988

Sold by

Trust Properties Mgmt Ltd

Bought by

Platte Valley Comm Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mayer Daniel B | $235,000 | Title America | |

| Cole Elizabeth T | $224,900 | North American Title Co | |

| Baker June | $169,900 | Land Title | |

| Ostrowski Kenn | $129,900 | -- | |

| Platte Valley Comm Corp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mayer Daniel B | $223,250 | |

| Previous Owner | Cole Elizabeth T | $213,650 | |

| Previous Owner | Baker June | $144,415 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,462 | $36,680 | $5,700 | $30,980 |

| 2023 | $2,487 | $36,680 | $5,700 | $30,980 |

| 2022 | $2,566 | $28,220 | $1,740 | $26,480 |

| 2021 | $2,669 | $28,220 | $1,740 | $26,480 |

| 2020 | $2,776 | $30,080 | $1,790 | $28,290 |

| 2019 | $2,785 | $30,080 | $1,790 | $28,290 |

| 2018 | $2,103 | $24,290 | $1,800 | $22,490 |

| 2017 | $2,136 | $24,290 | $1,800 | $22,490 |

| 2016 | $1,978 | $22,030 | $1,990 | $20,040 |

| 2015 | $2,021 | $22,030 | $1,990 | $20,040 |

| 2014 | $1,824 | $18,640 | $1,990 | $16,650 |

Source: Public Records

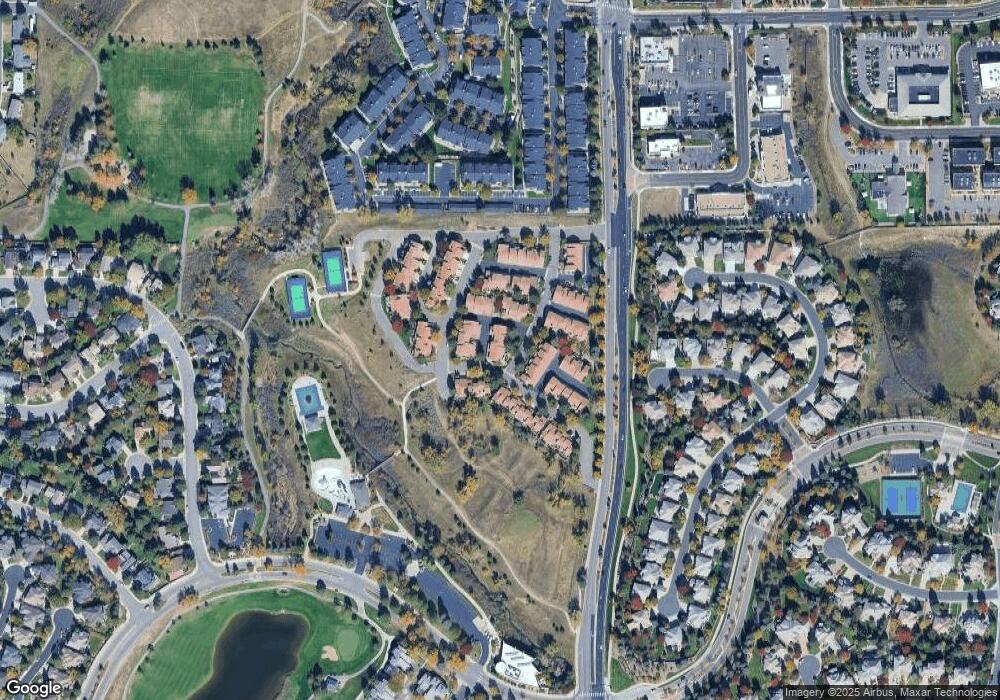

Map

Nearby Homes

- 8754 Mesquite Row

- 8860 Kachina Way

- 8260 Lodgepole Trail

- 9445 Aspen Hill Cir

- 9493 Southern Hills Cir Unit A25

- 8159 Lodgepole Trail

- 9464 E Aspen Hill Place

- 130 Dianna Dr

- 9308 Miles Dr Unit 5

- 181 Dianna Dr

- 8176 Lone Oak Ct

- 13134 Deneb Dr

- 13117 Deneb Dr

- 9645 Aspen Hill Cir

- 108 Olympus Cir

- 13483 Achilles Dr

- 9343 Vista Hill Ln

- 9559 Brook Hill Ln

- 9410 S Silent Hills Dr

- 9430 S Silent Hills Dr

- 8750 Mesquite Row

- 8756 Mesquite Row

- 8748 Mesquite Row

- 8774 Fiesta Terrace

- 8746 Mesquite Row

- 8744 Mesquite Row

- 8762 Fiesta Terrace

- 9174 Madre Place

- 9168 Madre Place

- 8786 Fiesta Terrace

- 8742 Mesquite Row

- 9162 Madre Place

- 8750 Fiesta Terrace

- 9156 Madre Place

- 8798 Fiesta Terrace

- 8771 Mesquite Row

- 8783 Mesquite Row

- 9150 Madre Place

- 8759 Mesquite Row

- 8795 Mesquite Row