8816 176th Ave SW Rochester, WA 98579

Estimated Value: $464,000 - $543,000

3

Beds

2

Baths

1,248

Sq Ft

$398/Sq Ft

Est. Value

About This Home

This home is located at 8816 176th Ave SW, Rochester, WA 98579 and is currently estimated at $497,026, approximately $398 per square foot. 8816 176th Ave SW is a home located in Thurston County with nearby schools including Rochester Primary School, Grand Mound Elementary School, and Rochester Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2008

Sold by

Aames Funding Corp

Bought by

Jacobs Charles D and Jacobs Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,400

Outstanding Balance

$104,851

Interest Rate

6.04%

Mortgage Type

Unknown

Estimated Equity

$392,175

Purchase Details

Closed on

Apr 6, 2007

Sold by

Fox Walter and Fox Tawnya

Bought by

Aames Funding Corp and Aames Home Loan

Purchase Details

Closed on

Apr 23, 2004

Sold by

Fiola Gerard J and Fiola Katie

Bought by

Fox Walter and Fox Tawnya

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,640

Interest Rate

6.35%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jacobs Charles D | $184,900 | First American Title | |

| Aames Funding Corp | $202,326 | Chicago Title Company | |

| Fox Walter | -- | Stewart Title Of Western |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jacobs Charles D | $166,400 | |

| Previous Owner | Fox Walter | $140,640 | |

| Closed | Fox Walter | $35,160 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,388 | $410,900 | $156,600 | $254,300 |

| 2023 | $3,388 | $391,300 | $121,400 | $269,900 |

| 2022 | $2,963 | $360,800 | $83,300 | $277,500 |

| 2021 | $2,871 | $287,700 | $100,900 | $186,800 |

| 2020 | $3,105 | $256,600 | $54,200 | $202,400 |

| 2019 | $2,721 | $231,400 | $60,600 | $170,800 |

| 2018 | $3,132 | $219,400 | $53,900 | $165,500 |

| 2017 | $2,761 | $195,050 | $46,350 | $148,700 |

| 2016 | $2,331 | $179,000 | $49,800 | $129,200 |

| 2014 | -- | $160,850 | $49,350 | $111,500 |

Source: Public Records

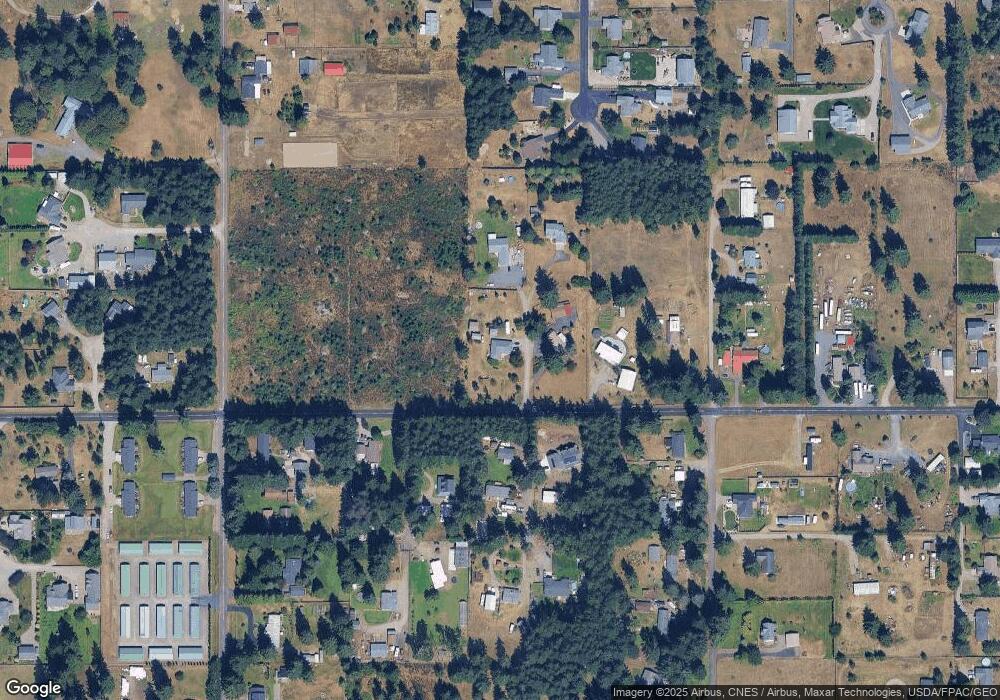

Map

Nearby Homes

- 8927 178th Ave SW

- 8505 176th Ave SW

- 17615 Irwin St SW

- 9237 Applegate Loop SW

- 8820 183rd Ave SW

- 17340 Sargent Rd SW Unit 66

- 17340 Sargent Rd SW Unit 47

- 17927 Daryl Ln SW

- 9015 183rd Ave SW

- 17237 Weaver Ln SW

- 9441 180th Way SW

- 17837 Sargent Rd SW

- 16615 Williams Ln SW

- 18024 Jordan St SW

- 12624 183rd Ave SW

- 12630 183rd Ave SW

- 9523 184th Ave SW

- 18549 Roseburg St SW

- 17930 Littlerock Rd SW

- 17710 Albany St SW

- 8812 176th Ave SW

- 8803 176th Ave SW

- 8808 176th Ave SW

- 8833 176th Ave SW

- 8831 176th Ave SW

- 8724 176th Ave SW

- 0 XXX 176th Ave SW

- 17411 Privet Ct SW

- 17607 Denmark St SW

- 17617 Denmark St SW

- 8909 176th Ave SW

- 17405 Privet Ct SW

- 17412 Privet Ct SW

- 17604 Applegate St SW

- 8807 176th Ave SW

- 8628 176th Ave SW

- 17406 Privet Ct SW

- 8634 176th Ave SW

- 17627 Denmark St SW

- 17345 Privet Ct SW