8812 223rd Stct E Graham, WA 98338

Estimated Value: $420,585 - $474,000

2

Beds

2

Baths

1,398

Sq Ft

$318/Sq Ft

Est. Value

About This Home

This home is located at 8812 223rd Stct E, Graham, WA 98338 and is currently estimated at $444,146, approximately $317 per square foot. 8812 223rd Stct E is a home located in Pierce County with nearby schools including Graham Elementary School, Frontier Middle School, and Graham Kapowsin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2015

Sold by

Bond Kitty L

Bought by

Kitty Bond Living Trust

Current Estimated Value

Purchase Details

Closed on

Oct 20, 2011

Sold by

Bank Of America Na

Bought by

Bond Kitty L

Purchase Details

Closed on

Jun 13, 2011

Sold by

Federal National Mortgage Association

Bought by

Bank Of America Na

Purchase Details

Closed on

Sep 7, 2010

Sold by

Corrigan Kenneth Richard

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Feb 8, 2008

Sold by

Corrigan Kenneth Richard

Bought by

Corrigan Kenneth Richard

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,400

Interest Rate

5.65%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 20, 2006

Sold by

Corrigan Vicki Lee

Bought by

Corrigan Kenneth Richard

Purchase Details

Closed on

Apr 4, 1997

Sold by

Francel Fred J

Bought by

Corrigan Kenneth R and Corrigan Vicki L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,500

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kitty Bond Living Trust | -- | None Available | |

| Bond Kitty L | $125,900 | Fidelity Natl Title Ins Co | |

| Bank Of America Na | -- | First American Mortgage Serv | |

| Federal National Mortgage Association | $210,757 | None Available | |

| Corrigan Kenneth Richard | -- | First American | |

| Corrigan Kenneth Richard | -- | None Available | |

| Corrigan Kenneth R | $123,000 | Commonwealth Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Corrigan Kenneth Richard | $218,400 | |

| Previous Owner | Corrigan Kenneth R | $104,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,076 | $401,300 | $184,400 | $216,900 |

| 2024 | $4,076 | $392,000 | $184,400 | $207,600 |

| 2023 | $4,076 | $347,300 | $188,700 | $158,600 |

| 2022 | $3,746 | $365,300 | $180,200 | $185,100 |

| 2021 | $3,705 | $263,700 | $118,100 | $145,600 |

| 2019 | $2,793 | $226,000 | $97,400 | $128,600 |

| 2018 | $3,253 | $223,200 | $97,400 | $125,800 |

| 2017 | $2,611 | $208,400 | $79,700 | $128,700 |

| 2016 | $2,625 | $160,600 | $69,000 | $91,600 |

| 2014 | $2,424 | $154,900 | $69,000 | $85,900 |

| 2013 | $2,424 | $145,200 | $63,400 | $81,800 |

Source: Public Records

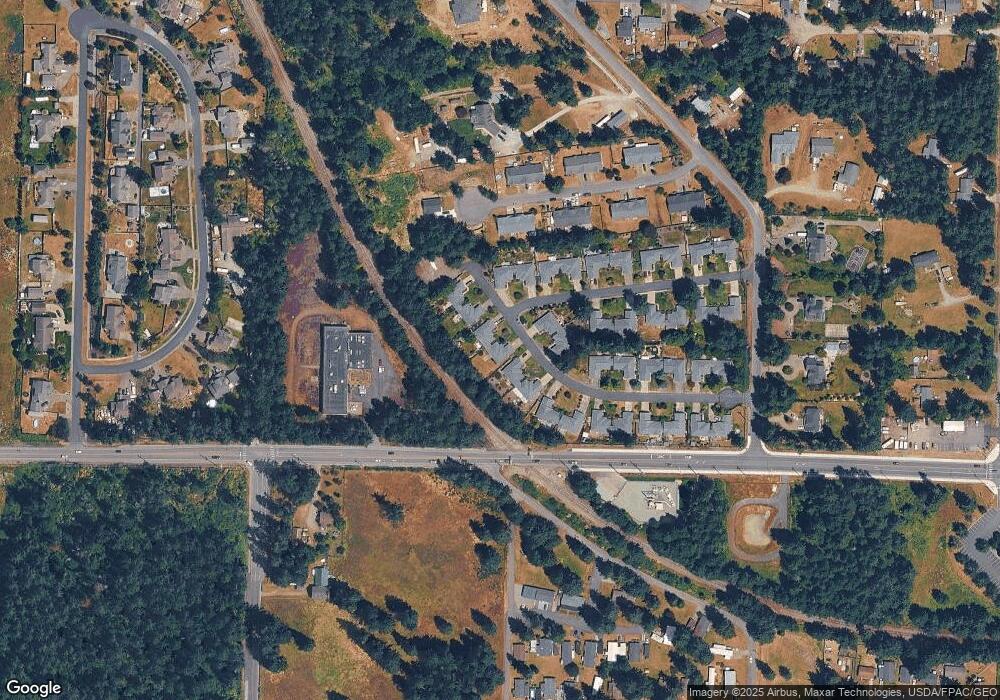

Map

Nearby Homes

- 8911 223rd Street Ct E Unit 14B

- 8815 226th St E Unit 19

- 9003 219th Street Ct E

- 9116 219th Street Ct E

- 22607 91st Avenue Ct E Unit 10

- 9203 219th Street Ct E

- 8903 216th Street Ct E

- 8106 224th St E

- 21616 94th Avenue Ct E

- 9602 219th Street Ct E

- 9612 218th Street Ct E

- 9701 219th Street Ct E

- 8608 232nd Street Ct E

- 22010 Meridian Ave E

- 10010 219th Street Ct E

- 22010 Meridian (Lot 3) E

- 22006 Meridian (Lot 2) E

- 21114 94th Avenue Ct E

- 8402 209th St E

- 23401 79th Ave E

- 8812 223rd Street Ct E Unit 7B

- 8810 223rd Street Ct E Unit 7A

- 8814 223rd Street Ct E Unit 8A

- 8816 223rd Street Ct E Unit 8B

- 8808 223rd Street Ct E

- 8813 223rd Street Ct E Unit 16B

- 8815 223rd Street Ct E Unit 16A

- 8806 223rd Street Ct E Unit 6A

- 8807 222nd St E

- 8807 222nd Street Ct E

- 8818 223rd Street Ct E Unit 9A

- 8809 222nd St E

- 8809 222nd Street Ct E

- 8815 222nd St E

- 8903 223rd Street Ct E Unit 15B

- 8820 223rd Street Ct E Unit 9B

- 8902 222nd St E

- 8902 222nd Street Ct E

- 8904 222nd Street Ct E

- 8902 222nd Street Ct E Unit 17A