8800 N Callahan Rd Unit 186 Prescott, AZ 86305

Williamson Valley Road NeighborhoodEstimated Value: $1,638,000 - $1,966,000

--

Bed

--

Bath

2,941

Sq Ft

$596/Sq Ft

Est. Value

About This Home

This home is located at 8800 N Callahan Rd Unit 186, Prescott, AZ 86305 and is currently estimated at $1,754,091, approximately $596 per square foot. 8800 N Callahan Rd Unit 186 is a home located in Yavapai County with nearby schools including Granite Mountain Middle School, Abia Judd Elementary School, and Prescott Mile High Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 5, 2025

Sold by

Mahon Elizabeth and Parker Mary Virginia

Bought by

Mkc Living Trust and Caldemeyer

Current Estimated Value

Purchase Details

Closed on

Jan 26, 2016

Sold by

Viola Daniel Troy and Viola Karla Susan

Bought by

Mahon Elizabeth and Parker Mary Virginia

Purchase Details

Closed on

Nov 13, 2007

Sold by

Viola Daniel T and Viola Karla S

Bought by

Viola Daniel Troy and Viola Karla Susan

Purchase Details

Closed on

Jan 6, 2006

Sold by

Yavapai Title Agency Inc

Bought by

Viola Daniel T and Viola Karla S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

6.27%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mkc Living Trust | $1,700,000 | Yavapai Title Agency | |

| Mahon Elizabeth | $200,000 | Yavapai Title | |

| Viola Daniel Troy | -- | None Available | |

| Viola Daniel T | $350,000 | Yavapai Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Viola Daniel T | $280,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $5,668 | $118,167 | -- | -- |

| 2024 | $5,483 | $113,419 | -- | -- |

| 2023 | $5,483 | $86,878 | $10,277 | $76,601 |

| 2022 | $5,292 | $73,544 | $8,287 | $65,257 |

| 2021 | $5,356 | $69,585 | $7,156 | $62,429 |

| 2020 | $5,291 | $0 | $0 | $0 |

| 2019 | $1,279 | $0 | $0 | $0 |

| 2018 | $1,229 | $0 | $0 | $0 |

| 2017 | $1,263 | $0 | $0 | $0 |

| 2016 | $1,249 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

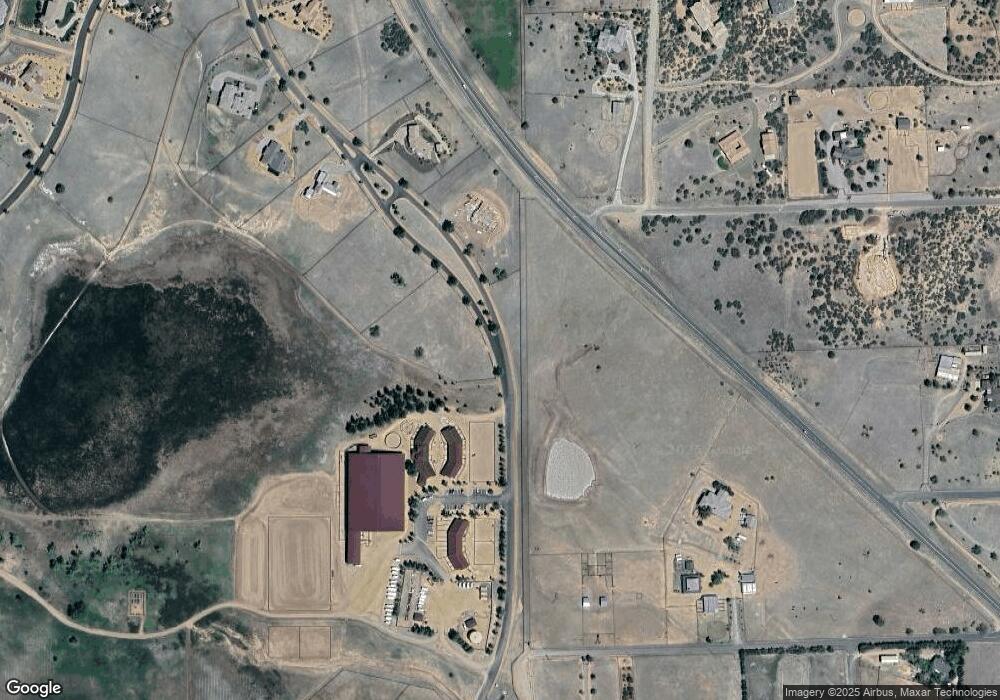

Map

Nearby Homes

- 8815 N Callahan Rd

- 9230 N Callahan Rd

- 9730 N Callahan

- 9270 N Callahan Rd

- 4695 W Phantom Hill Rd

- 9235 N Distant View Cir

- 4490 W Julesberg Cir

- 8860 Buchanan Dr

- 3550 W Chipmunk Rd

- 4634 Black Jack Ridge Rd

- 4554 Black Jack Ridge Rd

- 2055 Black Jack Ridge Rd Unit LOT 1

- 2055 Black Jack Ridge Rd

- 4430 W Pointer Mountain Cir

- 9730 N Equine Rd

- 9830 N Equine Rd

- 3655 W Oak View Ln

- 9596 N Bridle Ridge Rd

- 4155 W Oatman Flat Cir

- 9970 N Clear Fork Rd Unit 29

- 8850 N Callahan Rd

- 8850 N Callahan Rd Unit 185

- 8750 N Callahan Rd

- 8750 N Callahan Rd

- 8815 N Callahan Rd Unit 179

- 8700 N Callahan Rd

- 8700 N Callahan Rd Unit 178

- 8900 N Callahan Rd

- 8845 N Callahan Rd Unit 180-

- 8845 N Callahan Rd

- 8875 N Callahan Rd

- 8650 N Callahan Rd

- 4200 W Harper Dr

- 0 Harper Dr

- 4505 W Phantom Hill Rd Unit 188

- 4505 W Phantom Hill Rd

- 4228 W Harper Dr

- 8935 N Callahan Rd Unit 183

- 8935 N Callahan Rd

- 4505 W Phantom Hill