8771 Mesquite Row Lone Tree, CO 80124

Estimated Value: $586,000 - $607,199

3

Beds

4

Baths

2,236

Sq Ft

$267/Sq Ft

Est. Value

About This Home

This home is located at 8771 Mesquite Row, Lone Tree, CO 80124 and is currently estimated at $596,300, approximately $266 per square foot. 8771 Mesquite Row is a home located in Douglas County with nearby schools including Eagle Ridge Elementary School, Cresthill Middle School, and Highlands Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2009

Sold by

Mattix Forrest E

Bought by

Notary Janet

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2007

Sold by

Ritchey Terry J

Bought by

Mattix Forrest E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.15%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 27, 2002

Sold by

Hartnett Carole Meehan

Bought by

Ritchey Terry J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,000

Interest Rate

6.26%

Purchase Details

Closed on

Nov 2, 1988

Sold by

Trust Properties Mgmt Ltd

Bought by

Meehan Hartnett Carole

Purchase Details

Closed on

Sep 21, 1988

Sold by

Trust Properties Mgmt Ltd

Bought by

Platte Valley Comm Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Notary Janet | $255,000 | Chicago Title Co | |

| Mattix Forrest E | $285,000 | Utc Colorado | |

| Ritchey Terry J | $232,500 | Land Title | |

| Meehan Hartnett Carole | $113,500 | -- | |

| Platte Valley Comm Corp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mattix Forrest E | $180,000 | |

| Previous Owner | Ritchey Terry J | $186,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,429 | $40,300 | $5,700 | $34,600 |

| 2023 | $3,464 | $40,300 | $5,700 | $34,600 |

| 2022 | $2,773 | $30,490 | $1,740 | $28,750 |

| 2021 | $2,883 | $30,490 | $1,740 | $28,750 |

| 2020 | $2,895 | $31,370 | $1,790 | $29,580 |

| 2019 | $2,904 | $31,370 | $1,790 | $29,580 |

| 2018 | $2,331 | $26,930 | $1,800 | $25,130 |

| 2017 | $2,368 | $26,930 | $1,800 | $25,130 |

| 2016 | $2,166 | $24,130 | $1,990 | $22,140 |

| 2015 | $1,107 | $24,130 | $1,990 | $22,140 |

| 2014 | $998 | $20,390 | $1,990 | $18,400 |

Source: Public Records

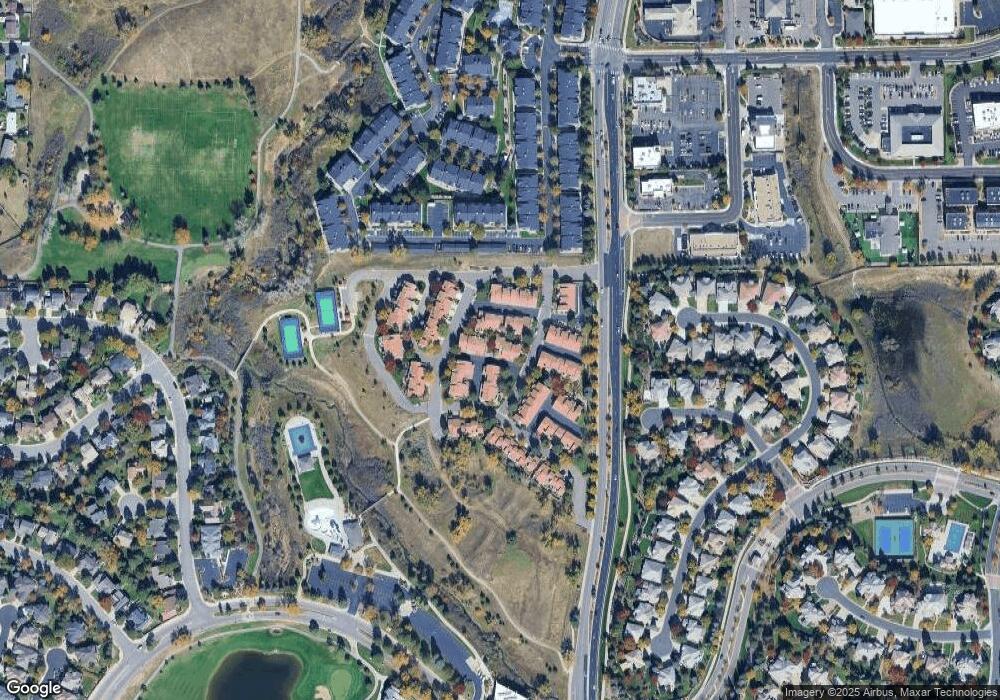

Map

Nearby Homes

- 8754 Mesquite Row

- 8860 Kachina Way

- 8260 Lodgepole Trail

- 8159 Lodgepole Trail

- 9493 Southern Hills Cir Unit A25

- 9445 Aspen Hill Cir

- 9308 Miles Dr Unit 5

- 130 Dianna Dr

- 9445 Southern Hills Cir Unit 20C

- 9464 E Aspen Hill Place

- 181 Dianna Dr

- 8176 Lone Oak Ct

- 13134 Deneb Dr

- 13117 Deneb Dr

- 13483 Achilles Dr

- 108 Olympus Cir

- 9645 Aspen Hill Cir

- 9559 Brook Hill Ln

- 9343 Vista Hill Ln

- 9410 S Silent Hills Dr

- 8783 Mesquite Row

- 8795 Mesquite Row

- 8759 Mesquite Row

- 8756 Mesquite Row

- 8746 Kachina Way

- 8758 Kachina Way

- 8747 Mesquite Row

- 8734 Kachina Way

- 8770 Kachina Way

- 8722 Kachina Way

- 8782 Kachina Way

- 8735 Mesquite Row

- 8742 Mesquite Row

- 8752 Mesquite Row

- 8838 Mesquite Row

- 8744 Mesquite Row

- 8750 Mesquite Row

- 8746 Mesquite Row

- 8850 Mesquite Row

- 9150 Madre Place