8765 Glasgow Pointe Duluth, GA 30097

Estimated Value: $1,357,263 - $1,602,000

5

Beds

6

Baths

7,965

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 8765 Glasgow Pointe, Duluth, GA 30097 and is currently estimated at $1,482,566, approximately $186 per square foot. 8765 Glasgow Pointe is a home located in Forsyth County with nearby schools including Johns Creek Elementary School, Riverwatch Middle School, and Lambert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 11, 2023

Sold by

Mohabir Rookminee

Bought by

Kim Kay

Current Estimated Value

Purchase Details

Closed on

Sep 6, 2017

Sold by

Jeon Yeong Geun

Bought by

Rookminee Mohabir

Purchase Details

Closed on

Jun 27, 2002

Sold by

Jeon Yeong Geun

Bought by

Jeon Yeong Geun and Jeon Jina S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$448,000

Interest Rate

5.98%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 6, 2002

Sold by

Fradley Carolyn A

Bought by

Fradley John T

Purchase Details

Closed on

Jul 18, 2000

Sold by

Newman Homes Inc

Bought by

Fradley John T and Fradley Carolyn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

7.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kim Kay | -- | None Listed On Document | |

| Rookminee Mohabir | $430,000 | -- | |

| Jeon Yeong Geun | -- | -- | |

| Jeon Yeong Geun | $560,000 | -- | |

| Fradley John T | -- | -- | |

| Fradley John T | $568,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jeon Yeong Geun | $448,000 | |

| Previous Owner | Fradley John T | $400,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,016 | $570,848 | $100,000 | $470,848 |

| 2024 | $3,016 | $389,332 | $60,000 | $329,332 |

| 2023 | $9,583 | $389,332 | $60,000 | $329,332 |

| 2022 | $8,807 | $341,068 | $60,000 | $281,068 |

| 2021 | $9,418 | $341,068 | $60,000 | $281,068 |

| 2020 | $5,854 | $212,000 | $60,000 | $152,000 |

| 2019 | $5,863 | $212,000 | $60,000 | $152,000 |

| 2018 | $7,327 | $212,000 | $60,000 | $152,000 |

| 2017 | $8,270 | $301,132 | $60,000 | $241,132 |

| 2016 | $7,715 | $281,132 | $40,000 | $241,132 |

| 2015 | $6,640 | $241,956 | $40,000 | $201,956 |

| 2014 | $6,318 | $241,956 | $0 | $0 |

Source: Public Records

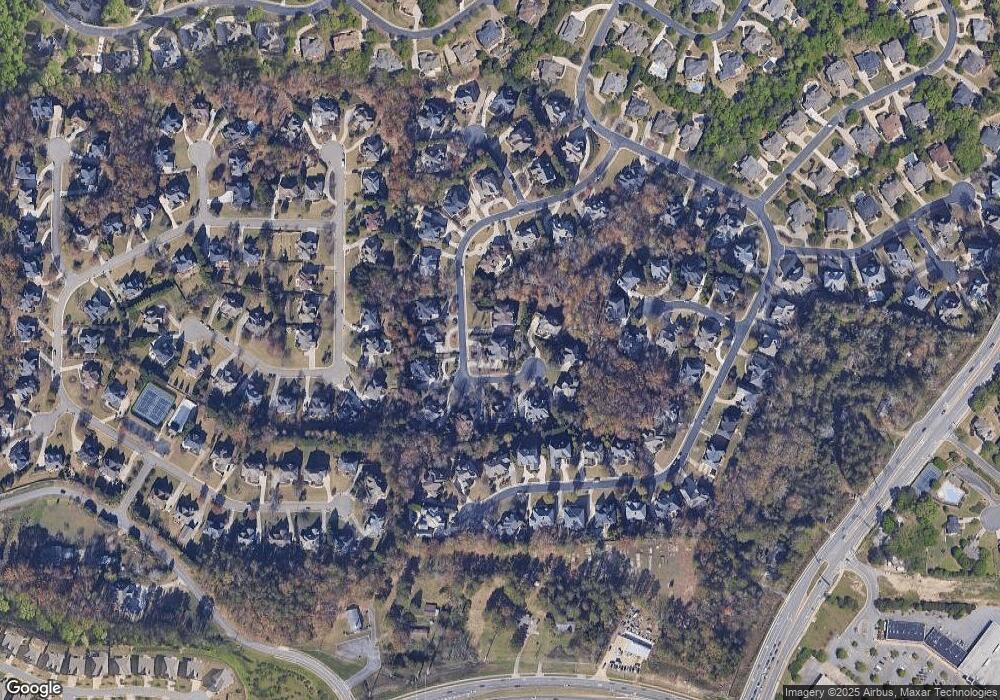

Map

Nearby Homes

- 8630 Moor Park Run

- 1370 Boomer Cir

- 8320 Kenningston Way

- 6555 Fairfield Trace

- 8935 Muirfield Ct

- 1020 Grace Ct

- 7685 Settles Walk Ln

- 955 Gardiner Cir

- 6745 Fairfield Trace

- 6580 Marlowe Glen Way

- 7950 Laurel Creek Dr

- 11100 Crofton Overlook Ct Unit 2

- 8965 Friarbridge Dr Unit 1B

- 11120 Crofton Overlook Ct Unit 2

- 9020 Friarbridge Dr

- 7315 Craigleith Dr

- 7745 Saint Marlo Country Club Pkwy

- 7945 Saint Marlo Fairway Dr

- 8765 Glasgow

- 8745 Glasgow Pointe

- 8815 Glasgow Pointe

- 8810 Glasgow Pointe

- 8810 Glasgow Point

- 8820 Glasgow Pointe

- 8820 Glasgow Pointe

- 8760 Glasgow

- 8760 Glasgow Pointe Unit 402

- 8760 Glasgow Pointe

- 8760 Glasgow Pte Unit 402

- 0 Glasgow Point Unit 7522830

- 0 Glasgow Point Unit 7443754

- 0 Glasgow Point Unit 7272886

- 0 Glasgow Point Unit 3276645

- 0 Glasgow Point Unit 3122431

- 0 Glasgow Point Unit 8200870

- 0 Glasgow Point

- 8820 Glasgow Point

- 8820 Glasgow Pte